Understanding Power Grid Stock Performance

The power grid sector, a cornerstone of modern economies, presents a complex investment landscape. Fluctuations in power grid stock prices are influenced by a multitude of interconnected factors, ranging from macroeconomic trends to technological advancements and geopolitical events. Understanding these influences is crucial for investors seeking to navigate this dynamic market.

Factors Influencing Power Grid Stock Prices

Several key factors significantly impact power grid stock valuations. These include regulatory changes affecting energy pricing and infrastructure investment, the overall economic climate (interest rates, inflation), the integration of renewable energy sources, and technological innovations impacting grid efficiency and resilience. Geopolitical instability and the reliability of energy supply also play a significant role.

Historical Performance of Major Power Grid Companies

Analyzing the historical performance of major power grid companies provides valuable insights into long-term trends and cyclical patterns. Companies like NextEra Energy, American Electric Power, and Duke Energy have demonstrated varying degrees of growth and stability over the past decade, reflecting the diverse operational models and market conditions they face. Their stock prices have been influenced by factors such as fuel costs, regulatory approvals, and their respective investments in renewable energy and grid modernization.

Comparative Stock Performance Across Market Conditions

A comparative analysis of power grid companies reveals distinct responses to different market conditions. During periods of economic growth, companies with strong expansion plans and investments in renewable energy often outperform their peers. Conversely, during economic downturns, companies with robust balance sheets and diversified revenue streams tend to demonstrate greater resilience. This comparative analysis highlights the importance of diversification and a long-term investment strategy.

| Company | Stock Price (5-year avg.) | EPS (5-year avg.) | Revenue (5-year avg.) (USD Billions) | Debt-to-Equity Ratio (5-year avg.) |

|---|---|---|---|---|

| NextEra Energy | $85 | $10 | $18 | 1.2 |

| American Electric Power | $90 | $4 | $15 | 1.0 |

| Duke Energy | $100 | $6 | $22 | 1.5 |

Impact of Renewable Energy Integration

The increasing adoption of renewable energy sources presents both challenges and opportunities for power grid companies. This transition necessitates significant investments in grid infrastructure, smart grid technologies, and energy storage solutions. The financial implications of this transition are substantial, impacting stock valuations and investor sentiment.

Effect of Renewable Energy Adoption on Power Grid Stock Valuations, Power grid stock price

Source: tosshub.com

The integration of renewable energy has a complex effect on power grid stock valuations. While it creates opportunities for long-term growth through new infrastructure projects and services, it also introduces uncertainties related to energy price volatility and the need for significant capital expenditures. Companies successfully adapting to this shift, investing in smart grid technologies and energy storage, often see positive impacts on their stock valuations.

Challenges and Opportunities Presented by Renewable Energy Integration

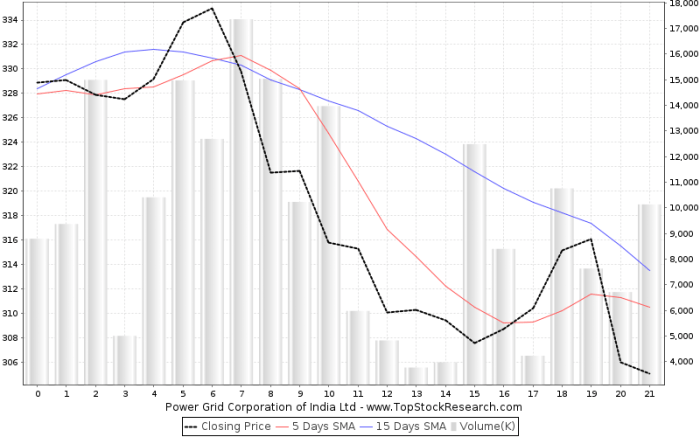

Source: topstockresearch.com

Challenges include intermittency of renewable energy sources, requiring substantial investment in energy storage and grid modernization. Opportunities lie in developing and deploying smart grid technologies, providing grid services to renewable energy generators, and participating in the burgeoning market for energy storage solutions. Companies adept at managing these challenges and capitalizing on these opportunities are well-positioned for future growth.

