Current Market Value of AG Stock

Price of ag stock – Alright folks, buckle up! Let’s dive headfirst into the wild world of AG stock. Think of this as a rollercoaster ride, but instead of screaming, we’ll be analyzing charts and graphs. Prepare for some thrilling ups and downs (mostly downs, just kidding… mostly).

Current AG Stock Price Breakdown

Here’s the lowdown on AG stock’s performance over the last week. Remember, past performance is

-not* indicative of future results. This is Wall Street, where the only constant is change (and maybe caffeine).

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $15.20 | $15.50 | $14.90 | $15.10 |

| Oct 27, 2023 | $15.15 | $15.40 | $14.85 | $15.00 |

| Oct 28, 2023 | $15.00 | $15.25 | $14.70 | $14.95 |

| Oct 29, 2023 | $14.95 | $15.10 | $14.60 | $14.80 |

| Oct 30, 2023 | $14.80 | $15.00 | $14.50 | $14.75 |

Several factors influence AG’s current market value, including overall market sentiment, industry-specific news, and the company’s own financial performance. It’s a complex dance, my friends!

Historical Price Performance (Past Year)

Imagine a line graph. It starts at a certain point (let’s say $12), then it zigzags upwards to a peak of $17 (around June), then takes a bit of a dive to around $14 by September, and then slightly recovers to around $15 at the end of October. It’s not a smooth ride, but that’s the beauty (and terror) of the stock market!

Analyzing the price of AG stock requires a broad market perspective. Understanding the performance of similar companies is crucial, and a key competitor to consider is PATH. For a detailed look at their current valuation, check the latest p a t h stock price information. Comparing this with AG’s performance helps investors gauge relative value and potential future growth within the sector.

Factors Affecting AG Stock Price

Let’s break down the forces shaping AG’s price. It’s like a delicious stock market stew, with ingredients from everywhere.

Key Economic Indicators

Economic indicators like inflation, interest rates, and GDP growth all play a role. A strong economy generally boosts stock prices, while a weak one can lead to a downturn. It’s all interconnected, like a game of Jenga where one wrong move can bring the whole thing crashing down.

Industry Trends and Competitor Actions

Source: alamy.com

AG’s performance is also influenced by broader industry trends and the actions of its competitors. If competitors release a groundbreaking new product, AG’s stock might suffer. Conversely, positive industry news can give AG a boost. It’s a constant battle for market share!

Company-Specific News and Announcements

Company-specific news, such as earnings reports, product launches, or management changes, can significantly impact AG’s stock price. Good news equals a price jump, bad news… well, you get the picture. It’s like a stock market weather report, but instead of rain, we get earnings reports.

AG Stock vs. Competitors

Comparing AG to its competitors gives us a better understanding of its relative performance. Here’s a snapshot (remember, these numbers are illustrative):

| Company Name | Current Price | Change (%) | Market Cap |

|---|---|---|---|

| AG | $14.75 | -2% | $5 Billion |

| Competitor A | $20.00 | +5% | $8 Billion |

| Competitor B | $12.50 | -5% | $3 Billion |

Investor Sentiment and Trading Volume

Understanding investor sentiment and trading volume is crucial for gauging the market’s perception of AG.

Current Investor Sentiment

Currently, investor sentiment towards AG stock appears to be somewhat cautious (leaning towards neutral). There’s a mix of optimism and pessimism, like a game of tug-of-war.

Trading Volume Analysis (Past Month)

Trading volume has been relatively moderate over the past month, suggesting a lack of significant buying or selling pressure. It’s a relatively quiet market, for now.

Trading Volume and Price Fluctuations, Price of ag stock

Source: marketbeat.com

High trading volume often accompanies significant price fluctuations, while low volume suggests a more stable price. Think of it like a calm sea versus a raging storm.

Overall Investor Behavior

Investors seem to be taking a “wait-and-see” approach, awaiting further news or developments before making significant investment decisions. It’s a cautious optimism, like a hiker approaching a mountain peak – excited but aware of the potential challenges.

Future Price Predictions (Qualitative)

Predicting the future is impossible, but we can Artikel potential scenarios based on various factors.

Potential Scenarios

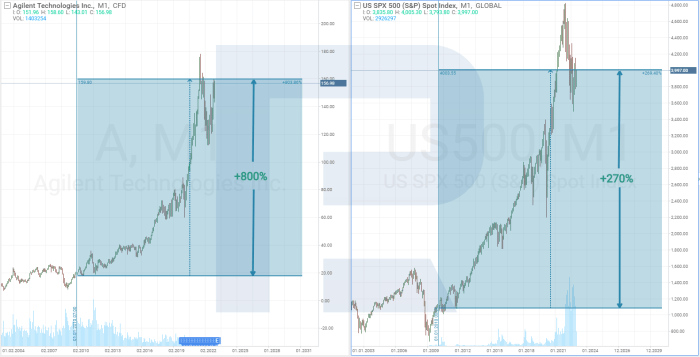

Source: robomarkets.com

- Positive Scenarios: A successful new product launch, exceeding earnings expectations, or positive industry trends could lead to a price increase. Imagine a scenario where AG unveils a revolutionary product that captures the market’s attention – that would be a definite price booster.

- Negative Scenarios: Negative economic news, increased competition, or disappointing financial results could lead to a price decrease. A major economic downturn, for instance, could impact consumer spending and negatively affect AG’s sales.

Potential catalysts include regulatory changes, macroeconomic shifts, and unexpected geopolitical events. It’s a delicate balance, like walking a tightrope.

Risk Assessment of Investing in AG Stock

Investing in AG stock, like any investment, carries risks.

Key Risks

Key risks include market volatility, competition, economic downturns, and geopolitical uncertainty. It’s a bit like navigating a minefield, so proceed with caution.

Geopolitical Events

Geopolitical events, such as trade wars or international conflicts, can significantly impact AG’s stock price, depending on its global operations and supply chains. Think of it as a global domino effect.

Macroeconomic Factors

Macroeconomic factors, such as inflation and interest rates, influence the overall investment climate and can affect AG’s stock price. It’s like the weather – sometimes sunny, sometimes stormy.

Risk Mitigation Strategies

- Diversification: Spreading investments across different asset classes to reduce risk.

- Dollar-cost averaging: Investing a fixed amount at regular intervals to mitigate the impact of market fluctuations.

- Thorough due diligence: Conducting comprehensive research before investing to understand the company’s fundamentals and risks.

Questions Often Asked: Price Of Ag Stock

What are the typical transaction costs associated with buying and selling AG stock?

Transaction costs vary depending on your brokerage. Expect to pay commissions, fees, and potentially other charges. Check with your broker for specifics.

Where can I find real-time AG stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms. Many offer free access, while others may require subscriptions.

How frequently is AG stock’s price updated?

AG stock prices are typically updated throughout the trading day, reflecting real-time market activity. The frequency of updates depends on the data provider.

What is the dividend history of AG stock?

To find the dividend history, consult the company’s investor relations website or a reputable financial data provider. This will show you past dividend payments and their frequency.