OLED Technology: A Deep Dive

Stock price of oled – Organic Light-Emitting Diodes (OLEDs) represent a significant advancement in display technology, offering superior image quality and efficiency compared to their predecessors. This analysis explores the technology, its market dynamics, and the implications for the stock prices of companies involved in its production and integration.

OLED Technology Overview

OLED displays function by using a thin film of organic compounds that emit light when an electric current is applied. The manufacturing process involves depositing these organic layers onto a substrate, typically glass, along with other components such as transistors and electrodes. Different types of OLED technologies exist, each with its own characteristics and applications.

Types of OLED Technologies

Active-Matrix Organic Light-Emitting Diode (AMOLED) and Passive-Matrix Organic Light-Emitting Diode (PMOLED) are the two primary types. AMOLED displays use a thin-film transistor (TFT) backplane to individually control each pixel, enabling higher resolutions and faster refresh rates. PMOLED displays, conversely, use a simpler matrix addressing scheme, resulting in lower resolution and slower response times. AMOLED is dominant in high-end applications like smartphones and premium televisions, while PMOLED finds niche applications in smaller displays.

OLED Advantages and Disadvantages

Compared to Liquid Crystal Displays (LCDs) and Quantum Dot Light Emitting Diodes (QLEDs), OLEDs offer several advantages, including deeper blacks due to true pixel-level light control, wider viewing angles, and superior color reproduction. However, OLEDs generally have higher manufacturing costs, potential for burn-in (image retention), and a shorter lifespan compared to LCDs. QLEDs offer a compromise, boasting better brightness than OLEDs but lacking the perfect blacks.

Comparison of OLED Display Types

| Feature | AMOLED | PMOLED | LCD |

|---|---|---|---|

| Resolution | High (e.g., 4K, 8K) | Low to Medium | Variable, generally lower than AMOLED |

| Brightness | High | Medium | Medium to High |

| Contrast Ratio | Infinite (theoretically) | High | Limited |

| Response Time | Very Fast | Medium | Relatively Slow |

| Power Consumption | Medium | Low | Medium to High |

Market Analysis of OLED Displays: Stock Price Of Oled

The OLED display market is dominated by a few key players, with significant implications for their respective stock prices. Understanding market share, growth trends, and influencing factors is crucial for investors.

Major Players and Market Share

Samsung Display, LG Display, and BOE Technology are among the leading manufacturers of OLED displays, holding a significant portion of the global market share. Precise market share figures fluctuate constantly, but these three companies consistently rank at the top. Smaller players also exist, focusing on niche applications or specific display technologies.

Market Trends and Growth Projections

The OLED market is experiencing substantial growth, driven by increasing demand from the smartphone, television, and automotive sectors. Future projections suggest continued expansion, although the rate of growth may vary depending on technological advancements and economic conditions. The adoption of foldable and flexible OLED displays is expected to fuel further market expansion.

Factors Influencing OLED Demand

Source: nationalinterest.org

The proliferation of high-resolution smartphones and the rising popularity of premium televisions are key drivers of OLED demand. Furthermore, the automotive industry’s adoption of OLEDs for instrument panels and infotainment systems contributes significantly to market growth. Consumer preference for superior image quality and improved energy efficiency also plays a vital role.

Market Share Distribution

A bar chart illustrating market share would show Samsung Display, LG Display, and BOE Technology with significantly larger bars compared to other players. The x-axis would represent the companies, and the y-axis would represent market share percentage. The chart would visually demonstrate the market concentration within the OLED display industry.

Stock Price Influences

The stock prices of companies involved in OLED production and integration are subject to various factors, including technological advancements, economic conditions, and company-specific performance.

Publicly Traded OLED Companies

Several publicly traded companies are heavily involved in the OLED supply chain. Examples include Samsung Electronics (005930.KS), LG Display (034220.KS), and BOE Technology Group (000725.SZ). Analyzing their stock performance provides insights into the market’s perception of the OLED industry.

Stock Performance Comparison

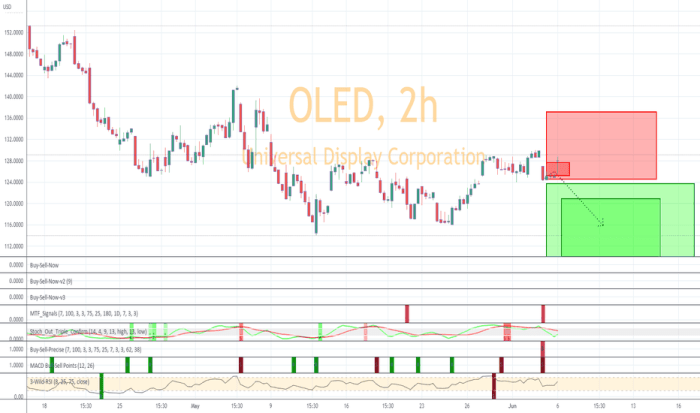

Source: tradingview.com

A five-year comparison of these companies’ stock prices would reveal periods of growth and decline, influenced by factors such as technological breakthroughs, product launches, and overall market sentiment. Some years may show strong positive growth, while others may reflect market corrections or industry-specific challenges.

Impact of Technological Advancements

Significant technological advancements, such as the introduction of foldable OLED displays or improvements in manufacturing efficiency, can positively impact the stock prices of OLED companies. Conversely, delays in technological progress or the emergence of competing technologies could negatively affect stock prices.

