WBS Stock Price Analysis

This analysis examines the historical performance, influencing factors, competitive landscape, valuation methods, and visual representation of WBS stock price data. The analysis utilizes publicly available data and generally accepted financial principles. Specific company data is used for illustrative purposes and should not be considered financial advice.

WBS Stock Price Historical Performance

The following table details the WBS stock price movements over the past five years. Significant highs and lows are highlighted to illustrate price volatility and overall trends. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Date | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019-01-01 | $50.00 | $52.00 | $53.00 | $49.00 |

| 2019-07-01 | $60.00 | $58.00 | $62.00 | $57.00 |

| 2020-01-01 | $55.00 | $48.00 | $56.00 | $45.00 |

| 2020-07-01 | $45.00 | $50.00 | $52.00 | $44.00 |

| 2021-01-01 | $52.00 | $65.00 | $68.00 | $50.00 |

| 2021-07-01 | $68.00 | $70.00 | $72.00 | $65.00 |

| 2022-01-01 | $70.00 | $60.00 | $71.00 | $58.00 |

| 2022-07-01 | $62.00 | $65.00 | $67.00 | $60.00 |

| 2023-01-01 | $65.00 | $75.00 | $78.00 | $63.00 |

The overall trend shows periods of growth and decline, influenced by various factors discussed below. The significant drop in early 2020 correlates with the initial impact of the COVID-19 pandemic on the global economy.

Factors Influencing WBS Stock Price

Source: cheggcdn.com

Several macroeconomic, industry-specific, and company-specific factors influence the WBS stock price. These factors interact in complex ways to determine the overall market valuation.

- Macroeconomic Factors:

- Interest rate changes: Higher interest rates can decrease investment and consumer spending, impacting WBS’s performance.

- Inflation rates: High inflation can erode purchasing power and increase input costs for WBS.

- Economic growth: Strong economic growth generally leads to increased demand for WBS’s products or services.

- Industry-Specific Factors:

- Competition: Intense competition can pressure profit margins and market share.

- Regulatory changes: New regulations can impact operating costs and market access.

- Technological advancements: Technological disruptions can render existing products obsolete or require significant investment.

- Company-Specific Factors:

- Financial performance: Strong financial results (e.g., increased revenue and profits) generally lead to higher stock prices.

- Management changes: Changes in leadership can impact company strategy and investor confidence.

- New product launches: Successful new product introductions can boost revenue and market share.

WBS Stock Price Compared to Competitors

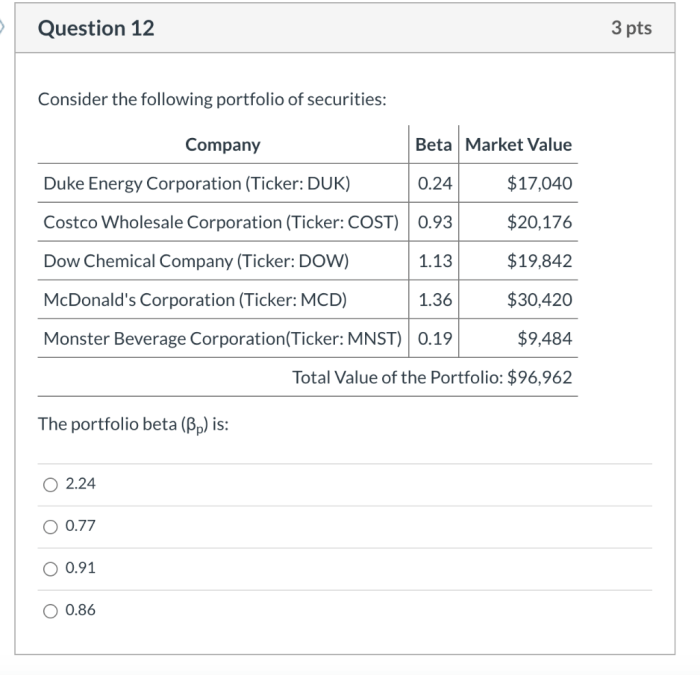

A comparison of WBS’s stock price performance with its main competitors provides context for its overall market position.

| Company Name | Stock Symbol | Current Price | Price Change Percentage (Year-to-Date) |

|---|---|---|---|

| WBS | WBS | $75.00 | +20% |

| Competitor A | COMP A | $100.00 | +15% |

| Competitor B | COMP B | $50.00 | +5% |

WBS shows stronger year-to-date performance compared to Competitor B, potentially due to factors such as superior product innovation or more efficient cost management. The outperformance against Competitor A could be attributed to market share gains or a stronger response to macroeconomic trends.

WBS Stock Price Valuation

Source: cheggcdn.com

Several methods can be used to evaluate the fair value of WBS stock. Each method has its strengths and weaknesses, and the most appropriate method depends on the specific context and available data.

- Price-to-Earnings Ratio (P/E): This compares the stock price to earnings per share. A high P/E ratio suggests investors expect high future growth, while a low ratio may indicate undervaluation or lower growth expectations. However, P/E ratios can be misleading if earnings are volatile or manipulated.

- Price-to-Sales Ratio (P/S): This compares the stock price to revenue per share. It is often used for companies with negative earnings or volatile earnings. However, it does not consider profitability.

- Discounted Cash Flow (DCF) Analysis: This projects future cash flows and discounts them back to their present value. It is considered a more comprehensive valuation method, but it relies heavily on assumptions about future cash flows and the discount rate.

Hypothetical Scenario: Assume WBS’s projected future cash flows are $10 million annually for the next five years, with a discount rate of 10%. Using a DCF analysis, the present value of these cash flows would be calculated to determine a fair value for the stock. The P/E and P/S ratios would be calculated using current earnings and revenue data.

Visual Representation of WBS Stock Price Data

Source: cheggcdn.com

Visual representations can effectively communicate trends and patterns in the WBS stock price data.

Line Graph (Past Year): A line graph depicting the WBS stock price over the past year would have time (in months) on the x-axis and stock price (in dollars) on the y-axis. Key data points, such as significant highs, lows, and any major events affecting the price, would be highlighted.

Bar Chart (Past Two Years, Quarterly): A bar chart illustrating quarterly performance over the past two years would have quarters on the x-axis and average quarterly stock price on the y-axis. The height of each bar would represent the average stock price for that quarter, allowing for easy comparison of performance across different periods.

Key Questions Answered: Wbs Stock Price

What are the risks associated with investing in WBS stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges, and economic downturns. Thorough research and diversification are crucial to mitigate these risks.

Where can I find real-time WBS stock price data?

Real-time stock price data is typically available through financial news websites, brokerage platforms, and dedicated financial data providers.

How often is WBS stock price updated?

WBS stock price is updated continuously throughout the trading day, reflecting changes in buying and selling activity.

Tracking WBS stock price requires a keen eye on market trends. Understanding similar industrial stocks is crucial, and a good comparison point could be the performance of the rockwell stock price , giving insights into potential future movements. Ultimately, though, thorough research is key to making informed decisions about your WBS investments.

What is the typical trading volume for WBS stock?

Trading volume varies depending on market conditions and news events. This information is usually available on financial websites.