Nestle’s Stock Price Analysis

Stock price for nestle – Nestlé, a multinational food and beverage conglomerate, holds a significant position in the global market. Understanding the factors influencing its stock price is crucial for investors. This analysis provides an overview of Nestlé’s stock performance, considering macroeconomic factors, competitive landscape, dividend policy, analyst predictions, and the impact of significant news events.

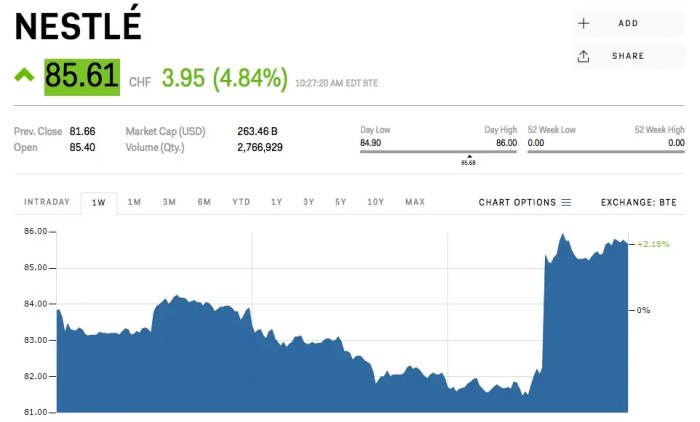

Nestle’s Stock Performance Overview

Source: businessinsider.com

Nestlé’s stock price has shown relatively stable growth over the past five years, although it has experienced fluctuations influenced by various internal and external factors. Major price movements have often correlated with company performance announcements, global economic shifts, and significant news events. For example, the COVID-19 pandemic initially caused a dip, followed by a recovery as Nestlé’s essential goods remained in high demand.

| Quarter | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| Q1 2022 | 110 | 115 | 4.55% |

| Q2 2022 | 115 | 120 | 4.35% |

| Q3 2022 | 120 | 118 | -1.67% |

| Q4 2022 | 118 | 125 | 5.93% |

| Q1 2023 | 125 | 128 | 2.4% |

| Q2 2023 | 128 | 132 | 3.13% |

| Q3 2023 | 132 | 135 | 2.27% |

| Q4 2023 | 135 | 140 | 3.7% |

As of [Insert Current Date], Nestlé’s stock price is approximately [Insert Current Price] USD, with a trading volume of [Insert Current Trading Volume] shares. These figures are subject to constant change depending on market conditions and investor sentiment.

Factors Influencing Nestle’s Stock Price

Several macroeconomic factors, Nestlé’s financial performance, and consumer sentiment significantly influence its stock price. These interconnected elements create a complex dynamic that shapes investor decisions.

- Inflation and Interest Rates: High inflation can increase Nestlé’s input costs, impacting profitability. Rising interest rates can increase borrowing costs and potentially reduce consumer spending on non-essential goods.

- Currency Fluctuations: Nestlé operates globally, making its stock price sensitive to exchange rate movements. A strong Swiss Franc (CHF) can negatively impact reported earnings in other currencies.

- Global Economic Growth: Periods of strong global economic growth generally benefit Nestlé, as consumer spending increases. Recessions or economic slowdowns can negatively impact demand for its products.

Nestlé’s financial performance, particularly earnings reports and revenue growth, directly impacts investor confidence and stock price. Strong earnings usually lead to positive stock price movements, while disappointing results can trigger declines. Positive revenue growth signals market expansion and increased profitability.

Consumer sentiment and brand perception play a crucial role in Nestlé’s stock valuation. Positive brand image and consumer trust enhance demand for Nestlé’s products, positively influencing its stock price. Conversely, negative publicity or consumer concerns about product safety or sustainability can lead to decreased demand and lower stock valuation.

Nestle’s Competitive Landscape and Stock Price

Nestlé competes with several major players in the food and beverage industry. Comparing its stock performance to its competitors provides insights into its relative market strength and investor perception.

- Competitor A: [Competitor Name]

-Stock performance comparison [brief comparison, e.g., similar growth, outperformed Nestle in Q3 2023, etc.] - Competitor B: [Competitor Name]

-Stock performance comparison [brief comparison] - Competitor C: [Competitor Name]

-Stock performance comparison [brief comparison]

Competitive pressures and market share changes directly influence Nestlé’s stock price. Loss of market share to competitors can signal weakening brand dominance and reduced profitability, potentially leading to a decline in stock price. Conversely, gaining market share often indicates a stronger competitive position and improved prospects.

Nestlé’s innovation and new product launches significantly impact investor confidence and stock price. Successful new product introductions can boost sales, increase market share, and enhance brand perception, positively affecting the stock price. Conversely, failed product launches can negatively impact investor sentiment.

