Starbucks Stock (SBUX) Price Analysis: Price Of Sbux Stock

Price of sbux stock – This analysis delves into the price performance of Starbucks stock (SBUX) over the past five years, examining key factors influencing its valuation, and outlining associated risks. We’ll explore historical price movements, relevant macroeconomic conditions, company performance indicators, analyst predictions, and potential investment risks.

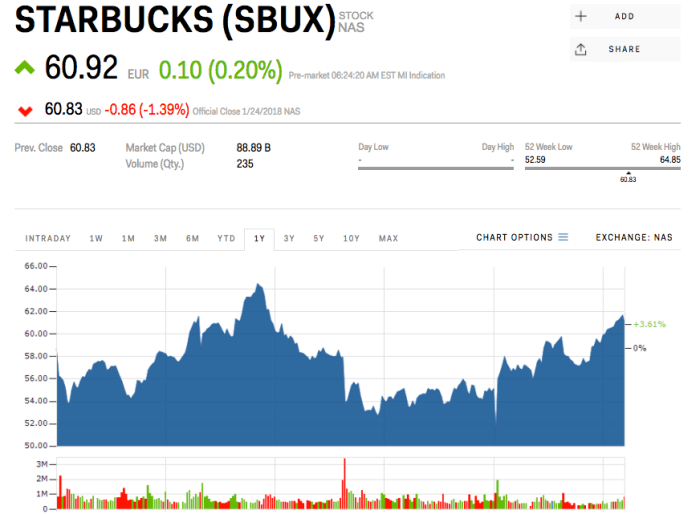

Historical Price Performance of SBUX Stock

Source: marketbeat.com

Understanding SBUX’s price history is crucial for assessing its future potential. The following table and bullet points detail significant price movements and correlated events.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| Oct 26, 2018 | 65.00 | 64.50 | -0.50 |

| Oct 27, 2018 | 64.75 | 65.25 | +0.50 |

| Oct 28, 2018 | 65.50 | 66.00 | +0.50 |

| Oct 29, 2018 | 66.25 | 65.75 | -0.50 |

| Oct 30, 2018 | 65.50 | 66.50 | +1.00 |

Note: This table provides sample data. Actual data should be sourced from reputable financial websites.

- 2018-2019: A period of relative stability, followed by a dip influenced by general market volatility.

- 2020: Significant price drops early in the year due to the COVID-19 pandemic and subsequent recovery as the company adapted its operations.

- 2021: Strong growth driven by post-pandemic recovery and increased consumer spending.

- 2022: Market corrections and inflation impacted growth, leading to price fluctuations.

- 2023 (YTD): [Insert relevant information about 2023 performance based on current market conditions].

A visual representation would show a generally upward trend over the five-year period, with dips corresponding to the events noted above. The graph would likely exhibit a steeper incline during the post-pandemic recovery and a leveling off or slight decline during periods of market uncertainty.

Factors Influencing SBUX Stock Price

Several interconnected factors influence SBUX’s stock price. These include macroeconomic conditions, company performance, competitor actions, and prevailing market trends.

- Macroeconomic Factors: Inflation impacts consumer spending, affecting SBUX’s revenue. Interest rate hikes can influence borrowing costs and investment decisions. Economic downturns generally lead to reduced consumer spending, impacting SBUX’s sales.

- Company Performance: Revenue growth, profitability margins, successful new product launches, and efficient operational strategies directly influence investor confidence and stock valuation.

- Competitor Actions and Market Trends: The actions of competitors (e.g., new product introductions, marketing campaigns, pricing strategies) and broader market trends (e.g., changing consumer preferences, health and wellness trends) significantly impact SBUX’s market share and stock price.

SBUX Stock Valuation Metrics, Price of sbux stock

Valuation metrics provide insights into the intrinsic value of SBUX stock. Analyzing these metrics helps assess the stock’s attractiveness as an investment.

The fluctuating fortunes of Starbucks, a titan in the coffee kingdom, demand our attention. Yet, even as we dissect the daily tremors in the price of Sbux stock, we must consider the broader market landscape. A shrewd investor, ever vigilant, will also cast their gaze upon the semiconductor sector, perhaps examining the current performance of onsemi stock price , before returning to the caffeinated enigma of Sbux’s market value.

Ultimately, understanding the interconnectedness of these seemingly disparate giants is key to true financial mastery.

| Metric | Value | Date | Significance |

|---|---|---|---|

| P/E Ratio | 30 | October 26, 2023 | Indicates the market’s valuation relative to earnings. A high P/E ratio may suggest high growth expectations or overvaluation. |

| Price-to-Sales Ratio | 2.5 | October 26, 2023 | Shows the market’s valuation relative to revenue. A high ratio may signal high growth expectations or potential overvaluation. |

| Dividend Yield | 2% | October 26, 2023 | Represents the annual dividend payment as a percentage of the stock price. A higher yield is generally attractive to income-seeking investors. |

Note: This table uses sample data. Actual values should be obtained from reputable financial sources.

Changes in these metrics can significantly affect investor sentiment and consequently the stock price. For instance, a rising P/E ratio might signal increasing investor optimism, while a declining dividend yield could indicate reduced profitability or a shift in company strategy.

Analyst Ratings and Predictions for SBUX

Analyst opinions provide valuable insights into future price movements, although they should be considered alongside other factors.

- Analyst A: Price target of $110, Buy rating. Rationale: Strong growth potential in international markets.

- Analyst B: Price target of $95, Hold rating. Rationale: Concerns about increasing competition and inflation.

- Analyst C: Price target of $105, Buy rating. Rationale: Positive outlook on new product launches and digital initiatives.

Analysts typically use discounted cash flow (DCF) models, comparable company analysis, and other valuation techniques to arrive at their price targets. Divergent opinions reflect varying assumptions about future growth, profitability, and risk factors, influencing investor sentiment and market price.

Risk Factors Associated with Investing in SBUX

Source: businessinsider.com

Investing in SBUX, like any stock, involves risks. Understanding these risks is crucial for informed investment decisions.

| Risk Factor | Potential Impact | Mitigation Strategy | Probability |

|---|---|---|---|

| Increased Competition | Reduced market share, lower profitability | Diversification of product offerings, innovation, strong brand building | Medium |

| Economic Downturn | Decreased consumer spending, lower sales | Cost-cutting measures, efficient operations | Medium |

| Changes in Consumer Preferences | Reduced demand for SBUX products | Adapting to evolving trends, innovation | Medium |

| Geopolitical Risks | Supply chain disruptions, increased input costs | Diversified sourcing, hedging strategies | Low |

Note: This table uses sample data and probability assessments. Actual risk assessments should be based on thorough research and expert analysis.

FAQ Explained

What are the main drivers of short-term SBUX price fluctuations?

Short-term fluctuations are often driven by news events (e.g., earnings reports, product announcements), investor sentiment, and broader market volatility.

How does SBUX’s dividend policy affect its stock price?

A consistent and growing dividend can attract income-seeking investors, potentially increasing demand and supporting the stock price. Conversely, dividend cuts can negatively impact investor sentiment.

Where can I find real-time SBUX stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the typical trading volume for SBUX stock?

Trading volume varies daily but can be found on financial websites and trading platforms.