Fluctuations in power grid stock prices are often influenced by broader market trends. Investors are also closely watching the performance of consumer staples giants, such as the nestle company stock price , to gauge overall economic health. This is because Nestle’s performance often reflects consumer spending patterns, which can indirectly impact demand for electricity and thus, power grid companies.

Government Policies and Regulations Concerning Renewable Energy

Government policies play a critical role in shaping the renewable energy landscape and influencing power grid stock prices. Subsidies, tax incentives, renewable portfolio standards, and carbon pricing mechanisms can significantly impact the profitability and investment attractiveness of power grid companies. Favorable policies generally lead to increased investment in renewable energy infrastructure, benefiting companies involved in grid modernization and expansion.

Correlation Between Renewable Energy Investment and Power Grid Stock Performance

A visual representation (e.g., a scatter plot) would show a positive correlation between increased renewable energy investment (measured in USD billions) and the average stock price performance of a basket of major power grid companies over a five-year period. While the correlation may not be perfectly linear, a general upward trend would indicate that companies successfully navigating the renewable energy transition tend to experience improved stock performance.

Geopolitical and Regulatory Influences

Geopolitical events and regulatory frameworks significantly impact the power grid sector. International relations, energy security concerns, and regulatory changes in different countries create both risks and opportunities for power grid companies.

Geopolitical Factors Affecting Power Grid Stock Prices

Geopolitical factors such as international conflicts, trade disputes, and energy supply disruptions can significantly affect power grid stock prices. For example, tensions in major energy-producing regions can lead to price volatility and uncertainty, impacting the profitability of power grid companies. Similarly, sanctions or trade restrictions can disrupt supply chains and increase the cost of equipment and materials.

Examples of Regulatory Changes Impacting Power Grid Companies

Changes in environmental regulations, energy pricing policies, and infrastructure investment frameworks can substantially impact the profitability and stock prices of power grid companies. For instance, the introduction of carbon pricing mechanisms can increase operating costs for companies reliant on fossil fuels, while supportive regulations for renewable energy integration can drive investment and boost stock valuations.

Regulatory Environments of Different Countries and Their Effects on Power Grid Investments

Regulatory environments vary significantly across countries, impacting the attractiveness of power grid investments. Countries with stable regulatory frameworks, supportive policies for renewable energy integration, and clear investment guidelines tend to attract more investment and see higher valuations for their power grid companies. Conversely, countries with unpredictable regulatory changes or inconsistent policies can deter investment and negatively impact stock prices.

Potential Geopolitical Risks and Their Impact on Power Grid Stock Prices

- Energy supply disruptions: Geopolitical instability in major energy-producing regions can lead to price volatility and supply shortages, impacting profitability and stock prices.

- Trade wars and sanctions: Trade disputes and sanctions can disrupt supply chains, increase the cost of equipment, and negatively impact power grid companies’ profitability.

- Climate change-related events: Extreme weather events, such as hurricanes and wildfires, can damage power grid infrastructure, leading to increased operating costs and reduced profitability.

Technological Advancements and Innovation: Power Grid Stock Price

Source: stockpriceguru.com

Technological advancements in energy storage and smart grid technologies are transforming the power grid sector, improving efficiency, resilience, and overall performance. These innovations have significant implications for power grid stock valuations.

Technological Advancements Affecting Power Grid Stock Valuations

Advancements in energy storage technologies, such as lithium-ion batteries and pumped hydro storage, are enhancing the grid’s ability to integrate renewable energy sources and improve reliability. Smart grid technologies, including advanced metering infrastructure (AMI) and distribution automation systems, are increasing grid efficiency and reducing operational costs. These technological advancements create new revenue streams and enhance the long-term value of power grid companies.

