Understanding the Ambiguity of “Yellow Stock Price”

The term “yellow stock price” lacks a standardized definition within the financial world. Its meaning depends heavily on context. It could refer to a specific company’s stock denoted by a “yellow” ticker symbol (though this is uncommon), a color-coded market indicator system (where yellow might signify a specific price range or trend), or even a metaphorical expression used in informal discussions.

Potential Interpretations of “Yellow Stock Price”

Several interpretations are possible. In a hypothetical scenario, a financial news outlet might use “yellow stock price” informally to describe a stock experiencing a period of consolidation or sideways movement after a previous price surge, represented visually by a yellow line on a chart. Alternatively, a proprietary trading platform might employ a color-coded system where yellow indicates a stock within a specific price range deemed moderately risky.

Finally, the term might be used figuratively, such as in a discussion about stocks showing signs of cautionary signals. These different interpretations have significant implications for investment strategies.

Examples in Financial News and Discussions

Consider these examples: “The yellow stock price suggests a period of market uncertainty,” or “Analysts are watching the yellow stock price closely for signs of a breakout.” These examples highlight the ambiguity inherent in the term. The specific meaning would need to be clarified based on the context of the conversation or news report.

Historical Data and Trends of a Hypothetical “Yellow” Stock

To illustrate historical price fluctuations, let’s analyze a hypothetical “Yellow Corp” (ticker symbol: YELW), a fictional company. The following table shows sample daily stock prices:

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2024-03-01 | $50.00 | $52.50 | $49.00 | $51.75 |

| 2024-03-04 | $51.75 | $53.00 | $50.50 | $52.25 |

| 2024-03-05 | $52.25 | $54.00 | $51.00 | $53.50 |

| 2024-03-06 | $53.50 | $55.00 | $52.00 | $54.50 |

| 2024-03-07 | $54.50 | $53.75 | $51.50 | $52.00 |

Significant price changes, as seen in the table above, could be attributed to various factors. For example, a sudden drop might follow a negative earnings report, while a surge could be linked to a positive product launch announcement or favorable market trends.

A line chart visualizing this data would show the daily closing prices over time, highlighting upward and downward trends. Key features would include the overall trend direction (upward, downward, or sideways), significant peaks and troughs, and any periods of volatility.

Factors Influencing “Yellow” Stock Price: Yellow Stock Price

Several economic indicators and company-specific factors can influence a stock’s price. For our hypothetical Yellow Corp, these might include:

Economic Indicators

Macroeconomic factors such as inflation rates, interest rate changes, and overall economic growth directly impact investor confidence and thus stock prices. Higher inflation, for instance, might lead to increased borrowing costs for Yellow Corp, potentially impacting profitability and reducing investor appeal.

Understanding the fluctuations in yellow stock price requires a broad perspective on the market. For comparative analysis, it’s helpful to examine the performance of similar companies; a good example is to consider the current trends in the nvts stock price , which offers insights into related sectors. Returning to yellow stock, further research into its underlying financials and market position is crucial for a complete assessment.

Company Performance

Yellow Corp’s financial performance, as reflected in earnings reports, new product launches, and operational efficiency, significantly influences investor sentiment. Positive earnings surprises typically boost the stock price, while disappointing results can lead to declines.

External Factors

Geopolitical events and industry-specific regulations also play a role. A global recession or changes in transportation regulations could directly affect Yellow Corp’s revenue and profitability, impacting its stock price.

Investor Sentiment and Market Behavior

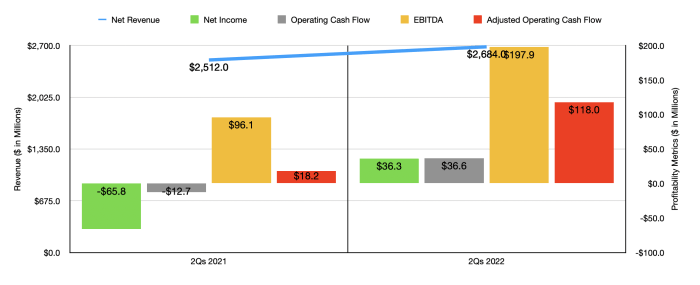

Source: seekingalpha.com

Investor sentiment, characterized by optimism or pessimism, plays a crucial role in driving stock prices. Market speculation and trading volume amplify these effects.

Influence of Investor Sentiment

Widespread optimism often leads to buying pressure, driving prices higher. Conversely, pessimism can trigger selling, causing prices to fall. News articles, analyst ratings, and social media discussions can all contribute to shifts in investor sentiment.

Role of Speculation and Volume

Market speculation, driven by anticipation of future events, can cause significant price swings. High trading volume often accompanies periods of strong investor sentiment, either positive or negative.

Hypothetical Scenario

Imagine a scenario where positive news about Yellow Corp’s new delivery technology emerges. Optimistic investors rush to buy the stock, increasing demand and driving the price upward. Conversely, if a competitor announces a superior technology, investor sentiment might turn negative, leading to a price drop.

Predictive Modeling for “Yellow” Stock Price

A simple predictive model for Yellow Corp’s stock price could use historical data and relevant factors. One approach might involve a regression model that considers past price movements, earnings per share (EPS), and key economic indicators as predictor variables.

Model Limitations, Yellow stock price

Predictive models for stock prices are inherently limited. Unexpected events, such as unforeseen geopolitical crises or sudden changes in investor sentiment, can significantly impact prices in ways that models cannot accurately anticipate.

Sources of Error

Source: seekingalpha.com

Errors in forecasting stem from limitations in data accuracy, model assumptions, and the inherent unpredictability of market forces. Oversimplification of complex market dynamics is a common source of error.

Risk Assessment for Investing in “Yellow” Stock

Investing in Yellow Corp, or any stock, involves inherent risks. These risks need careful consideration.

Potential Risks

Risks include market volatility, company-specific risks (such as financial distress or management changes), and macroeconomic risks (like recessions or inflation). The level of risk is influenced by factors such as the company’s financial health, industry competition, and the overall economic climate.

Risk Mitigation Strategies

Diversification, thorough due diligence, and setting realistic investment goals are key risk mitigation strategies. Diversifying investments across multiple assets can help reduce the impact of losses in a single stock.

Investment Approaches and Risk Levels

Different investment approaches, such as value investing or growth investing, carry varying levels of risk. Value investing typically focuses on undervalued companies, which might present higher risk but also higher potential returns. Growth investing, on the other hand, focuses on companies with high growth potential, which also can have higher risk.

Helpful Answers

What if “yellow” is just a random color and not a real stock ticker?

Then the analysis would focus on broader market trends and investor psychology. The “yellow” becomes a metaphorical representation of a specific investment strategy or market segment.

How reliable are stock price prediction models?

Not very! While models can help identify trends, they can’t account for unexpected events or sudden shifts in market sentiment. They should be used as one tool among many, not a crystal ball.

Where can I find reliable historical stock data?

Many financial websites (like Yahoo Finance, Google Finance) provide free access to historical stock data. You can also access data through brokers or specialized financial data providers.

What are some common risks associated with stock investing?

Market volatility, inflation, interest rate changes, company-specific risks (e.g., poor performance, scandals), and geopolitical instability are all potential risks.