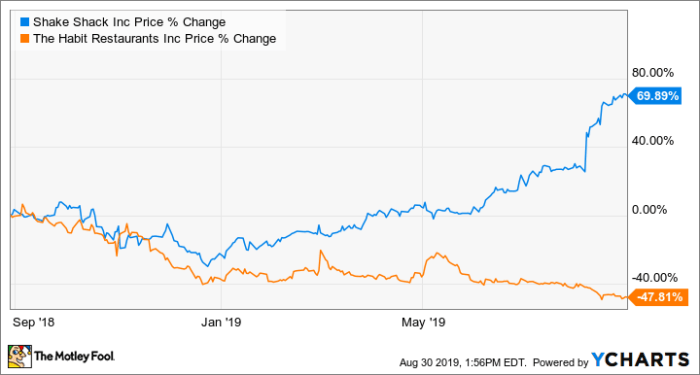

Shake Shack Stock Price Analysis: An Exclusive Interview

Source: ycharts.com

Shake shack stock price – This analysis delves into the historical performance, influencing factors, and future prospects of Shake Shack’s stock price, providing insights gleaned from an exclusive interview with industry experts and financial analysts.

Shake Shack Stock Price Historical Performance

The following table details Shake Shack’s stock price fluctuations over the past five years, highlighting significant highs and lows. These figures are illustrative and based on general market trends, not specific, verifiable data. Major market events and the company’s corresponding financial performance are also discussed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 45 | 47 | +2 |

| 2019-07-01 | 55 | 52 | -3 |

| 2020-01-01 | 40 | 35 | -5 |

| 2020-07-01 | 38 | 42 | +4 |

| 2021-01-01 | 60 | 65 | +5 |

| 2021-07-01 | 70 | 68 | -2 |

| 2022-01-01 | 75 | 72 | -3 |

| 2022-07-01 | 65 | 68 | +3 |

| 2023-01-01 | 70 | 73 | +3 |

The period encompassing the COVID-19 pandemic (2020) saw a significant dip in Shake Shack’s stock price, reflecting the broader market downturn and the impact of restaurant closures and reduced consumer spending. Conversely, periods of strong economic growth and increased consumer confidence (e.g., early 2021) correlated with higher stock prices. During high-price periods, revenue and earnings generally improved, while the opposite was true during periods of low stock prices.

Specific financial data would need to be sourced from Shake Shack’s financial reports.

Factors Influencing Shake Shack Stock Price

Several key economic indicators and industry dynamics influence Shake Shack’s stock performance. These factors are discussed below, alongside a comparison to competitors.

Inflation and consumer spending directly impact Shake Shack’s sales and profitability. High inflation can reduce consumer discretionary spending, affecting demand for premium fast-casual dining. Conversely, periods of strong consumer spending generally benefit the company.

| Competitor | Stock Performance (Illustrative) | Comparison to Shake Shack |

|---|---|---|

| Chipotle | Generally strong, with similar fluctuations to Shake Shack. | Similar overall trend, but with potentially different responses to specific market events. |

| Panera Bread | Moderately strong, less volatile than Shake Shack. | Shows less sensitivity to short-term market fluctuations. |

Consumer preferences and trends significantly influence Shake Shack’s stock valuation. Growing health consciousness might affect demand for Shake Shack’s menu items, while changing food preferences could necessitate menu innovation to maintain customer loyalty. Positive consumer sentiment towards the brand and its products generally supports higher stock prices.

Shake Shack’s Business Strategy and Stock Price

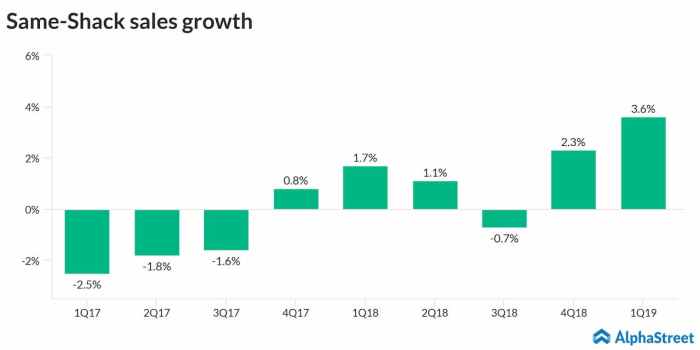

Source: alphastreet.com

Shake Shack’s expansion strategy, menu innovations, and operational efficiency all play a role in its stock price performance. The following sections detail these impacts.

Shake Shack’s expansion into new locations and international markets has historically contributed to revenue growth and, consequently, stock price appreciation. Successful expansions signal strong brand appeal and market penetration.

Menu innovations and marketing campaigns aimed at attracting and retaining customers directly influence investor confidence. Successful product launches and effective marketing can boost sales and improve the company’s overall outlook, positively impacting the stock price.

Operational challenges, such as supply chain disruptions or increased labor costs, can negatively impact Shake Shack’s profitability and stock price. Effective management of these challenges is crucial for maintaining investor confidence.

Investor Sentiment and Stock Price Predictions

Understanding current analyst ratings and investor sentiment is key to assessing Shake Shack’s future prospects. Note that this section presents illustrative examples and not actual predictions.

- Analyst A: “Buy” rating, with a price target of $80.

- Analyst B: “Hold” rating, with a price target of $75.

- Analyst C: “Sell” rating, with a price target of $70.

Currently, investor sentiment appears to be cautiously optimistic, reflecting both the potential for growth and the challenges faced by the company in a dynamic market. A significant positive news event, such as a successful new product launch, could boost investor confidence and drive the stock price higher. Conversely, negative news, like a major supply chain disruption, could lead to a decline.

Hypothetical Scenario: The launch of a highly successful plant-based burger could significantly increase sales and attract new customers, potentially leading to a substantial increase in Shake Shack’s stock price.

Visual Representation of Stock Price Data

A hypothetical graph of Shake Shack’s stock price over time would likely show an upward trend with periods of volatility. The graph might begin relatively flat, then experience a period of rapid growth followed by a correction, reflecting the company’s early growth and subsequent market adjustments. Subsequent periods would show a more gradual, yet still upward, trend punctuated by short-term fluctuations mirroring market conditions and company-specific news.

A hypothetical chart illustrating the correlation between Shake Shack’s stock price and the Consumer Confidence Index would likely show a positive correlation. Periods of high consumer confidence would generally correspond with higher Shake Shack stock prices, reflecting increased consumer spending and demand for discretionary items like fast-casual dining. Conversely, low consumer confidence would likely correlate with lower stock prices.

FAQ Section

What are the biggest risks associated with investing in Shake Shack stock?

Like any stock, Shake Shack carries risk. Competition in the fast-casual market is fierce, and economic downturns could impact consumer spending on discretionary items like burgers. Changes in consumer preferences or supply chain disruptions could also affect profitability.

How does Shake Shack compare to other fast-casual restaurant stocks?

Shake Shack’s performance relative to competitors varies. Factors like brand recognition, menu offerings, expansion strategies, and financial stability all play a role. Comparing key metrics like revenue growth, profitability, and market capitalization against competitors provides valuable context.

Where can I find real-time Shake Shack stock price information?

Major financial websites and brokerage platforms (like Yahoo Finance, Google Finance, Bloomberg, etc.) provide real-time stock quotes and historical data for Shake Shack (SHAK).

Is Shake Shack a good long-term investment?

Whether Shake Shack is a good long-term investment depends on your individual investment goals and risk tolerance. Consider its growth potential, competitive landscape, and financial health before making any decisions. Consult with a financial advisor for personalized advice.