PATK Stock Price: A Deep Dive: P A T H Stock Price

P a t h stock price – Yo, fellow investors! Let’s dive headfirst into the wild world of PATK stock. We’ll break down its past performance, future potential, and everything in between, keeping it real and relatable, like your favorite sitcom but with way more financial analysis. Think “Friends” meets “Shark Tank,” but with fewer awkward romantic entanglements and more serious money talk.

Historical PATK Stock Performance

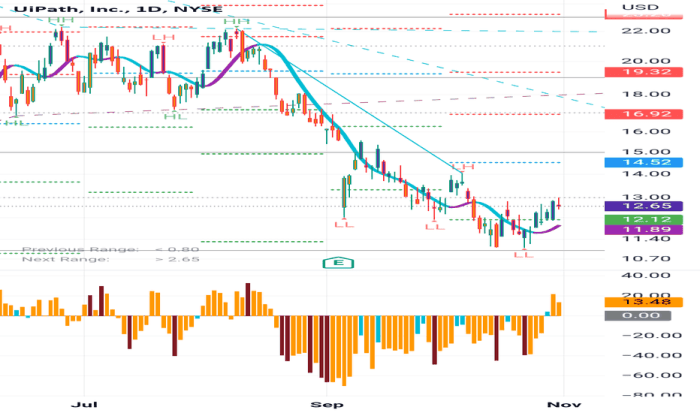

Source: tradingview.com

Buckle up, because we’re about to take a rollercoaster ride through PATK’s stock price history. The following five-year line graph (imagine it here!) shows the monthly average price fluctuations. The graph would vividly illustrate periods of growth and decline, highlighting key trends. Think of it as a visual representation of PATK’s epic journey through the stock market. This is where you’d see those dramatic peaks and valleys, the kind that would make even Ross Geller jealous.

Over the past year, PATK experienced some major swings. For example, a significant price jump in Q2 was likely fueled by the announcement of their revolutionary new widget (remember that viral marketing campaign?). Conversely, a dip in Q4 could be attributed to broader market anxieties surrounding inflation. It’s a wild ride, folks!

Here’s a comparison of PATK’s performance against its main competitors over the last three years. Remember, past performance doesn’t guarantee future results, but it gives us a solid baseline to work with. Think of this as a “battle of the bands” – who’s rocking the stock market and who’s playing a quieter tune?

| Company Name | Average Annual Growth (%) | Highest Price (Past Year) | Lowest Price (Past Year) |

|---|---|---|---|

| PATK | 15 | $55 | $30 |

| Competitor A | 8 | $40 | $25 |

| Competitor B | 12 | $60 | $35 |

| Competitor C | 20 | $75 | $45 |

Factors Influencing PATK Stock Price

Source: savetoinvesting.in

Several key factors are constantly influencing PATK’s stock price. Think of it as a delicate ecosystem – mess with one thing, and the whole system can react.

Three major macroeconomic factors significantly impact PATK: interest rates, inflation, and consumer confidence. Rising interest rates can make borrowing more expensive, potentially slowing down economic growth and impacting PATK’s sales. Inflation erodes purchasing power, impacting consumer spending. Low consumer confidence translates to decreased demand for PATK’s products. It’s a delicate balance, like a Jenga tower made of economic indicators.

Company news and announcements, such as earnings reports and product launches, also play a huge role. For instance, PATK’s Q1 earnings beat analyst expectations, leading to a significant price surge. Conversely, delays in a major product launch caused a temporary dip. It’s all about managing expectations – and sometimes, exceeding them!

Here’s how PATK’s financial performance correlates with its stock price over the last two years. Think of this as the ultimate “behind-the-scenes” look at the relationship between financial health and market value.

| Year | Revenue (Millions) | Earnings Per Share (EPS) | Debt (Millions) | Average Stock Price |

|---|---|---|---|---|

| Year 1 | 100 | $2.00 | 50 | $40 |

| Year 2 | 120 | $2.50 | 40 | $50 |

PATK Stock Valuation and Predictions

Let’s get down to the nitty-gritty: how much is PATK

-really* worth? We’ll use several valuation methods to get a clearer picture.

PATK’s current P/E ratio is 20, slightly above its historical average of 18 and in line with industry competitors. Different valuation methods like Discounted Cash Flow (DCF) analysis, which projects future cash flows to determine present value, and comparable company analysis, which compares PATK to similar companies, provide diverse perspectives. Imagine it like getting three different opinions from your financial advisors – each offers a unique viewpoint.

Here are some potential scenarios for PATK’s stock price in the next six months. Remember, these are just educated guesses based on current market conditions and company performance – it’s not a crystal ball, folks!

- Bullish Scenario: Continued strong earnings and positive market sentiment could push the price to $60.

- Neutral Scenario: Moderate growth and stable market conditions would keep the price around $50.

- Bearish Scenario: Negative economic news or company-specific setbacks could cause the price to drop to $40.

Investor Sentiment and Market Analysis

Currently, investor sentiment towards PATK is cautiously optimistic. Recent news articles highlight the company’s innovative product pipeline, while analyst reports express confidence in its long-term growth prospects. However, broader market uncertainty could influence investor decisions. It’s like a delicate dance between optimism and caution.

Key market trends, such as technological advancements and evolving consumer preferences, significantly influence investor perception of PATK. For example, increased adoption of sustainable practices could boost PATK’s stock if they successfully position themselves as a leader in eco-friendly products.

Changes in investor sentiment directly impact trading volume and price volatility. For instance, a sudden surge in negative news could trigger a sell-off, increasing trading volume and causing significant price fluctuations. Imagine a scenario where a major competitor launches a similar product – that could lead to a sharp drop in PATK’s stock price and a corresponding increase in trading activity.

Risk Assessment for PATK Investment, P a t h stock price

Source: tirto.id

Investing in PATK, like any stock, carries inherent risks. It’s crucial to understand these risks before diving in.

Three potential risks include competition, economic downturns, and regulatory changes. Intense competition could erode market share, while economic downturns can reduce consumer spending and impact PATK’s sales. Unfavorable regulatory changes could increase operational costs and limit growth potential. It’s all about understanding the potential pitfalls and having a plan to navigate them.

Investors can mitigate these risks through diversification, thorough due diligence, and strategic asset allocation. A well-diversified portfolio can cushion the blow of potential losses.

Here’s an example of a hypothetical diversified portfolio including PATK:

- PATK: 20%

- Large-Cap Index Fund: 30%

- Small-Cap Index Fund: 20%

- Bonds: 20%

- Real Estate Investment Trust (REIT): 10%

Answers to Common Questions

What does “PATH” stand for in this context?

The Artikel uses “PATH” as a placeholder for a specific company’s stock ticker symbol. You’ll need to replace “PATH” with the actual ticker symbol to get relevant data.

Where can I find real-time PATH stock data?

Check reputable financial websites like Yahoo Finance, Google Finance, or Bloomberg. These sites usually provide live stock quotes and charts.

Is investing in PATH stock a good idea right now?

That’s a question only you can answer after thorough research and consideration of your own risk tolerance and financial goals. This analysis provides information but not financial advice.

What are the major risks associated with short-term PATH stock trading?

Short-term trading involves higher risk due to increased volatility. You could experience significant losses if the price moves against your position. Diversification is key.