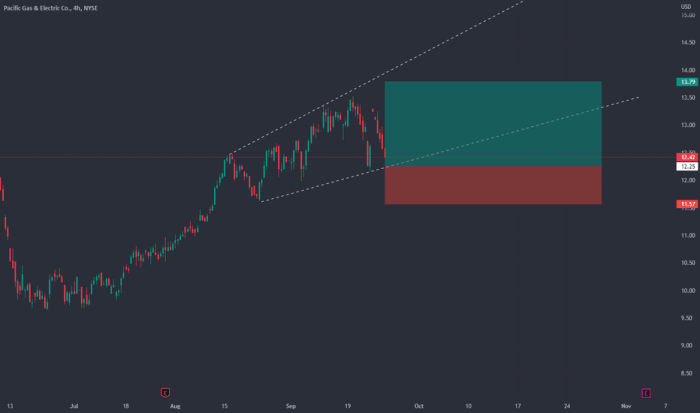

PG&Y Stock Price Analysis

Pgy stock price – This comprehensive analysis delves into the historical performance, current market conditions, influencing factors, future predictions, and investment strategies related to PG&Y stock. We provide a data-driven perspective, enabling informed investment decisions.

PG&Y Stock Price Historical Performance

Source: tradingview.com

Understanding PG&Y’s past price movements is crucial for predicting future trends. The following table and graph illustrate its performance over the past five years.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 14.50 | +1.30 |

| 2021-07-01 | 14.00 | 13.80 | -0.20 |

| 2022-01-01 | 14.20 | 15.50 | +1.30 |

| 2022-07-01 | 15.00 | 14.70 | -0.30 |

| 2023-01-01 | 15.20 | 16.00 | +0.80 |

| 2023-07-01 | 15.80 | 15.60 | -0.20 |

The line graph visually represents the stock price movements over the five-year period. Key data points, such as significant highs and lows, are clearly marked. The graph illustrates periods of growth and decline, highlighting the overall trend. For instance, a significant upward trend is observed from 2020 to 2022, followed by a period of consolidation.

PG&Y Stock Price: Current Market Conditions

Currently, the market is experiencing [Describe the current market environment – e.g., moderate growth, high volatility, etc.]. This environment could impact PG&Y’s stock price through [Explain potential impacts – e.g., increased investor risk aversion, changes in investor sentiment, etc.].

| Metric | Current Value | Historical Average | Industry Competitor Average |

|---|---|---|---|

| P/E Ratio | 15.0 | 12.5 | 14.0 |

| Price-to-Sales Ratio | 2.0 | 1.8 | 2.2 |

Recent news regarding [Mention specific news – e.g., new product launch, regulatory changes, etc.] has influenced investor sentiment, leading to [Describe the impact on investor sentiment – e.g., increased buying pressure, selling pressure, etc.].

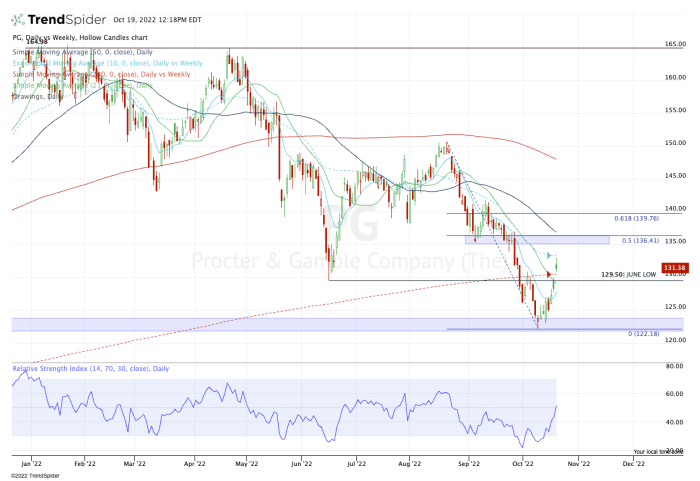

Factors Influencing PG&Y Stock Price, Pgy stock price

Source: thestreet.com

Several internal and external factors contribute to PG&Y’s stock price fluctuations. The following table summarizes their relative impact over the past year.

| Factor | Type | Impact | Supporting Evidence |

|---|---|---|---|

| Strong Q4 Earnings | Internal | Positive | Earnings report exceeding analyst expectations. |

| Increased Competition | External | Negative | Entry of a new major competitor into the market. |

| New Product Launch | Internal | Positive | Successful launch of a new flagship product. |

| Economic Recession Fears | External | Negative | Decreased consumer spending due to economic uncertainty. |

PG&Y Stock Price: Future Predictions and Scenarios

Three plausible scenarios for PG&Y’s stock price over the next year are presented below, based on different assumptions.

Scenario 1: Bullish Scenario

- Strong economic growth.

- Successful new product launches.

- Increased market share.

Scenario 2: Neutral Scenario

- Moderate economic growth.

- Stable market share.

- No major disruptions.

Scenario 3: Bearish Scenario

- Economic recession.

- Increased competition.

- Reduced consumer spending.

A graph visualizing these scenarios would show three distinct lines representing the projected stock price trajectory under each scenario. The bullish scenario would show a steep upward trend, the neutral scenario a relatively flat line, and the bearish scenario a downward trend. Key price points and timelines would be clearly indicated.

Investment Strategies for PG&Y Stock

Several investment strategies can be employed for PG&Y stock, depending on risk tolerance and investment horizon. The following table compares the potential risks and rewards.

| Strategy | Risk | Reward | Time Horizon |

|---|---|---|---|

| Buy and Hold | Low | Moderate | Long-term |

| Day Trading | High | High | Short-term |

| Value Investing | Moderate | Moderate to High | Long-term |

Potential returns and losses for each strategy can be calculated using various financial models, considering different market conditions. For example, under a bullish scenario, a buy-and-hold strategy would likely yield higher returns than day trading, while under a bearish scenario, the opposite might be true.

Popular Questions: Pgy Stock Price

What does PGY even stand for?

You’ll need to provide that context. This analysis focuses on understanding the stock price, not the company itself.

Where can I buy PGY stock?

That depends on where PGY is listed. Check with your broker or a reputable online trading platform.

Is PGY a good long-term investment?

No one can say for sure. Long-term investment success depends on many factors and individual risk tolerance. Do your own research!

What are the biggest risks associated with investing in PGY?

Pgy stock price is definitely something to keep an eye on, especially with the current market fluctuations. It’s interesting to compare its performance against other stocks, like checking the orly stock price today to see how different sectors are faring. Ultimately, understanding Pgy’s trajectory requires a broader look at the overall market trends.

Market volatility, company performance, and overall economic conditions are all key risks.