Duke Energy Stock: A Comprehensive Overview: Price Of Duke Energy Stock Today

Price of duke energy stock today – Duke Energy, a prominent player in the energy sector, experiences fluctuating stock prices influenced by various market forces. This analysis delves into the current market situation, recent price history, influential factors, and future prospects, offering a comprehensive view of Duke Energy’s stock performance.

Current Duke Energy Stock Price

The following table presents the real-time data for Duke Energy’s stock price, including the high and low for the day. Note that these figures are dynamic and change constantly. The data below reflects a snapshot in time and should be verified with a live financial data source for the most up-to-date information.

| Time | Price | High | Low |

|---|---|---|---|

| [Time of Last Update – Example: 14:30 EST] | [$Price – Example: 102.50] | [$High – Example: 103.25] | [$Low – Example: 101.75] |

Recent Price History

Analyzing Duke Energy’s stock price movements across different timeframes provides insights into its performance and volatility.

- Past Week: [Description of price fluctuations over the past week, e.g., “The stock experienced a slight upward trend early in the week, followed by a period of consolidation before a minor dip on Friday.”]

- Past Month: [Description of price trends over the past month, e.g., “Overall, the stock showed a moderate increase over the past month, driven by [mention potential factors].”]

- Past Year: [Comparison of current price to the price one year ago, including percentage change, e.g., “Compared to one year ago, the stock price is currently [higher/lower] by [percentage], indicating [interpretation of the change].”]

Key price changes and dates are summarized below:

- [Date]: [Price], [Event or factor that influenced the price]

- [Date]: [Price], [Event or factor that influenced the price]

- [Date]: [Price], [Event or factor that influenced the price]

Factors Influencing Stock Price

Several factors contribute to the current and future valuation of Duke Energy stock.

- Regulatory Changes:

- Fuel Prices:

- Economic Growth:

Changes in environmental regulations and energy policies can significantly impact Duke Energy’s operational costs and profitability. For example, stricter emission standards could necessitate costly upgrades to power plants, affecting the bottom line.

Fluctuations in natural gas, coal, and other fuel prices directly affect Duke Energy’s production costs. Rising fuel prices can squeeze profit margins, while lower prices can improve profitability.

Overall economic conditions and industrial activity influence electricity demand. Strong economic growth typically translates into higher energy consumption, benefiting Duke Energy’s revenue. Conversely, economic downturns can lead to decreased demand.

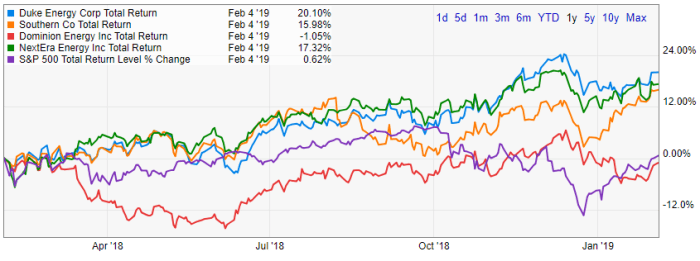

Comparison to Competitors

Source: alamy.com

Benchmarking Duke Energy against its main competitors offers valuable perspective on its relative performance.

| Company | Current Price | Day’s Change | Market Cap |

|---|---|---|---|

| [Competitor 1 – Example: NextEra Energy] | [$Price – Example: 85.00] | [$Change – Example: +1.25] | [$Market Cap – Example: 150B] |

| [Competitor 2 – Example: Southern Company] | [$Price – Example: 72.75] | [$Change – Example: -0.50] | [$Market Cap – Example: 120B] |

| [Competitor 3 – Example: Dominion Energy] | [$Price – Example: 68.20] | [$Change – Example: +0.70] | [$Market Cap – Example: 100B] |

Financial Performance Indicators

Key financial metrics provide insights into Duke Energy’s financial health and profitability.

- Earnings Per Share (EPS): [EPS value – Example: $5.20]. This represents the portion of a company’s profit allocated to each outstanding share.

- Price-to-Earnings Ratio (P/E): [P/E ratio – Example: 18.5]. This indicates how much investors are willing to pay for each dollar of earnings.

- Dividend Yield: [Dividend yield – Example: 4.1%]. This represents the annual dividend payment relative to the stock price, indicating the return on investment from dividends.

