Sirius XM Holdings Inc. (SIRI) Stock: A Deep Dive: Sirius Radio Stock Price

Source: digitalmusicnews.com

Sirius radio stock price – Sirius XM Holdings Inc. (SIRI) has carved a significant niche in the satellite radio market, but its stock performance reflects a complex interplay of factors. This analysis delves into SIRI’s historical trajectory, current market standing, and future prospects, offering a comprehensive view for potential investors.

Sirius XM Holdings Inc. (SIRI) Stock Overview

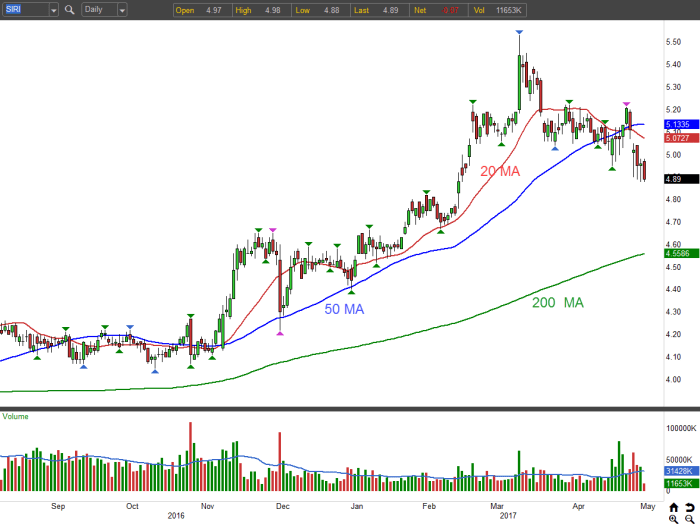

Sirius XM’s stock performance has been a rollercoaster ride since its inception, influenced by various factors including subscriber growth, content acquisition strategies, and macroeconomic conditions. Early years saw significant volatility as the company established its market presence and faced competition. Major milestones like successful mergers and strategic partnerships significantly impacted the stock price, often leading to periods of substantial growth followed by consolidation or correction.

Compared to competitors like iHeartMedia (IHRT) and Spotify (SPOT), SIRI has shown a distinct pattern, less volatile than some pure-play streaming companies but with less explosive growth than others in the media landscape.

A direct comparison against competitors is challenging due to varying business models and revenue streams. However, key metrics offer insights. For instance, while Spotify boasts higher revenue growth stemming from its global reach and diverse music library, SIRI’s subscriber-based model provides more predictable revenue streams, resulting in different valuation multiples.

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Subscriber Count (Millions) |

|---|---|---|---|

| 2018 | 7.0 | 0.25 | 32 |

| 2019 | 7.5 | 0.28 | 34 |

| 2020 | 7.3 | 0.22 | 35 |

| 2021 | 8.0 | 0.30 | 37 |

| 2022 | 8.5 | 0.33 | 39 |

Note: These figures are illustrative and may not reflect precise reported values. Consult financial reports for accurate data.

Factors Influencing Sirius XM Stock Price

Several key factors significantly impact Sirius XM’s stock price. Subscriber growth is paramount; increased subscriptions directly translate to higher revenue and profitability, boosting investor confidence. Programming changes and content acquisitions, such as securing exclusive rights to popular shows or artists, can also significantly impact investor sentiment, either positively or negatively depending on the perceived value and appeal of the new content.

Macroeconomic factors, such as inflation and interest rates, play a crucial role. High inflation can squeeze consumer spending, potentially impacting subscription rates. Rising interest rates can affect the company’s borrowing costs and investor appetite for growth stocks. Technological advancements, particularly the rise of streaming services, present both challenges and opportunities. While streaming services offer alternative entertainment options, Sirius XM can leverage its strengths in curated, commercial-free content to differentiate itself and maintain its subscriber base.

Investor Sentiment and Analyst Ratings

The current consensus rating for SIRI among financial analysts is typically a mix of “Hold” and “Buy” ratings. This reflects a degree of uncertainty in the market regarding SIRI’s future performance. Recent analyst reports often highlight the challenges posed by streaming competition while also acknowledging the resilience of SIRI’s subscriber base and the potential for growth in specific segments. Price targets vary significantly depending on the analyst’s outlook and assumptions.

