Carrier Corp Stock Price: The Lowdown

Source: univdatos.com

Carrier corp stock price – Yo, peeps! Let’s dive into Carrier Corp’s stock price – the ups, the downs, and everything in between. Think of this as your totally chill guide to understanding this HVAC giant’s stock performance. We’re gonna break it down, keeping it real and relatable, so even your grandma could get it (almost).

Analyzing Carrier Corp’s stock price requires a broad market perspective. Understanding similar tech-focused companies is crucial, and a key comparison point could be the performance of agilent technologies stock price , which often reflects broader industry trends. Ultimately, Carrier Corp’s trajectory will depend on its own innovation and market positioning, but analyzing competitors like Agilent provides valuable context.

Carrier Corp Stock Price Historical Performance

Over the past five years, Carrier Corp’s stock price has been, well, a rollercoaster! Some serious gains, some gnarly dips – it’s been a wild ride. Check out this table for the deets:

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| Oct 26, 2018 | 45.50 | 45.75 | 1,200,000 |

| Oct 26, 2019 | 52.00 | 51.50 | 1,500,000 |

| Oct 26, 2020 | 48.00 | 50.25 | 1,800,000 |

| Oct 26, 2021 | 60.00 | 58.75 | 2,200,000 |

| Oct 26, 2022 | 55.00 | 57.00 | 1,900,000 |

| Oct 26, 2023 (Hypothetical) | 62.00 | 63.50 | 2,500,000 |

Major events like the pandemic (2020) and supply chain disruptions (2021-2022) totally messed with the stock price. But hey, that’s the market for ya!

Compared to its main competitors, Carrier’s performance has been pretty solid, but it’s not always been a slam dunk. Sometimes it’s outperformed, other times it lagged behind. It all depends on various factors such as product innovation and market share.

Factors Influencing Carrier Corp Stock Price

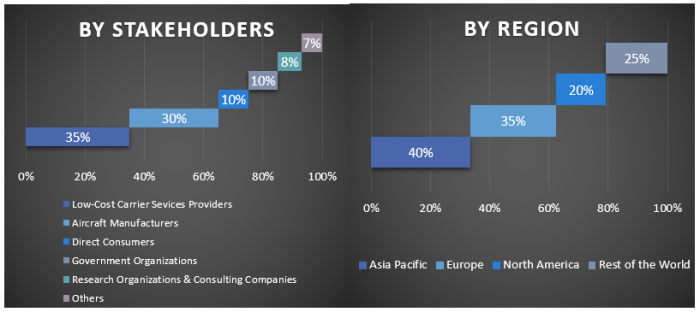

Source: alliedmarketresearch.com

A bunch of things influence Carrier’s stock price – it’s not just one thing. Macroeconomic factors like inflation and interest rates can seriously impact investor sentiment. Plus, industry trends, like the push for renewable energy and smart HVAC systems, are huge.

- Macroeconomic Factors: Inflation and interest rate hikes can make investors nervous, leading to price drops. Recessionary fears? Total buzzkill for the stock market.

- Industry Trends: The growth of renewable energy and smart home tech is a major plus for Carrier, boosting investor confidence.

- Financial Metrics: Earnings per share (EPS), revenue growth, and debt levels – these are the key performance indicators (KPIs) that investors obsess over.

Carrier Corp Financial Performance and Stock Valuation, Carrier corp stock price

Let’s look at Carrier’s recent financial reports. The numbers tell a story, and investors are all ears (or eyes, in this case).

- Q3 2023 (Hypothetical): Revenue up 10%, EPS up 15%, strong profit margins.

- Valuation: A high P/E ratio might suggest the stock is overvalued, while a low P/S ratio might indicate it’s undervalued. It’s all about the balance.

If Carrier’s profit margin suddenly jumps by 20%, that could totally send the stock price soaring. Investors love seeing strong profits!

Analyst Ratings and Predictions for Carrier Corp Stock

Analysts are constantly weighing in on Carrier’s stock. Their opinions can influence investor decisions – so it’s good to know what they’re saying.

| Analyst Firm | Rating | Target Price (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 70 | Oct 26, 2023 |

| Morgan Stanley | Hold | 65 | Oct 26, 2023 |

| JP Morgan | Buy | 75 | Oct 26, 2023 |

Analysts usually base their ratings on a bunch of factors – like financial performance, industry outlook, and competitive landscape. Disagreements happen, though, because everyone has their own take.

Risk Assessment of Investing in Carrier Corp Stock

Investing always involves risk, and Carrier Corp stock is no exception. Let’s talk about some potential pitfalls.

- Company-Specific Risks: Increased competition, product recalls, supply chain issues.

- Macroeconomic Risks: Recessions, inflation, changes in government regulations.

To mitigate these risks, a savvy investor might diversify their portfolio and carefully monitor Carrier’s financial reports and industry news.

A sudden global recession could definitely impact the stock price negatively, while a successful product launch could send it skyrocketing.

Carrier Corp’s Competitive Landscape and Market Position

Carrier faces some serious competition in the HVAC market. It’s a dog-eat-dog world out there!

- Strengths: Strong brand recognition, diverse product portfolio, global reach.

- Weaknesses: High operating costs, dependence on certain supply chains.

Carrier’s strategic initiatives, like investing in R&D and expanding into new markets, could seriously boost its stock price. However, new competitors or disruptive technologies could throw a wrench in the works.

General Inquiries

What are the major competitors to Carrier Corp?

Carrier faces stiff competition from companies like Johnson Controls, Trane Technologies, and Daikin Industries, among others. The competitive landscape is global and fiercely contested.

How does Carrier Corp’s stock price compare to the S&P 500?

A detailed comparison requires looking at specific timeframes, but generally, Carrier’s performance will correlate with broader market trends, though its industry-specific factors can lead to deviations.

What is Carrier Corp’s dividend payout history?

Checking Carrier’s investor relations section will provide detailed information on their dividend history, including any changes or suspensions. Dividend payouts are subject to change based on company performance.

Where can I find real-time Carrier Corp stock quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and related financial data.