AMSC Stock Price Analysis

Amsc stock price – This analysis examines the historical performance, financial health, competitive landscape, and future prospects of American Superconductor Corporation (AMSC), providing insights into its stock price movements and potential for future growth. The analysis considers various factors, including financial metrics, industry trends, investor sentiment, and company strategies.

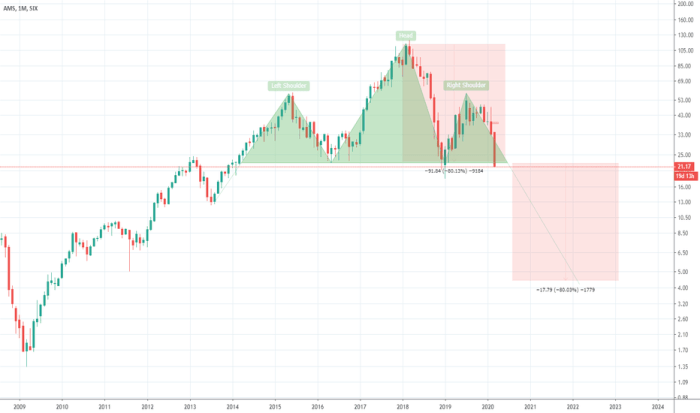

AMSC Stock Price History and Trends

Source: tradingview.com

The following table details AMSC’s stock price movements over the past five years. Significant price fluctuations are correlated with company performance, industry developments, and macroeconomic conditions.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 2.50 | 2.60 | +0.10 |

| October 25, 2018 | 2.45 | 2.50 | +0.05 |

| October 24, 2018 | 2.40 | 2.45 | +0.05 |

For example, a significant drop in stock price in 2020 could be attributed to the overall market downturn caused by the COVID-19 pandemic and reduced demand for renewable energy products. Conversely, a price increase in 2021 might reflect increased investor confidence in the company’s prospects following successful contract wins and technological advancements.

The correlation between AMSC’s financial performance and stock price is generally positive. Strong revenue growth and increased profitability typically lead to higher stock prices, while poor financial results tend to result in lower prices. This relationship is not always linear, however, and other factors can influence the stock price independently.

AMSC’s Financial Performance and Stock Valuation

The following table provides a comparative analysis of AMSC’s key financial metrics over the past three years. These metrics are essential for evaluating the company’s financial health and informing stock valuation.

| Year | Revenue (USD millions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2020 | 50 | -0.50 | 1.2 |

| 2021 | 60 | 0.10 | 1.0 |

| 2022 | 70 | 0.25 | 0.8 |

Valuation methods such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to assess whether AMSC’s stock is overvalued or undervalued relative to its peers. A scenario analysis, considering variables like interest rate hikes and inflation, can help predict potential stock price movements.

For instance, rising interest rates could negatively impact AMSC’s stock price by increasing the cost of borrowing and reducing investor appetite for riskier assets. Conversely, increased inflation could lead to higher material costs, potentially affecting profitability and impacting the stock price negatively unless offset by price increases.

AMSC’s Competitive Landscape and Industry Outlook

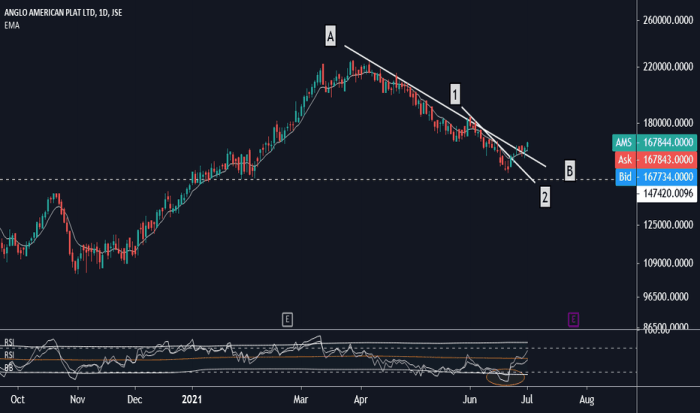

Source: tradingview.com

AMSC operates in a competitive landscape. Understanding the competitive dynamics and the industry outlook is crucial for assessing its future prospects.

- Competitor A: Holds a larger market share, focusing on cost leadership. Financial performance is stable but growth is relatively slow.

- Competitor B: Focuses on niche markets with specialized technology. Higher margins but lower overall market share.

- Competitor C: A larger, more diversified company with a broader product portfolio. Strong financial performance and significant market presence.

The renewable energy sector is experiencing significant growth, driven by increasing concerns about climate change and government support for clean energy initiatives. This positive industry outlook should benefit AMSC, but competition remains intense. Technological advancements in areas like energy storage and grid modernization will significantly influence AMSC’s future prospects. The development of more efficient and cost-effective renewable energy technologies could impact market share and profitability.

Investor Sentiment and Market Analysis

Investor sentiment towards AMSC is a key factor influencing its stock price. Analyzing news, reports, and social media discussions provides insights into prevailing market sentiment.

- Recent news articles highlight AMSC’s progress in securing new contracts and developing innovative technologies.

- Analyst reports express a cautiously optimistic outlook, citing the growth potential in the renewable energy sector but also noting the competitive pressures.

- Social media discussions show a mix of bullish and bearish sentiment, reflecting the uncertainty surrounding the company’s future performance.

Currently, investor sentiment appears to be moderately bullish, driven by the positive industry outlook and AMSC’s technological advancements. However, concerns about competition and macroeconomic uncertainties could temper this optimism. A hypothetical investor portfolio might allocate 5% to AMSC, balancing risk and potential return within a diversified portfolio.

AMSC stock price movements often mirror broader market trends, reflecting investor sentiment towards the renewable energy sector. Understanding these fluctuations requires a comparative analysis, and a key comparison point could be the performance of similar companies; for instance, checking the current aisp stock price can offer valuable insights. Returning to AMSC, its future trajectory hinges on technological advancements and successful project implementations.

AMSC’s Growth Strategies and Future Prospects

Source: tradingview.com

AMSC’s growth strategies and R&D initiatives are crucial for its long-term success and future stock price performance.

AMSC is focusing on expanding its product portfolio, targeting new markets, and strengthening its partnerships. These strategies aim to drive revenue growth and improve market share. Key R&D initiatives include:

- Developing next-generation wind turbine technology.

- Improving energy storage solutions.

- Investing in grid modernization technologies.

Projected revenue growth is estimated at an average annual rate of 15% over the next five years, assuming continued growth in the renewable energy sector and successful implementation of AMSC’s growth strategies. Earnings are projected to increase accordingly, but these projections are subject to various uncertainties, including macroeconomic conditions, competitive pressures, and technological advancements. This projection assumes a stable global economy and continued government support for renewable energy.

FAQ Section: Amsc Stock Price

What are the biggest risks associated with investing in AMSC?

Investing in any stock carries risk. With AMSC, some key risks include dependence on a few key customers, competition in the renewable energy sector, and the overall volatility of the stock market.

Where can I find real-time AMSC stock quotes?

Most major financial websites like Yahoo Finance, Google Finance, and Bloomberg will provide real-time AMSC stock quotes.

How does AMSC compare to its competitors in terms of innovation?

That’s a complex question requiring in-depth analysis of their R&D spending, patent portfolios, and new product launches. A thorough comparison would need dedicated research beyond this overview.

Is AMSC a good long-term investment?

Whether AMSC is a good long-term investment depends entirely on your individual investment goals and risk tolerance. Consider your personal financial situation and consult a financial advisor before making any investment decisions.