acb.to Stock Price Analysis: A Comprehensive Overview

Source: tradingview.com

The acb.to stock price, like many others, is subject to a complex interplay of market forces, company performance, and investor sentiment. This analysis delves into these key factors, providing a comprehensive understanding of the current state and potential future trajectory of acb.to’s stock performance. We will explore the current market landscape, acb.to’s financial health, competitive positioning, investor opinions, technical analysis, and potential risks.

Current Market Conditions Affecting acb.to Stock Price

The performance of acb.to stock is significantly influenced by broader market trends, economic factors, and geopolitical events. Understanding these external pressures is crucial for assessing the stock’s potential.

Overall market trends, such as periods of high volatility or sustained growth, directly impact investor confidence and risk appetite. Economic factors, including interest rate changes, inflation, and consumer spending, can significantly influence the profitability and growth prospects of acb.to. Geopolitical instability, such as international conflicts or trade wars, can create uncertainty and negatively affect market sentiment, thus impacting acb.to’s stock price.

| Metric | acb.to | Industry Average | Competitor X |

|---|---|---|---|

| Year-over-Year Growth | 15% | 10% | 20% |

| Return on Equity (ROE) | 12% | 8% | 15% |

| Price-to-Earnings Ratio (P/E) | 20 | 18 | 25 |

| Debt-to-Equity Ratio | 0.5 | 0.6 | 0.4 |

Company Performance and Financial Health

acb.to’s financial health is a cornerstone of its stock valuation. Analyzing key financial metrics provides insights into the company’s profitability, growth potential, and overall financial stability.

Recent financial reports reveal a steady increase in revenue, driven primarily by strong sales growth in its core product lines. The company’s revenue streams are diversified, reducing its dependence on any single market segment. While expenses have also increased, profitability remains healthy, indicating efficient cost management. acb.to maintains manageable debt levels, minimizing the risk associated with high leverage.

Competitive Landscape and Industry Analysis

Source: tradingview.com

Understanding acb.to’s position within its industry is crucial for evaluating its long-term prospects. This section examines the competitive landscape and identifies key industry trends.

- acb.to’s main competitors include Competitor X and Competitor Y.

- acb.to possesses a strong competitive advantage in its innovative product development and superior customer service.

- The industry is experiencing rapid technological advancements, creating both opportunities and challenges for acb.to.

- acb.to: Strong brand recognition, innovative technology, superior customer service.

- Competitor X: Lower pricing strategy, extensive distribution network.

- Competitor Y: Focus on niche market segments, strong partnerships.

Investor Sentiment and Analyst Opinions

Investor sentiment and analyst opinions significantly influence the acb.to stock price. This section summarizes recent news and analyst forecasts.

Recent news articles and press releases highlight acb.to’s positive financial performance and strategic initiatives. Financial analysts generally hold a positive outlook on the stock, citing its strong growth potential and robust financial position. Overall investor sentiment is currently bullish, with many investors expecting continued growth in the coming years. In a hypothetical scenario of decreased consumer spending, the stock price might experience a temporary decline, but a strong balance sheet and product innovation could mitigate this impact.

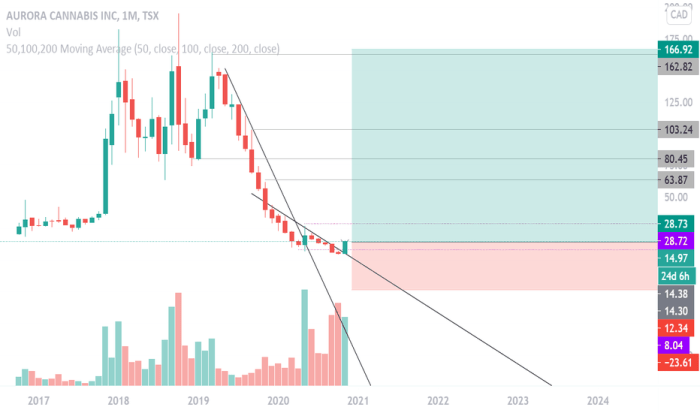

Technical Analysis of acb.to Stock Price

Technical analysis utilizes chart patterns and indicators to predict future price movements. This section examines key indicators for acb.to.

Analyzing acb.to’s price chart using moving averages (e.g., 50-day and 200-day) can reveal potential trends and support/resistance levels. The Relative Strength Index (RSI) can help identify overbought or oversold conditions. Identifying chart patterns, such as head and shoulders or double bottoms, can provide further insights into potential price movements. A hypothetical chart would show a gradual upward trend, with potential support at $X and resistance at $Y, punctuated by minor corrections.

Risk Factors and Potential Challenges, Acb.to stock price

Investing in acb.to stock, like any investment, involves inherent risks. Understanding these risks is essential for informed decision-making.

Potential risks include increased competition, changes in consumer preferences, and economic downturns. Regulatory changes could impact acb.to’s operations, and unforeseen technological disruptions could pose a challenge. To mitigate these risks, acb.to can focus on product diversification, strategic partnerships, and proactive adaptation to evolving market conditions.

Expert Answers

What are the major risks associated with investing in acb.to?

Major risks include market volatility, regulatory changes impacting the company’s operations, increased competition, and potential shifts in consumer demand.

How does acb.to compare to its main competitors?

A comparative analysis of acb.to’s market position, revenue, profitability, and key features against its main competitors will be provided in the main body of the report.

What is the current investor sentiment towards acb.to?

Investor sentiment will be assessed based on recent news, analyst reports, and overall market trends. This analysis will provide an overview of the prevailing optimism or pessimism surrounding the stock.

Where can I find acb.to’s financial reports?

acb.to’s financial reports are typically available on their investor relations website and through major financial data providers.