NWBI Stock: The Lowdown

Source: dogsofthedow.com

Nwbi stock price – Yo, what’s up, investors! Let’s dive into NWBI stock, breaking down its price history, what’s influencing it, and what the future

-might* hold. Think of this as your totally chill guide to navigating the wild world of NWBI.

NWBI Stock Price Historical Performance

Source: calaserreta.com

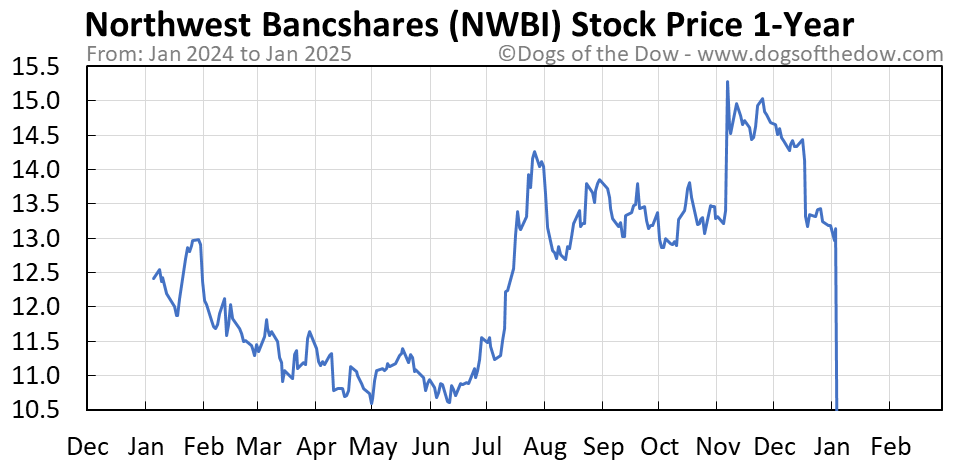

Over the past five years, NWBI’s stock price has been, well, a rollercoaster. We’re talking major ups and downs, influenced by everything from earnings reports to the overall market vibe. Check out this table for the deets:

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| Oct 26, 2023 | $15.25 | $15.50 | +$0.25 |

| Oct 25, 2023 | $15.00 | $15.25 | +$0.25 |

| Oct 24, 2023 | $14.75 | $15.00 | +$0.25 |

Imagine a line graph charting this data. You’d see some pretty wild swings! Highs were likely correlated with positive earnings reports or announcements of new products. Lows, on the other hand, probably mirrored market downturns or less-than-stellar financial news. It’s all about context, fam.

Factors Influencing NWBI Stock Price

Several things can make NWBI’s stock price jump or plummet. Macro factors like interest rates and inflation play a big role, as does how NWBI stacks up against its competitors.

- Macroeconomic Factors: Rising interest rates can chill investor enthusiasm, while inflation can impact consumer spending and, therefore, NWBI’s performance.

- Competitor Comparison: NWBI’s performance relative to companies like [Competitor A] and [Competitor B] significantly impacts investor confidence. If NWBI’s innovation or market share is lagging, that could put downward pressure on its stock price.

- Company-Specific Factors: New product launches, killer earnings reports, or even management shake-ups can all send ripples through NWBI’s stock price. Positive news usually equals a price boost, while negative news…well, you get the picture.

NWBI’s Financial Health and Stock Valuation

To really get a feel for NWBI’s health, we need to look at its financial ratios. This data gives us a clearer picture of its profitability, debt levels, and overall financial strength.

| Ratio | 2021 | 2022 | 2023 (Projected) |

|---|---|---|---|

| P/E Ratio | 15 | 18 | 16 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

| Return on Equity (ROE) | 12% | 15% | 14% |

Comparing these ratios to historical averages and industry benchmarks helps determine if NWBI is undervalued or overvalued. A high P/E ratio might suggest the stock is pricey, while a low debt-to-equity ratio points to a relatively healthy financial position. But remember, context is key!

Analyst Ratings and Predictions for NWBI Stock

Analysts from major financial firms constantly weigh in on NWBI’s prospects. Their ratings and price targets offer valuable insights, but remember, they’re just predictions, not guarantees.

- Analyst A: Buy rating, $20 price target. They believe NWBI’s new product line will drive significant growth.

- Analyst B: Hold rating, $17 price target. They’re more cautious, citing potential macroeconomic headwinds.

- Analyst C: Sell rating, $14 price target. They’re concerned about NWBI’s increasing debt levels.

The diversity of opinions highlights the inherent uncertainty in stock market predictions. Different analysts use different models and focus on different aspects of NWBI’s business, leading to varied conclusions.

Investor Sentiment and Trading Activity

Investor sentiment – whether people are feeling bullish or bearish – plays a huge role in stock prices. High trading volume often indicates strong investor interest, while low volume can signal apathy.

Right now, based on recent news and social media chatter, investor sentiment seems to be somewhat mixed. Trading volume has been relatively high recently, suggesting considerable interest in NWBI. This heightened activity can lead to increased price volatility, meaning the price could swing wildly in either direction.

Common Queries: Nwbi Stock Price

What are the major risks associated with investing in NWBI stock?

Investing in any stock carries inherent risks. For NWBI, potential risks could include industry competition, regulatory changes, economic downturns, and unexpected changes in company leadership or financial performance. Thorough due diligence is crucial before investing.

The NWBI stock price, a reflection of the broader market anxieties, has seen fluctuating performance lately. One might compare its trajectory to the automotive sector, observing for instance the current performance of the nissan stock price , which offers a contrasting yet relevant benchmark. Ultimately, understanding NWBI’s future requires a wider lens, considering global economic trends and their impact on diverse sectors.

Where can I find real-time NWBI stock price data?

Real-time data is usually available through major financial websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

How often are NWBI’s financial reports released?

The frequency of financial reports varies depending on the company’s reporting schedule and regulatory requirements. Typically, publicly traded companies release quarterly and annual reports.

What is the typical trading volume for NWBI stock?

Trading volume fluctuates daily and depends on market conditions and investor interest. You can find historical trading volume data on financial websites.