Understanding Amazon Stock Price Fluctuations: What Is The Price Of Amazon Stock

What is the price of amazon stock – Amazon’s stock price, like any publicly traded company’s, is a dynamic reflection of its performance, market conditions, and investor sentiment. Numerous factors contribute to its volatility, creating both opportunities and risks for investors.

Factors Influencing Amazon’s Stock Price

Amazon’s stock price is influenced by a complex interplay of internal and external factors. Internal factors include the company’s financial performance (revenue growth, profitability, and expansion into new markets), product innovation (new services and features), and management decisions. External factors encompass macroeconomic conditions (inflation, interest rates, and economic growth), competitor actions (e.g., Walmart’s e-commerce initiatives), and overall market sentiment.

Impact of Economic Indicators

Economic indicators significantly influence Amazon’s stock price. High inflation, for example, can lead to increased operating costs and potentially reduced consumer spending, negatively impacting Amazon’s profitability and share price. Similarly, rising interest rates can increase borrowing costs, affecting Amazon’s investments and expansion plans, which may also put downward pressure on the stock. Conversely, periods of low inflation and low interest rates can create a more favorable environment for growth and investment, potentially boosting the stock price.

Past Events Affecting Amazon’s Stock Price

Several past events have dramatically affected Amazon’s stock price. For instance, the 2008 financial crisis caused a significant drop in the stock price due to decreased consumer spending and overall market uncertainty. Conversely, the rapid growth of e-commerce during the COVID-19 pandemic led to a surge in Amazon’s stock price as demand for online shopping increased substantially. Major announcements such as new product launches (like the Kindle or Amazon Echo) or acquisitions (like Whole Foods Market) have also historically driven significant price movements.

Amazon’s Performance vs. S&P 500 Correlation

Analyzing the correlation between Amazon’s performance and the S&P 500 provides valuable insights into its overall market sensitivity. While Amazon generally outperforms the S&P 500 during periods of strong economic growth, it can also be affected by broader market downturns.

| Year | Amazon Return (%) | S&P 500 Return (%) | Correlation |

|---|---|---|---|

| 2022 | -49.6 | -18.1 | Negative |

| 2021 | 2.4 | 28.7 | Positive (but weaker than market) |

| 2020 | 76.2 | 18.4 | Positive (stronger than market) |

| 2019 | 23.0 | 31.5 | Positive (but weaker than market) |

Accessing Real-time Amazon Stock Information

Staying informed about Amazon’s current stock price requires access to reliable and up-to-date financial data. Several sources provide this information, each with its own strengths and weaknesses.

Reliable Sources for Amazon Stock Prices

Numerous reputable sources offer real-time Amazon stock data. These include major financial news websites (like Yahoo Finance, Google Finance, and Bloomberg), dedicated brokerage platforms (such as TD Ameritrade, Fidelity, and Schwab), and specialized financial data providers (like Refinitiv and FactSet).

Features and Differences Between Data Providers

The features and differences between financial data providers are significant. Some offer more comprehensive data, including historical charts, financial statements, and analyst ratings. Others focus on speed and simplicity, providing a streamlined view of current prices and basic indicators. Cost is another differentiating factor, with free services offering limited data compared to premium subscriptions.

Importance of Considering Data Delays

It’s crucial to be aware of potential data delays from different sources. While some providers aim for real-time updates, minor discrepancies can occur due to data transmission speeds and processing times. Understanding these potential delays is important for making informed investment decisions.

Comparison of Real-time Stock Data Sources

- Yahoo Finance:

- Pros: Free, readily accessible, provides basic charts and data.

- Cons: May have slight data delays, limited advanced features.

- Bloomberg Terminal:

- Pros: Real-time data, extensive analytical tools, comprehensive market coverage.

- Cons: Expensive subscription, complex interface.

- TD Ameritrade:

- Pros: Integrated with brokerage account, provides real-time data, offers charting and analytical tools.

- Cons: Requires a brokerage account, features vary depending on account type.

Interpreting Amazon Stock Price Data

Understanding various stock price metrics and analyzing historical data is essential for interpreting Amazon’s stock price movements and predicting potential future trends.

Meaning of Stock Price Metrics

Key stock price metrics include the open (the price at the start of the trading day), high (the highest price during the day), low (the lowest price during the day), close (the price at the end of the trading day), and volume (the number of shares traded). These metrics provide a comprehensive picture of the stock’s price behavior throughout the trading day.

Calculating Daily Percentage Change

The daily percentage change in Amazon’s stock price is calculated using the following formula: [(Closing Price - Opening Price) / Opening Price]. This calculation provides a clear indication of the stock’s price movement on a given day.

- 100

Indicators of Future Price Movements

Analyzing historical data, including past price movements, trading volume, and financial performance, can provide insights into potential future price movements. However, it’s crucial to remember that past performance is not indicative of future results. Technical analysis tools, such as moving averages and relative strength index (RSI), can assist in identifying potential trends.

