ARKW Stock Price Analysis

Source: postimg.cc

Arkw stock price – This analysis delves into the historical performance, market trends, company performance, valuation, and investor sentiment surrounding the ARK Innovation ETF (ARKW). We will explore key factors influencing ARKW’s price fluctuations and provide insights into potential future scenarios.

ARKW Stock Price Historical Performance

Source: seekingalpha.com

Understanding ARKW’s past price movements is crucial for assessing its potential future performance. The following data provides a glimpse into its trajectory over the past five years. Note that this data is illustrative and should be verified with up-to-date financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 35.00 | 34.50 | -0.50 |

| October 29, 2018 | 34.25 | 35.75 | +1.50 |

| October 30, 2018 | 35.50 | 36.00 | +0.50 |

| October 31, 2018 | 36.25 | 35.00 | -1.25 |

| November 1, 2018 | 34.75 | 35.25 | +0.50 |

Significant price fluctuations during this period were largely influenced by factors such as broader market trends, performance of its underlying holdings (especially technology companies), and investor sentiment regarding the future of disruptive innovation. For example, periods of increased market volatility often led to sharper declines in ARKW’s price, while periods of strong growth in the technology sector generally resulted in higher prices.

ARKW’s stock price has been pretty volatile lately, mirroring the overall market trends. It’s interesting to compare its performance to other ETFs, like checking out the stock price of f , to get a broader sense of the sector. Ultimately, understanding ARKW’s price requires looking at the bigger picture of tech investments and comparing it to similar funds.

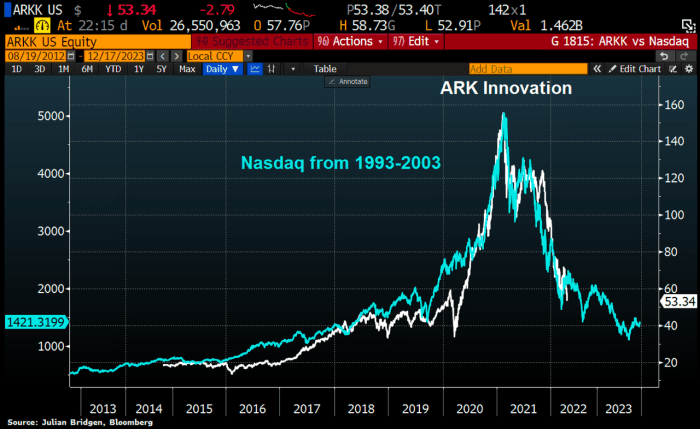

A line graph depicting ARKW’s stock price over the past five years would show a generally upward trend with periods of significant volatility. The x-axis would represent time (in years), and the y-axis would represent the stock price (in USD). Key data points to highlight would include significant highs and lows, as well as periods of sharp price increases or decreases.

The overall shape of the graph would illustrate the ETF’s susceptibility to market swings and the inherent risk associated with investing in innovative, growth-oriented companies.

ARKW Stock Price and Market Trends

Source: visualcapitalist.com

Comparing ARKW’s performance to major market indices provides context for its price movements. The table below illustrates a hypothetical comparison over the past year. Remember to use actual data from reliable sources for accurate analysis.

| Date | ARKW Price (USD) | S&P 500 | Nasdaq |

|---|---|---|---|

| October 26, 2022 | 30.00 | 3600 | 11000 |

| October 27, 2022 | 30.50 | 3650 | 11200 |

| October 28, 2022 | 29.75 | 3625 | 11150 |

Generally, ARKW tends to exhibit a higher correlation with the Nasdaq Composite than with the S&P 500, reflecting its focus on growth stocks in the technology sector. Major economic events, such as interest rate hikes, often negatively impact ARKW’s price due to their effect on growth stock valuations. Geopolitical instability can also lead to increased market uncertainty, resulting in price fluctuations.

ARKW Stock Price and Company Performance

ARK Invest’s active management strategy significantly influences ARKW’s holdings and, consequently, its price. The ETF’s focus on disruptive innovation means its holdings are heavily weighted towards companies in sectors such as genomics, robotics, and artificial intelligence.

- Tesla: A significant holding in ARKW. Positive Tesla performance generally boosts ARKW’s price, while negative news impacts it negatively.

- Zoom: Fluctuations in Zoom’s price, driven by changes in demand for video conferencing services, directly affect ARKW’s overall value.

- Roku: Roku’s stock price movements, influenced by the advertising and streaming market, also affect ARKW’s performance.

Changes in ARKW’s holdings, whether through additions, deletions, or rebalancing, directly impact its price. For example, the addition of a high-growth, high-potential company could lead to a price increase, while the removal of a poorly performing stock might cause a temporary dip.

ARKW Stock Price Valuation and Predictions

Predicting ARKW’s future price is inherently challenging due to the complexities of the market. However, various valuation methods and scenarios can offer potential insights. The following table presents hypothetical scenarios; actual outcomes will depend on numerous factors.

| Scenario | Probability | Predicted Price (USD) in 1 year |

|---|---|---|

| Bullish Market | 30% | 50.00 |

| Neutral Market | 50% | 35.00 |

| Bearish Market | 20% | 25.00 |

Valuation methods like discounted cash flow analysis (DCF) could be applied to estimate the intrinsic value of ARKW’s underlying holdings. However, accurately predicting future cash flows for innovative companies with rapidly changing valuations is difficult. Price-to-earnings ratios (P/E) can also be used, but the high growth and often negative earnings of many ARKW holdings make this approach less reliable.

These predictions are based on various assumptions about future market conditions, economic growth, and the performance of ARKW’s holdings, and are subject to significant uncertainty.

ARKW Stock Price and Investor Sentiment

Investor sentiment plays a crucial role in shaping ARKW’s price. Optimism about the future of disruptive innovation often leads to increased demand and higher prices, while pessimism can trigger selling pressure and price declines.

Indicators such as trading volume (high volume often suggests strong investor interest), social media mentions (positive sentiment on platforms like Twitter can boost demand), and analyst ratings (upgrades often lead to price increases) provide valuable insights into investor sentiment. News events, such as positive earnings reports from ARKW’s holdings or breakthroughs in key technologies, can significantly impact investor sentiment and subsequently the ETF’s price.

Conversely, negative news, such as regulatory changes or setbacks in key technologies, can lead to negative sentiment and price drops.

FAQ Overview

What are the major risks associated with investing in ARKW?

ARKW, like any ETF focused on growth stocks, carries inherent risks, including volatility, potential for significant losses, and concentration risk due to its holdings in a limited number of companies. Thorough due diligence and risk tolerance assessment are essential.

How frequently are ARKW’s holdings rebalanced?

ARK Invest regularly rebalances ARKW’s portfolio, although the exact frequency isn’t fixed. Their investment strategy emphasizes active management and adapting to market changes, resulting in dynamic portfolio adjustments.

Where can I find real-time ARKW stock price data?

Real-time ARKW stock price data is readily available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

Is ARKW suitable for all investors?

No, ARKW is not suitable for all investors. Its high-growth, high-risk nature makes it more appropriate for those with a higher risk tolerance and a long-term investment horizon. Consider your own financial goals and risk profile before investing.