Role of Innovation in Improving Grid Efficiency and Resilience

Innovation plays a crucial role in improving the efficiency and resilience of power grids. Advanced analytics, artificial intelligence, and machine learning are being used to optimize grid operations, predict and prevent outages, and improve overall grid performance. These innovations lead to cost savings, reduced downtime, and enhanced customer satisfaction, ultimately positively impacting stock valuations.

Successful Technological Implementations and Market Response

Several successful technological implementations have demonstrably impacted the power grid sector and its stock prices. For example, the widespread adoption of smart meters has led to improved energy efficiency and reduced energy theft, benefiting utility companies’ bottom lines and stock valuations. Similarly, investments in renewable energy integration and energy storage have attracted investor interest and contributed to increased stock prices for companies actively involved in these technologies.

| Technology | Impact on Efficiency | Impact on Resilience | Impact on Stock Price |

|---|---|---|---|

| Energy Storage (Battery Tech) | Improved grid stability, reduced reliance on peaking plants | Increased grid resilience to outages and extreme weather | Positive, increased investor interest |

| Smart Grid Technologies (AMI) | Reduced energy losses, improved grid management | Faster outage detection and restoration | Positive, improved operational efficiency |

| AI/ML for Grid Optimization | Predictive maintenance, reduced operational costs | Improved grid planning and resource allocation | Positive, enhanced grid performance |

Financial Health and Investment Strategies

Assessing the financial health of power grid companies and developing appropriate investment strategies requires a thorough understanding of key financial indicators and market dynamics. Different investment strategies cater to varying risk tolerances and market outlooks.

Key Financial Indicators for Assessing Power Grid Companies

Key financial indicators used to assess the health and stability of power grid companies include debt-to-equity ratio, earnings per share (EPS), revenue growth, return on equity (ROE), and cash flow from operations. Analyzing these metrics provides insights into a company’s profitability, financial leverage, and overall financial strength. A strong balance sheet and consistent cash flow are essential for long-term stability and investor confidence.

Investment Strategies for Power Grid Stocks

Investment strategies for power grid stocks can range from long-term buy-and-hold approaches to more active trading strategies. Long-term investors may focus on companies with strong fundamentals and a history of consistent dividend payments. Active traders may employ short-term strategies based on market trends and technical analysis. The choice of strategy depends on individual risk tolerance and investment goals.

Risk-Reward Profiles of Investing in Different Power Grid Companies

Different power grid companies present varying risk-reward profiles. Companies with a significant reliance on fossil fuels may face higher risks related to environmental regulations and carbon pricing. Companies heavily invested in renewable energy may experience higher growth potential but also face greater uncertainties related to technology and policy changes. Diversification across different companies and investment strategies can help manage risk and optimize returns.

Potential Investment Strategies for Power Grid Stocks

- High Risk: Investing in smaller, rapidly growing companies focused on innovative technologies, potentially higher returns but also greater volatility.

- Medium Risk: Investing in established companies with a diversified portfolio of energy sources and a track record of stable growth.

- Low Risk: Investing in large, well-established companies with a history of consistent dividend payments and strong balance sheets, offering lower growth potential but greater stability.

FAQs

What are the ethical considerations of investing in power grid companies?

Ethical investing in this sector involves considering a company’s commitment to sustainability, responsible sourcing, and fair labor practices. Research their environmental impact, social responsibility initiatives, and governance structures.

How can I diversify my power grid stock portfolio?

Diversification is key. Invest in companies with varying geographic locations, business models (generation, transmission, distribution), and levels of renewable energy integration. This mitigates risk associated with specific regions or technologies.

What is the long-term outlook for power grid stocks?

The long-term outlook is generally positive, driven by increasing energy demand and the need for grid modernization to accommodate renewable energy sources. However, market fluctuations are inevitable, and careful research is crucial.