Big Lots Stock Price Analysis: A Comprehensive Overview: Biglots Stock Price

Biglots stock price – Big Lots, Inc. (BIG) operates a chain of discount retail stores, offering a unique value proposition in a competitive market. Understanding its stock price performance requires a multifaceted analysis, considering historical trends, influencing factors, financial health, competitive landscape, and future projections. This analysis aims to provide a comprehensive view of Big Lots’ stock, fostering a clearer understanding of its investment potential.

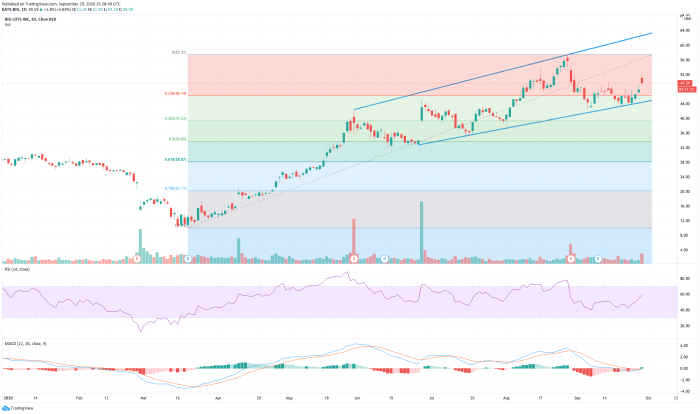

Big Lots Stock Price History

Source: investopedia.com

A line graph illustrating Big Lots’ stock price over the past five years would reveal periods of both significant growth and decline. The x-axis would represent the time period (e.g., years and months), while the y-axis would depict the stock price. The graph would clearly show the peaks and troughs, providing a visual representation of the stock’s volatility.

For example, a period of strong economic growth might correlate with higher stock prices, while periods of economic uncertainty or increased competition could lead to price drops. A detailed analysis would pinpoint specific events such as economic downturns, changes in consumer spending, or company-specific news that impacted the stock price.

Comparing Big Lots’ stock price performance to competitors like Dollar General (DG) and Dollar Tree (DLTR) would provide valuable context. This comparative analysis would involve overlaying the stock price graphs of all three companies, highlighting relative performance during various market conditions. For instance, during periods of inflation, a company focusing on value-priced goods might outperform others. The analysis would delve into the reasons behind any observed differences in performance, considering factors such as company strategy, financial strength, and market positioning.

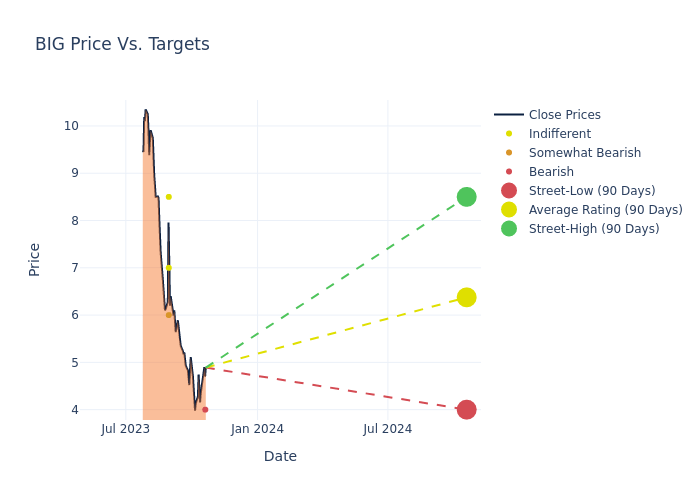

Factors Influencing Big Lots Stock Price, Biglots stock price

Source: benzinga.com

Several macroeconomic factors, consumer behaviors, and company-specific events significantly impact Big Lots’ stock price. Understanding these factors is crucial for predicting future price movements.

Three key macroeconomic factors are inflation rates, interest rates, and consumer confidence. High inflation can squeeze consumer spending, impacting Big Lots’ sales. Rising interest rates increase borrowing costs for businesses, affecting profitability and investment. Low consumer confidence translates to reduced spending, directly impacting demand for Big Lots’ products.

Consumer spending habits are paramount. Changes in consumer preferences, particularly regarding discount retail, directly influence Big Lots’ revenue and profitability. For example, a shift towards online shopping could negatively impact Big Lots’ performance if it fails to adapt its e-commerce strategy.

Big Lots’ quarterly earnings reports heavily influence its stock price. Positive surprises (exceeding analyst expectations) typically lead to price increases, while negative surprises (missing expectations) cause price drops. The market reacts swiftly to these reports, reflecting investor sentiment towards the company’s financial performance.

| Event | Date | Stock Price Change | Explanation |

|---|---|---|---|

| Positive Earnings Surprise | Q4 2023 (Example) | +5% | Exceeded analyst expectations on both revenue and earnings per share. |

| Negative Consumer Confidence Report | October 2023 (Example) | -3% | Concerns about weakening consumer spending impacted investor sentiment. |

| Announcement of New Store Openings | July 2023 (Example) | +2% | Expansion plans signaled confidence in future growth. |

| Recall of a Product | March 2023 (Example) | -1% | Negative publicity and potential financial impact weighed on the stock. |

Big Lots Financial Performance

Analyzing Big Lots’ key financial metrics over the past three years offers insights into its financial health and growth trajectory. These metrics include revenue, net income, gross profit margin, and debt levels.

