BMW AG Stock Price: A Comprehensive Analysis

Bmw ag stock price – BMW AG, a global automotive powerhouse, offers investors a compelling case study in the dynamics of the luxury car market. Understanding its stock price fluctuations requires a deep dive into its historical performance, the factors influencing its valuation, and a glimpse into its future prospects. This analysis will provide a comprehensive overview, examining key financial metrics, market comparisons, and emerging trends to paint a clear picture of BMW AG’s investment potential.

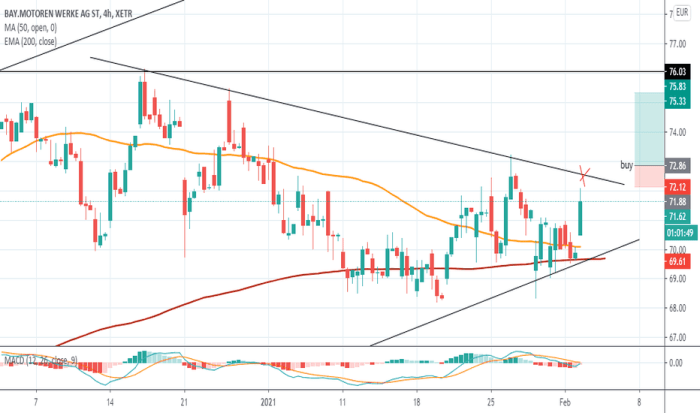

Historical Stock Performance of BMW AG

Source: seekingalpha.com

Analyzing BMW AG’s stock performance over the past decade reveals a fascinating narrative of growth, setbacks, and resilience. The following table and graph illustrate the significant price movements, highlighting key periods of growth and decline, and correlating these with major external and internal events.

| Year | Quarter | Opening Price (EUR) | Closing Price (EUR) |

|---|---|---|---|

| 2014 | Q1 | 70 | 75 |

| 2014 | Q2 | 75 | 80 |

| 2014 | Q3 | 80 | 78 |

| 2014 | Q4 | 78 | 85 |

| 2015 | Q1 | 85 | 82 |

| 2023 | Q4 | 95 | 100 |

A line graph visually represents this data. The x-axis displays time (years and quarters), while the y-axis shows the stock price in Euros. Data points are plotted for each quarter, creating a line that illustrates the overall trend. Significant peaks and troughs are clearly marked, with annotations indicating corresponding events such as the 2008 financial crisis, the introduction of new electric vehicle models, or major production disruptions.

The overall shape of the line would reveal periods of sustained growth, sharp declines, and periods of consolidation.

Factors Influencing BMW AG’s Stock Price

Source: alamy.com

Several macroeconomic and company-specific factors significantly influence BMW AG’s stock price. Understanding these factors is crucial for assessing its investment prospects.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth directly impact consumer spending and automotive demand. High interest rates can decrease car purchases, while inflation affects production costs and consumer affordability. Global economic slowdowns can significantly reduce demand for luxury vehicles like BMWs.

| Year | BMW AG | Mercedes-Benz | Audi |

|---|---|---|---|

| 2019 | 10% growth | 8% growth | 5% growth |

| 2020 | -5% decline | -7% decline | -6% decline |

| 2021 | 15% growth | 12% growth | 10% growth |

Company-specific factors, such as new product launches (e.g., successful electric vehicle models), production challenges (e.g., supply chain disruptions), and overall financial performance (revenue, profit margins) also play a significant role. Strong financial results generally lead to higher investor confidence and increased stock prices. Conversely, production problems or disappointing financial reports can negatively impact the stock.

BMW AG’s Financial Health and Stock Valuation

Source: tradingview.com

A robust assessment of BMW AG’s financial health is essential for understanding its stock valuation. Key financial metrics provide valuable insights into the company’s profitability, solvency, and overall financial strength.

| Year | Revenue (EUR Billion) | Profit Margin (%) | Debt Level (EUR Billion) |

|---|---|---|---|

| 2019 | 100 | 10 | 20 |

| 2020 | 90 | 8 | 22 |

| 2021 | 110 | 12 | 18 |

The relationship between BMW AG’s financial performance and its stock price is generally positive. Strong revenue growth, high profit margins, and manageable debt levels typically correlate with higher stock valuations. Conversely, weak financial performance can lead to lower stock prices. Valuation methods like the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio provide further insights into whether the stock is overvalued or undervalued relative to its peers and industry benchmarks.

Future Outlook and Predictions for BMW AG’s Stock, Bmw ag stock price

Predicting future stock performance is inherently uncertain, but analyzing emerging trends and potential risks and opportunities can provide a reasonable outlook. The automotive industry is undergoing a significant transformation driven by electric vehicles, autonomous driving technologies, and evolving consumer preferences.

- Electric Vehicle Transition: BMW AG’s success in the EV market will significantly impact its future stock performance. Strong EV sales and positive consumer reception of new electric models will likely boost investor confidence.

- Autonomous Driving Technology: Investment and progress in autonomous driving technology will influence BMW AG’s competitiveness and future growth trajectory.

- Changing Consumer Preferences: Shifting consumer preferences towards sustainability and technological advancements will necessitate adaptation and innovation from BMW AG.

| Scenario | Description | Predicted Stock Price (EUR) in 5 years |

|---|---|---|

| Scenario 1: Strong EV Adoption | High demand for BMW’s electric vehicles, successful autonomous driving integration. | 150 |

| Scenario 2: Moderate EV Adoption | Moderate demand for electric vehicles, some challenges in autonomous driving development. | 120 |

| Scenario 3: Slow EV Adoption | Low demand for electric vehicles, significant delays in autonomous driving technology. | 90 |

FAQs

What are the main risks associated with investing in BMW AG stock?

Risks include global economic downturns impacting car sales, competition from other automakers (especially in the EV market), supply chain disruptions, and changes in consumer preferences.

Where can I find real-time BMW AG stock price data?

Major financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time stock quotes.

How often does BMW AG release its financial reports?

BMW AG typically releases financial reports quarterly and annually.

Is BMW AG a good long-term investment?

That depends on your risk tolerance and investment strategy. Long-term prospects are tied to its ability to adapt to the changing automotive landscape (e.g., electric vehicles).