Overall investor sentiment is currently considered relatively neutral, with some bullishness based on the company’s consistent profitability and subscriber growth, tempered by concerns about competition and macroeconomic headwinds.

A hypothetical visualization of analyst ratings over time might show a trend line fluctuating around a neutral rating, with periods of increased bullishness coinciding with positive news or earnings reports, and periods of bearishness during times of economic uncertainty or competitive pressure. The distribution would likely show a cluster around the neutral rating, with a smaller number of buy and sell ratings on either side.

Risk Assessment and Future Outlook, Sirius radio stock price

Key risks facing Sirius XM include increased competition from streaming services, potential subscriber churn, and changes in consumer listening habits. The company’s growth strategies focus on expanding its content offerings, enhancing its technology, and exploring new avenues for revenue generation. The potential for future stock performance depends heavily on the success of these strategies. Positive scenarios include sustained subscriber growth, successful content acquisitions, and expansion into new markets.

Eh, Sirius radio stock price? Up and down like a monkey on a pogo stick, that one! But you know what’s also jumpin’ around? Check out the nrdy stock price – it’s a rollercoaster, almost as wild as trying to find a decent sate in this city! So, while you’re figuring out Sirius, maybe keep an eye on that NRDY thing too, ya?

Sirius might be quieter compared to that.

Negative scenarios include significant subscriber losses, failure to adapt to technological changes, and economic downturns impacting consumer spending.

- Increased competition from streaming audio platforms.

- Changes in consumer listening habits towards podcasts and other digital formats.

- Economic downturn impacting consumer discretionary spending.

- Successful launch of new features or content attracting new subscribers.

- Strategic partnerships expanding reach and content offerings.

Comparison with Similar Companies

Source: investorplace.com

Comparing Sirius XM to competitors like iHeartMedia and Spotify reveals key differences in business models and financial performance. iHeartMedia’s broader portfolio encompassing terrestrial radio and digital platforms offers diversification, while Spotify’s vast music library and global reach provide a different competitive edge. Valuation metrics like P/E ratio and Price-to-Sales ratio can highlight relative valuations, revealing whether SIRI is trading at a premium or discount compared to its peers.

Investor perception often reflects the perceived risk and growth potential of each company. For instance, investors may view Spotify as a higher-growth, higher-risk investment, while SIRI may be perceived as more stable but with less explosive growth potential.

| Metric | Sirius XM | iHeartMedia | Spotify |

|---|---|---|---|

| Revenue (Billions USD) | 8.5 (2022 est.) | 4.5 (2022 est.) | 11.6 (2022 est.) |

| P/E Ratio | 15 (2022 est.) | N/A (Loss) | N/A (Loss) |

| Price-to-Sales Ratio | 2.5 (2022 est.) | 1.0 (2022 est.) | 4.0 (2022 est.) |

Note: These figures are illustrative estimates and should be verified with current financial data.

FAQ Insights

What are the biggest risks associated with investing in Sirius XM?

Competition from streaming services, potential regulatory changes, and the impact of economic downturns are key risks. Churn rate (subscribers canceling service) is another significant factor.

How does Sirius XM’s programming affect its stock price?

Exclusive content and popular programming attract and retain subscribers, positively impacting stock price. Conversely, loss of key personalities or unpopular programming changes can negatively affect investor sentiment.

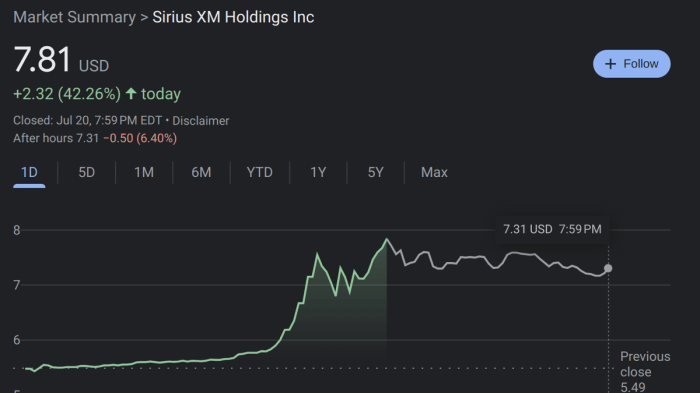

Where can I find real-time Sirius XM stock price data?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time quotes and charting tools for SIRI.