Effects of Global Economic Conditions

Global economic downturns or uncertainties can significantly influence investor sentiment and, consequently, the stock prices of OLED companies. Economic factors like consumer spending, supply chain disruptions, and geopolitical events all play a role.

Stock Price Fluctuations

| Company | Date | Stock Price (USD) |

|---|---|---|

| Samsung Electronics | 2024-10-27 | (Example: $70) |

| LG Display | 2024-10-27 | (Example: $25) |

| BOE Technology | 2024-10-27 | (Example: $15) |

Financial Performance of OLED Companies

Analyzing the financial performance of key OLED players provides further insights into the industry’s profitability and growth potential.

Revenue Streams and Profit Margins

Companies in the OLED supply chain generate revenue from the sale of displays to original equipment manufacturers (OEMs) such as smartphone and television manufacturers. Profit margins can vary significantly depending on factors such as production costs, economies of scale, and market competition.

Key Financial Ratios

Analyzing key financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, for Samsung Electronics, LG Display, and BOE Technology offers a comparative perspective on their financial health and investment attractiveness. These ratios provide insights into profitability, leverage, and overall financial stability.

Impact of R&D Investment

Significant investments in research and development are crucial for OLED companies to maintain a competitive edge. Innovation in materials science, display technology, and manufacturing processes directly impacts profitability and long-term growth.

Financial Milestones of Samsung Electronics (Example)

- 2014: Significant increase in OLED panel production capacity.

- 2017: Launch of a new generation of high-resolution OLED displays.

- 2020: Increased market share in the flexible OLED display segment.

- 2023: Strategic partnerships to expand OLED supply chain.

Future Outlook for OLED Stock Prices

Predicting future stock prices is inherently speculative, but analyzing potential factors can provide a framework for informed assessment.

Positive Factors Impacting OLED Stock Prices, Stock price of oled

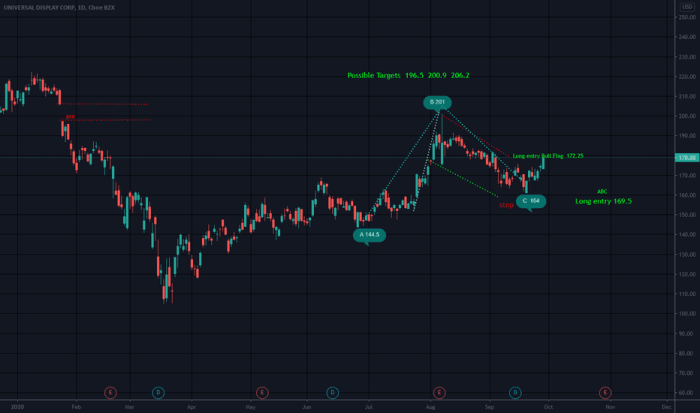

Source: tradingview.com

Continued growth in the smartphone and television markets, increasing adoption of OLED displays in automotive applications, and breakthroughs in flexible and foldable display technologies could positively influence OLED stock prices over the next five years. Furthermore, successful cost reductions in manufacturing could boost profitability and investor confidence.

Understanding the fluctuations in the stock price of OLED displays requires a broad market perspective. For instance, analyzing the performance of related tech companies, like checking the current prnhx stock price , can offer valuable insights into broader industry trends. This contextual understanding is crucial for accurately predicting future OLED stock price movements and making informed investment decisions.

Potential Risks and Challenges

The emergence of competing display technologies, such as microLED, could pose a challenge to OLED’s market dominance. Economic downturns, supply chain disruptions, and intense competition could negatively impact stock prices. Technological setbacks or delays in innovation also represent significant risks.

Impact of Emerging Display Technologies

The development and commercialization of microLED and other advanced display technologies pose a potential threat to OLED’s long-term market share. The competitive landscape will shape the future trajectory of OLED stock prices.

Strategic Decisions for Improved Stock Performance

OLED companies can enhance their stock performance through strategic decisions focused on innovation, cost reduction, efficient supply chain management, and expansion into new markets. Strategic partnerships and mergers and acquisitions could also play a role.

Hypothetical Stock Price Trajectory

Under a scenario of strong market growth and successful technological advancements, OLED stock prices could experience significant upward momentum. Conversely, in a scenario of economic slowdown and intense competition, stock prices may experience stagnation or decline. This highlights the inherent uncertainty in predicting future stock performance.

Question & Answer Hub

What are the major risks associated with investing in OLED companies?

Major risks include intense competition, rapid technological change (leading to obsolescence), economic downturns impacting consumer spending, and dependence on a limited number of key suppliers.

How can I track the stock prices of OLED companies in real-time?

You can use online brokerage platforms, financial news websites, or dedicated stock market tracking apps to monitor real-time stock prices.

What is the difference between AMOLED and PMOLED?

AMOLED (Active-Matrix Organic Light-Emitting Diode) uses a thin-film transistor (TFT) backplane for higher resolution and larger sizes, while PMOLED (Passive-Matrix Organic Light-Emitting Diode) is simpler and less expensive but has lower resolution and smaller display sizes.

What are the environmental considerations related to OLED manufacturing?

Environmental concerns include the use of rare earth materials in some components and the potential for waste generation during manufacturing and disposal. Sustainable manufacturing practices are increasingly important in the industry.