Brother, have you considered the volatility of Big Lots stock price lately? It’s a reflection of the broader market, much like the fluctuations we see in the pharmaceutical sector. For instance, understanding the current performance of teva pharmaceutical stock price can offer insight into the larger economic picture. Returning to Big Lots, we must remember that prudent investment requires careful prayer and research, considering both the immediate and long-term prospects.

- 2021: (Insert illustrative data – Revenue, Net Income, etc. This should be placeholder data for illustrative purposes.)

- 2022: (Insert illustrative data – Revenue, Net Income, etc.)

- 2023: (Insert illustrative data – Revenue, Net Income, etc.)

Comparing these metrics to industry averages helps assess Big Lots’ relative performance. A higher-than-average profit margin suggests stronger pricing power or cost efficiency. Conversely, a lower-than-average revenue growth rate might indicate challenges in market share or sales. Analyzing the trend of these metrics over time provides valuable insights into the company’s long-term performance.

High debt levels can negatively impact a company’s stock price, increasing financial risk and potentially limiting its growth potential. Conversely, a strong balance sheet with lower debt can signal financial stability and attract investors.

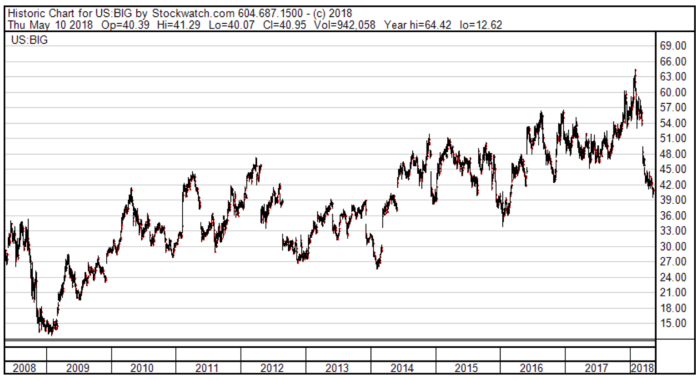

Big Lots’ Competitive Landscape

Source: mispricedmarkets.com

Big Lots competes primarily with Dollar General, Dollar Tree, and other discount retailers. Understanding their market positions and business models is crucial to assess Big Lots’ competitive advantages and disadvantages.

Dollar General and Dollar Tree are major competitors, each with a substantial market share in the discount retail sector. They differ slightly in their product mix and target demographics. A detailed analysis would compare their market capitalization, revenue, and profitability to Big Lots’.

Big Lots’ business model emphasizes a combination of value-priced merchandise and a focus on closeout items. Comparing this model to its competitors reveals differences in sourcing, inventory management, and pricing strategies. For example, Dollar General might focus on a broader range of everyday essentials, while Big Lots might lean more heavily on irregular or excess inventory.

| Aspect | Big Lots | Dollar General | Dollar Tree |

|---|---|---|---|

| Strengths | Strong brand recognition, unique product mix, efficient inventory management | Extensive store network, strong supply chain, broad product assortment | Value-oriented pricing, consistent performance, strong brand recognition |

| Weaknesses | Limited online presence, potential vulnerability to economic downturns, dependence on closeout deals | Potential for saturation in certain markets, competition from other discount retailers | Potential for price pressure from competitors, reliance on low-cost sourcing |

Future Outlook for Big Lots Stock Price

Several factors could influence Big Lots’ future stock price. Potential risks include economic downturns, increased competition, and changes in consumer spending patterns. Opportunities include expanding its online presence, enhancing its store experience, and exploring new product categories.

Predicting Big Lots’ stock price in one year is challenging, but a reasoned prediction could be based on several factors. Considering its current financial performance, the competitive landscape, and macroeconomic conditions, a reasonable prediction might range from a modest increase (e.g., 5-10%) to a slight decrease (e.g., -5% to 0%), depending on the prevailing economic climate and the company’s execution of its strategic initiatives.

This prediction, however, should be viewed with caution as it involves numerous uncertainties.

Significant increases could result from exceeding earnings expectations consistently, successful expansion strategies, and favorable macroeconomic conditions. Conversely, significant decreases could stem from disappointing financial results, increased competition, or a prolonged economic downturn.

Key Questions Answered

What are the major risks associated with investing in BigLots stock?

Risks include competition from larger retailers, economic downturns impacting consumer spending, and potential changes in consumer preferences affecting demand for BigLots’ products.

How does inflation affect BigLots’ stock price?

Inflation can negatively impact BigLots’ stock price by increasing operating costs and potentially reducing consumer spending power, leading to lower sales and profits.

What is BigLots’ dividend policy?

Information on BigLots’ current dividend policy should be obtained from official company sources or reputable financial websites. Dividend policies can change.

Where can I find real-time BigLots stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.