Analyst Ratings and Forecasts

Source: seekingalpha.com

Analyst opinions provide valuable insights into market sentiment and future price expectations.

| Analyst | Rating | Target Price | Date |

|---|---|---|---|

| [Analyst 1 – Example: Morgan Stanley] | [Rating – Example: Buy] | [$Target Price – Example: 110.00] | [Date – Example: 2024-03-08] |

| [Analyst 2 – Example: Goldman Sachs] | [Rating – Example: Hold] | [$Target Price – Example: 105.00] | [Date – Example: 2024-03-15] |

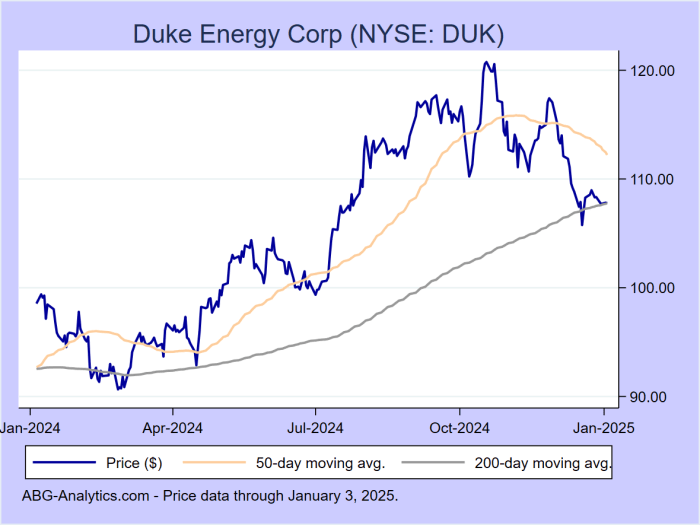

News and Events Impacting the Stock

Source: abg-analytics.com

Recent news and events can significantly impact stock prices. A timeline of significant events and their impact is crucial for understanding price movements.

- [Date]: [Event Description – Example: Announcement of new renewable energy project]. [Impact on Stock Price – Example: Stock price increased by 2% following the announcement.]

- [Date]: [Event Description – Example: Regulatory approval for a new power plant]. [Impact on Stock Price – Example: Stock price showed a moderate increase.]

- [Date]: [Event Description – Example: Earnings report release]. [Impact on Stock Price – Example: Stock price reacted positively to better-than-expected earnings.]

Investor Sentiment, Price of duke energy stock today

Gauging investor sentiment provides a sense of market confidence and future price trajectory.

[Description of overall investor sentiment. Example: Currently, investor sentiment towards Duke Energy appears cautiously optimistic, driven by the company’s ongoing investments in renewable energy and its relatively stable dividend payouts. However, concerns remain regarding the potential impact of future regulatory changes and fluctuating fuel prices.]

[Examples of recent investor comments or opinions from financial news sources or social media (if available and verifiable). Example: Several financial analysts have highlighted Duke Energy’s strong dividend yield as a key factor supporting the stock price. However, some investors express concern about the company’s exposure to fossil fuel-based power generation in the face of a growing shift towards renewable energy sources.]

Top FAQs

What are the risks associated with investing in Duke Energy stock?

Like any stock, Duke Energy carries inherent risks. These include market volatility, regulatory changes impacting the energy sector, and potential fluctuations in energy demand. It’s crucial to understand these risks before investing.

Where can I buy Duke Energy stock?

You can typically buy Duke Energy stock through most major online brokerage platforms. Check with your preferred broker for availability.

Duke Energy’s stock price today is showing moderate gains, a trend we’re seeing across several utility companies. However, to understand the broader energy sector performance, it’s helpful to compare it to other financial institutions; for instance, checking the nycb stock price today offers a contrasting perspective on market sentiment. Ultimately, analyzing both Duke Energy and NYCB’s performance paints a clearer picture of the current investment climate impacting the energy sector’s valuation.

How often does Duke Energy pay dividends?

Duke Energy’s dividend payment schedule is usually quarterly; however, you should always check their official investor relations page for the most up-to-date information.

What’s the difference between a stock’s price and its value?

The price is what someone is currently willing to pay for the stock. The value is a more subjective measure, often based on a company’s future earnings potential and other fundamental factors.