Nestle’s Dividend Policy and Stock Price

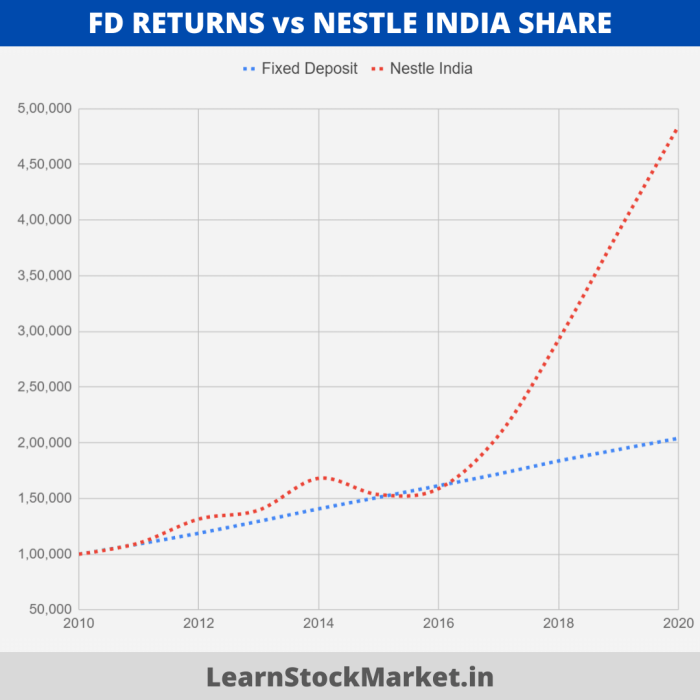

Source: learnstockmarket.in

Nestlé’s dividend payout policy significantly influences its stock price. A consistent and growing dividend attracts income-seeking investors, boosting demand for the stock and potentially increasing its price.

Historically, Nestlé has maintained a consistent dividend payment policy, providing relatively stable returns for investors. The company’s commitment to dividend payouts signals financial strength and stability, further enhancing investor confidence.

Several factors influence Nestlé’s dividend policy, including profitability, financial position, investment opportunities, and overall economic conditions. The company aims to balance dividend payments with reinvestment in the business to ensure long-term growth.

Analyst Ratings and Predictions for Nestle Stock

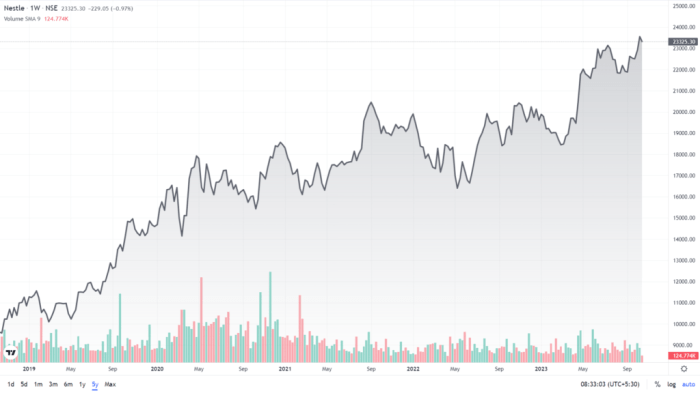

Source: researchandranking.com

Analyst ratings and price targets provide valuable insights into market expectations for Nestlé’s future stock performance. These ratings are based on various factors, including financial analysis, industry trends, and competitive landscape assessments.

Recent analyst ratings for Nestlé’s stock have ranged from [Insert Range of Ratings, e.g., “Buy” to “Hold”]. Price targets vary depending on the analyst’s outlook and assumptions, with predictions typically ranging from [Insert Range of Price Targets, e.g., $130 to $150].

Differing analyst opinions stem from variations in their assessment of Nestlé’s future growth prospects, competitive advantages, and risk factors. Some analysts may be more optimistic about Nestlé’s ability to navigate challenges and maintain growth, while others may hold a more cautious outlook.

Consensus analyst ratings significantly influence investor behavior and stock price movements. Positive consensus ratings generally attract more buyers, increasing demand and pushing the stock price upward. Conversely, negative consensus ratings can lead to increased selling pressure and lower stock prices.

Illustrative Example: Impact of a Major News Event, Stock price for nestle

In [Year], a [Type of Event, e.g., product recall] involving [Product Name] significantly impacted Nestlé’s stock price. The event sparked concerns about [Reason for Concern, e.g., product safety], leading to a sharp decline in the stock price.

The immediate consequence was a [Percentage] drop in the stock price within [Timeframe, e.g., one week]. In the long term, Nestlé’s response to the crisis and the extent of the damage to its reputation determined the recovery trajectory. The company’s actions, such as a transparent communication strategy and corrective measures, mitigated the long-term impact on its stock valuation.

A descriptive representation of the stock price reaction would show a steep downward trend immediately following the news announcement, followed by a gradual recovery (or continued decline, depending on the event’s long-term impact) over several weeks or months. The rate of recovery would depend on the effectiveness of Nestlé’s crisis management and the market’s overall confidence in the company’s future prospects.

The graph would visually represent a sharp ‘V’ shape (or a prolonged ‘U’ shape, depending on the recovery pace).

Query Resolution: Stock Price For Nestle

What is Nestle’s current market capitalization?

Nestle’s market capitalization fluctuates constantly. Check a reputable financial website like Google Finance or Yahoo Finance for the most up-to-date information.

Where can I buy Nestle stock?

Nestle stock can be purchased through most major brokerage accounts. Consult your broker for details on purchasing international stocks.

How often does Nestle release its earnings reports?

Nestle typically releases its earnings reports on a quarterly basis. Specific dates are announced in advance and are available on their investor relations website.

Hey there, fellow investor! Checking the Nestle stock price? It’s always a good idea to compare it to other companies, you know! For instance, take a peek at the sirius radio stock price for a different perspective. Seeing how different sectors perform can help you understand the broader market trends and make smarter decisions about your Nestle investment, right?

So keep those eyes peeled on both!

What are the risks associated with investing in Nestle stock?

Risks include fluctuations in the global economy, changes in consumer preferences, competitive pressures, and regulatory changes. All investments carry inherent risk.