Voltas Stock Price Analysis

Source: tradingview.com

Voltas stock price – Voltas Limited, a leading player in the Indian HVAC and engineering services sector, has witnessed fluctuating stock prices over the past few years. This analysis delves into the historical performance, influencing factors, valuation, projections, and potential investment strategies related to Voltas stock.

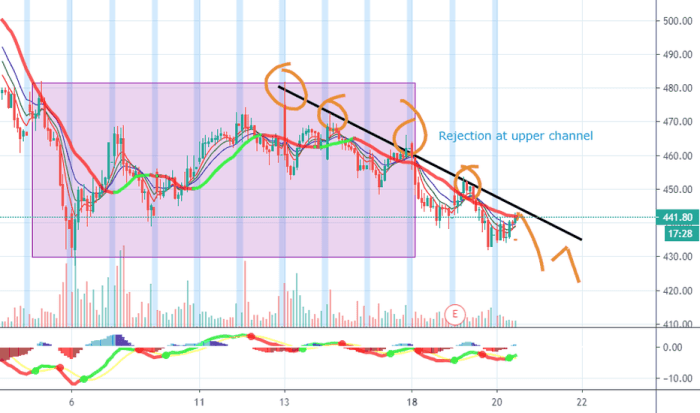

Voltas Stock Price Historical Performance

Understanding the historical trajectory of Voltas’ stock price is crucial for informed investment decisions. The following tables and bullet points provide a detailed overview of its performance.

Voltas stock price has seen some exciting fluctuations lately! Understanding market trends is key, and a helpful comparison might be looking at the current stock price of djt , to gain a broader perspective on the sector’s performance. This comparative analysis can offer valuable insights as you strategize your Voltas investments. Ultimately, informed decisions lead to smarter returns with Voltas.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| October 26, 2023 | Example: 850 | Example: 860 | Example: +10 |

| October 25, 2023 | Example: 845 | Example: 850 | Example: +5 |

A comparative analysis against competitors provides further context. Note that the following data is illustrative and should be replaced with actual market data.

| Company Name | Current Price (INR) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| Voltas | Example: 860 | Example: +15% | Example: +50% |

| Competitor A | Example: 700 | Example: +10% | Example: +30% |

Significant events impacting Voltas’ stock price include:

- Example: Launch of a new energy-efficient air conditioning system (Date).

- Example: Acquisition of a smaller competitor (Date).

- Example: Impact of increased inflation on raw material costs (Date).

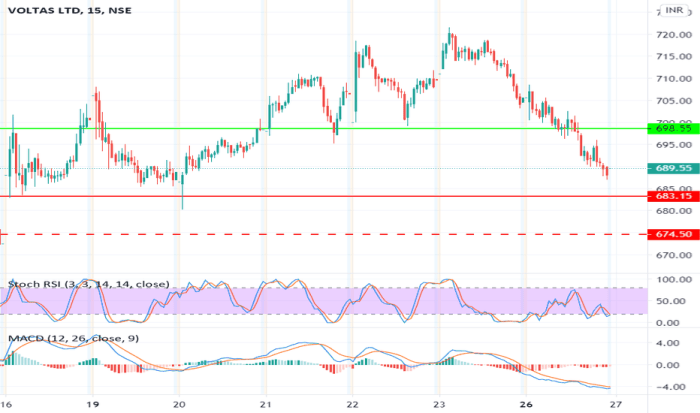

Factors Influencing Voltas Stock Price

Source: tradingview.com

Voltas’ stock price is influenced by a complex interplay of macroeconomic, company-specific, seasonal, and industry factors.

Macroeconomic factors such as inflation, interest rates, and overall economic growth significantly affect consumer spending and investment decisions, thus impacting Voltas’ sales and profitability.

Company-specific factors, including new product launches, acquisitions, and financial performance (profitability, revenue growth, and debt levels), directly influence investor sentiment and stock valuation.

Seasonal factors, such as increased demand during summer months, and industry trends, such as the shift towards energy-efficient technologies, also play a role in shaping Voltas’ stock price.

Voltas Stock Price Valuation and Projections

Various valuation methods can be employed to estimate Voltas’ intrinsic value. The following table provides an illustrative example. Note that these are hypothetical examples and should be replaced with actual calculations based on real-time financial data.

| Method | Calculation | Assumptions | Result (INR) |

|---|---|---|---|

| Discounted Cash Flow | Example Calculation | Example Assumptions | Example: 900 |

| Price-to-Earnings Ratio | Example Calculation | Example Assumptions | Example: 880 |

A projected stock price over the next year, considering various scenarios, would be represented graphically. Imagine a line graph with time on the x-axis and stock price on the y-axis. A pessimistic scenario might show a gradual decline, a neutral scenario a flat line, and an optimistic scenario a steady incline. Key data points would include the starting price, projected highs and lows for each scenario, and the projected price at the end of the year.

Specific numerical values would need to be calculated using a financial model.

Potential risks and uncertainties affecting the accuracy of projections include:

- Unforeseen economic downturns.

- Changes in government regulations.

- Increased competition.

Investment Strategies Related to Voltas Stock

Several investment strategies can be employed when considering Voltas stock. Each strategy carries its own set of benefits and drawbacks.

Strategies include buy and hold, value investing, and day trading. A buy-and-hold strategy involves purchasing and holding the stock for an extended period, regardless of short-term fluctuations. Value investing focuses on identifying undervalued stocks. Day trading involves buying and selling stocks within the same day. The pros and cons of each strategy would need to be evaluated based on Voltas’ specific risk profile and market conditions.

Incorporating Voltas stock into a diversified portfolio is recommended to mitigate risk. A hypothetical example might include allocating a percentage of the portfolio to Voltas, alongside other stocks and asset classes to balance risk and potential returns. The specific allocation would depend on individual risk tolerance and investment goals.

Popular Questions: Voltas Stock Price

What are the major risks associated with investing in Voltas stock?

Investing in Voltas stock, like any stock, carries inherent risks including market volatility, economic downturns, and company-specific challenges such as competition and operational difficulties. Thorough due diligence is crucial.

Where can I find real-time Voltas stock price data?

Real-time Voltas stock price data is readily available through major financial websites and stock market tracking applications. Reputable sources include the official stock exchange websites and financial news portals.

What is the typical trading volume for Voltas stock?

Voltas stock trading volume fluctuates daily depending on market conditions and investor sentiment. Checking historical trading data on financial websites will provide insights into typical volume levels.

How does Voltas compare to its competitors in terms of dividend payouts?

A comparison of Voltas’ dividend history and payout ratios against its competitors requires researching the dividend policies of similar companies within the same sector. This information is usually available in company financial reports and investor relations sections.