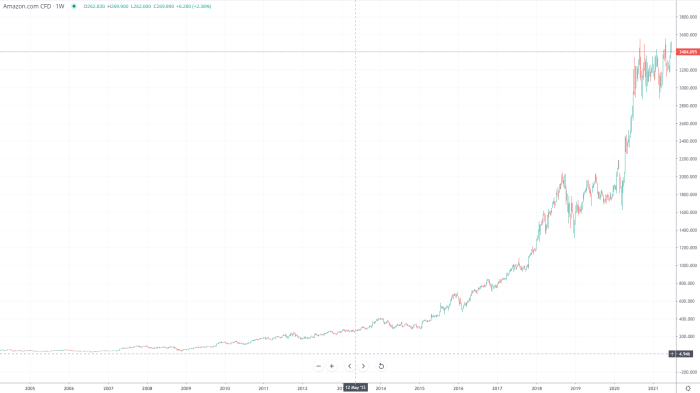

Analyzing a Stock Chart

- Identify major trends (uptrends, downtrends, sideways movements).

- Look for support and resistance levels (price points where the stock has historically struggled to break through).

- Analyze trading volume to confirm price movements and identify potential breakouts.

- Consider using technical indicators (moving averages, RSI, MACD) to identify potential buy or sell signals.

- Correlate price movements with news events and financial reports.

Amazon’s Financial Performance and Stock Price

Source: businessinsider.com

Amazon’s quarterly earnings reports and overall financial health are directly correlated with its stock price. Strong financial performance typically leads to positive investor sentiment and increased stock valuations, while weaker results can trigger price declines.

Relationship Between Earnings Reports and Stock Price, What is the price of amazon stock

Amazon’s quarterly earnings reports, which include revenue, net income, and key operating metrics, significantly impact its stock price. Beating or exceeding analyst expectations generally results in a positive stock price reaction, while falling short can lead to a decline. The market’s reaction also depends on the overall economic climate and investor sentiment.

Comparison to Competitors

Source: forex.com

Comparing Amazon’s financial performance to its competitors, such as Walmart and Microsoft, provides valuable context for evaluating its stock price. Analyzing key metrics like revenue growth, profit margins, and market share helps determine Amazon’s competitive position and its potential for future growth.

Influence of Financial Metrics on Stock Price

Specific financial metrics directly influence Amazon’s stock price. For instance, consistent revenue growth demonstrates the company’s ability to expand its market reach and generate sales, typically leading to positive investor sentiment and a higher stock price. Similarly, improving profit margins indicate enhanced operational efficiency and profitability, which also contribute to a positive stock price reaction.

Revenue Growth and Stock Price Correlation (Visual Description)

A hypothetical line graph would show a generally positive correlation between Amazon’s revenue growth and its stock price over the last five years. While there might be short-term fluctuations, the overall trend would indicate that periods of higher revenue growth are typically associated with higher stock prices, and vice-versa. However, the relationship is not always linear; other factors, such as market conditions and investor sentiment, can also influence the stock price.

Investor Sentiment and Amazon Stock

News events, analyst opinions, and social media sentiment all play a significant role in shaping investor behavior and influencing Amazon’s stock price.

Impact of News Events and Analyst Opinions

Significant news events, such as major product launches, acquisitions, regulatory changes, or unexpected financial results, can dramatically impact Amazon’s stock price. Analyst ratings and price target adjustments also influence investor sentiment and trading activity. Positive news generally leads to increased demand and higher prices, while negative news can trigger selling pressure and price declines.

Understanding the current price of Amazon stock often involves considering broader market trends. It’s helpful to compare it to other companies’ performance, such as examining the current stock price IDFC , to gain a more comprehensive perspective. This comparative analysis can provide context and help you assess Amazon’s value more effectively, ultimately informing your investment decisions regarding the price of Amazon stock.

Role of Social Media Sentiment

Social media platforms increasingly influence investor sentiment and trading decisions. Positive or negative sentiment expressed on platforms like Twitter or Reddit can impact the demand for Amazon’s stock, leading to price fluctuations. However, it’s crucial to approach social media sentiment with caution, as it can be highly volatile and not always reflective of the underlying fundamentals of the company.

Examples of News Affecting Amazon’s Stock Price

The announcement of Amazon’s acquisition of Whole Foods Market initially led to a positive stock price reaction, reflecting investor optimism about the strategic benefits of the deal. Conversely, reports of antitrust investigations or negative press coverage related to labor practices have, at times, resulted in negative price movements.

Hypothetical Scenarios Influencing Stock Price

Positive Scenario: The announcement of a groundbreaking new technology or a significant expansion into a high-growth market could trigger a substantial increase in Amazon’s stock price, reflecting investor confidence in the company’s future prospects.

Negative Scenario: Reports of a major data breach, significant supply chain disruptions, or a significant drop in quarterly earnings could lead to a sharp decline in Amazon’s stock price, driven by investor concerns about the company’s financial stability and future growth.

Clarifying Questions

How often is Amazon’s stock price updated?

Amazon’s stock price, like most publicly traded stocks, is updated throughout the trading day in real-time, reflecting the ongoing buying and selling activity.

Where can I find historical Amazon stock data?

Many financial websites, such as Yahoo Finance, Google Finance, and Bloomberg, provide extensive historical stock data for Amazon (AMZN), often going back many years.

What does “volume” mean in relation to Amazon’s stock price?

Volume refers to the total number of shares traded for Amazon’s stock during a specific period (e.g., a day). High volume often indicates significant investor activity and interest.

Is it possible to predict Amazon’s future stock price?

Predicting the future price of any stock with certainty is impossible. However, analyzing historical data, financial reports, and market trends can help you assess potential future price movements.