Wish Stock Price Analysis

Source: cheggcdn.com

Wish stock price – Wish, an e-commerce platform known for its discounted products, has experienced significant volatility in its stock price since its initial public offering (IPO). This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and business model of Wish, providing insights into the dynamics shaping its stock price.

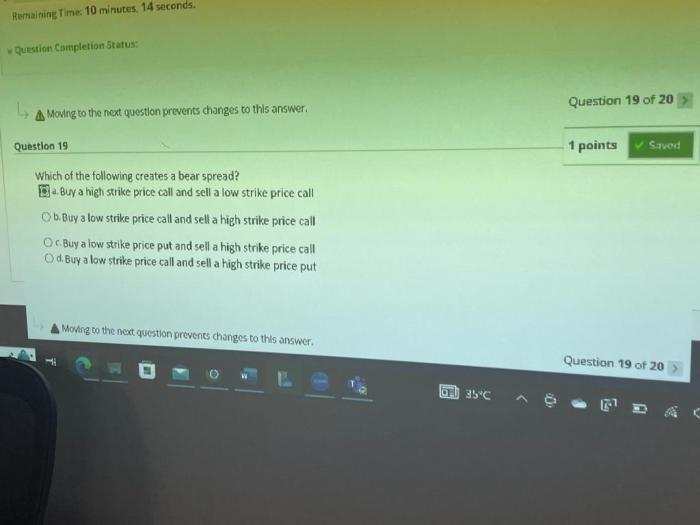

Wish Stock Price Historical Performance

Over the past five years, Wish’s stock price has shown considerable fluctuation, marked by periods of substantial growth followed by sharp declines. The initial IPO price was significantly higher than the current price, reflecting the market’s initial optimism and subsequent disillusionment. Key highs and lows correlate with specific events and overall market trends. Comparing Wish’s performance to similar e-commerce companies reveals its relative position within the competitive landscape.

| Company Name | Stock Symbol | 5-Year High | 5-Year Low |

|---|---|---|---|

| Wish | WISH | $29.00 (Approximate – Data varies by source and date) | $1.00 (Approximate – Data varies by source and date) |

| Amazon | AMZN | (Data varies by source and date) | (Data varies by source and date) |

| eBay | EBAY | (Data varies by source and date) | (Data varies by source and date) |

| Shopify | SHOP | (Data varies by source and date) | (Data varies by source and date) |

Factors Influencing Wish Stock Price

Source: cheggcdn.com

Several interconnected factors significantly influence Wish’s stock price. Economic indicators, consumer behavior, competition, and regulatory changes all play crucial roles.

- Economic Indicators: Macroeconomic factors like inflation, interest rates, and consumer confidence directly impact consumer spending, affecting Wish’s sales and valuation.

- Consumer Spending Habits: Changes in consumer preferences, particularly towards online shopping and budget-friendly options, significantly influence Wish’s growth trajectory and, consequently, its stock price.

- Competition: The intense competition from established e-commerce giants like Amazon and eBay, as well as newer players, puts pressure on Wish’s market share and profitability, affecting investor confidence.

- Regulations and Legislation: Changes in regulations related to e-commerce, data privacy, and international trade can impact Wish’s operational costs and market access, thereby influencing its stock price.

Wish’s Financial Performance and Stock Price

Source: cheggcdn.com

Wish’s revenue streams, profitability, and debt levels are closely intertwined with its stock price. Analyzing quarterly earnings reports reveals the correlation between financial performance and market valuation.

- Revenue Streams: Wish primarily generates revenue through commissions on sales. Fluctuations in sales directly impact revenue and consequently the stock price.

- Profitability: Wish’s profitability (or lack thereof) is a critical factor influencing investor sentiment. Consistent losses can lead to decreased investor confidence and a lower stock price.

- Debt Levels: High debt levels can raise concerns about Wish’s financial stability, potentially leading to a negative impact on investor perception and the stock price.

- Quarterly Earnings Comparison (Last Two Years): A detailed comparison of quarterly earnings reports (Note: Specific data needs to be inserted here from reliable financial sources) would show the correlation between earnings and stock price movements. For example, quarters with increased revenue and improved profitability generally correlate with stock price increases, while periods of decreased revenue and losses typically correlate with stock price declines.

Investor Sentiment and Wish Stock Price

Investor sentiment regarding Wish’s future prospects plays a significant role in shaping its stock price. Analyst opinions and media coverage influence investor perception and trading decisions.

- Overall Investor Sentiment: Currently, investor sentiment towards Wish is generally cautious, reflecting concerns about its profitability and competition.

- Analyst Opinions: Different analyst firms may have varying opinions on Wish’s stock, reflecting differing assessments of its growth potential and risk profile.

- News and Media Coverage: Positive news articles and media coverage can boost investor confidence, leading to price increases, while negative news can trigger sell-offs.

- Hypothetical Scenario:

Suppose Wish announces a major new partnership with a large retailer, significantly expanding its market reach. This positive news event would likely trigger a surge in investor confidence, leading to a substantial increase in the stock price. Conversely, if Wish reports disappointing quarterly earnings, missing revenue targets, and highlighting ongoing losses, the stock price would likely experience a significant drop.

Wish’s Business Model and Stock Price, Wish stock price

Wish’s unique business model, characterized by its focus on low prices and a vast selection of products, contributes to its stock price volatility. Marketing strategies and customer acquisition costs are key elements influencing its valuation.

- Business Model and Volatility: Wish’s reliance on low-cost products and a high-volume business model makes it vulnerable to fluctuations in consumer spending and competition.

- Marketing Strategies: Wish’s marketing effectiveness directly impacts its customer acquisition costs and revenue growth, consequently influencing its stock price.

- Customer Acquisition Costs: High customer acquisition costs can negatively impact profitability and investor sentiment, leading to a lower stock price.

- Visual Representation: A visual representation could depict interconnected circles representing Wish’s key business model components (product sourcing, marketing, logistics, customer acquisition, sales, and revenue). Arrows connecting these circles would illustrate the flow of activities and their impact on the stock price. A larger circle at the center would represent the stock price, influenced by the combined effect of all other components.

The size of each circle could be proportional to its relative influence on the stock price.

General Inquiries: Wish Stock Price

What are the major risks associated with investing in Wish stock?

Investing in Wish stock carries inherent risks, including volatility due to its business model and market competition, potential for decreased profitability, and susceptibility to changes in consumer spending and regulatory environments.

How does Wish’s international presence affect its stock price?

Wish’s significant international presence exposes it to various economic and political factors in different regions, influencing both revenue and operational costs, which in turn impacts its stock price.

What is Wish’s long-term growth potential?

Wish’s long-term growth potential depends on its ability to adapt to evolving market trends, enhance its brand reputation, improve its logistics and customer service, and maintain a competitive edge in the increasingly crowded e-commerce space. This is subject to considerable uncertainty.