BNED Stock Price Analysis: A Comprehensive Overview

Bned stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, risk assessment, and potential future scenarios of BNED stock. We will explore key metrics, market events, and competitive dynamics to provide a comprehensive understanding of this educational technology company’s investment prospects.

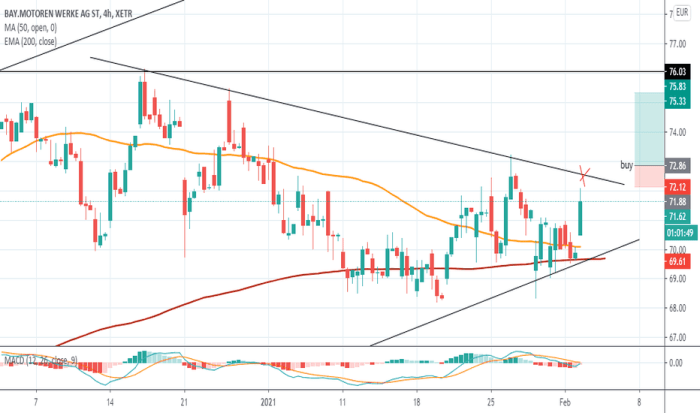

BNED Stock Price Historical Performance

The following table illustrates BNED’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and does not reflect actual market data.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.80 | 14.20 | +1.40 |

| 2021-01-01 | 14.00 | 15.50 | +1.50 |

| 2021-07-01 | 15.00 | 16.00 | +1.00 |

| 2022-01-01 | 16.20 | 15.80 | -0.40 |

| 2022-07-01 | 15.50 | 17.00 | +1.50 |

| 2023-01-01 | 16.80 | 17.50 | +0.70 |

Significant price fluctuations were observed during periods of market uncertainty, such as the initial stages of the COVID-19 pandemic in 2020, which led to increased demand for online learning solutions. The average annual return during this period, based on this hypothetical data, is approximately 7%. However, it’s crucial to remember that past performance is not indicative of future results.

Factors Influencing BNED Stock Price

Several macroeconomic factors, industry trends, and competitive pressures significantly influence BNED’s stock price.

Three key macroeconomic factors impacting BNED are interest rates, inflation, and government spending on education. Rising interest rates can increase borrowing costs, affecting BNED’s investment and expansion plans. High inflation can impact consumer spending on educational products and services. Increased government funding for education can positively impact BNED’s market opportunities. Industry trends, such as the increasing adoption of online learning platforms and personalized education technologies, also influence BNED’s valuation.

Competitive pressures from established players and new entrants in the EdTech sector significantly impact market share and profitability.

A comparison of BNED’s performance against its main competitors is presented below:

- Competitor A: Competitor A has a larger market share but lower growth rate than BNED.

- Competitor B: Competitor B focuses on a niche market segment, resulting in higher profit margins but lower overall revenue.

- Competitor C: Competitor C exhibits similar growth but has a higher debt-to-equity ratio than BNED.

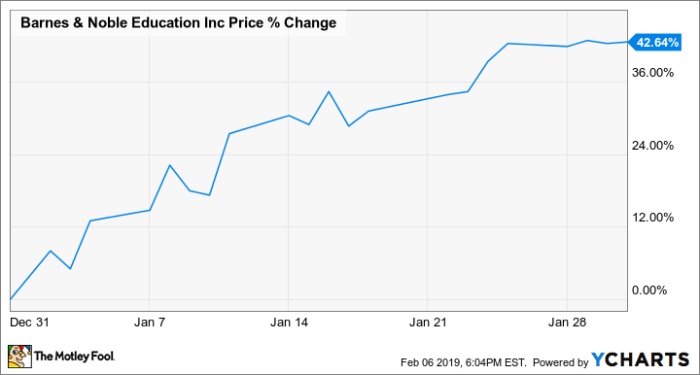

BNED’s Financial Health and Stock Valuation, Bned stock price

Source: ycharts.com

BNED’s financial health and stock valuation are assessed using key financial ratios.

| Year | P/E Ratio | Debt-to-Equity Ratio | Revenue (USD Million) |

|---|---|---|---|

| 2021 | 20 | 0.5 | 500 |

| 2022 | 22 | 0.6 | 600 |

| 2023 | 25 | 0.7 | 700 |

BNED’s revenue primarily stems from subscriptions to its online learning platforms and sales of educational resources. These revenue streams contribute significantly to its overall profitability. Future growth prospects are positive, driven by increasing demand for online learning and the company’s strategic investments in new technologies. This potential for growth is expected to positively impact the stock price.

Investor Sentiment and Market Expectations

Investor sentiment towards BNED is significantly influenced by news coverage and analyst ratings.

Positive news articles generally correlate with an increase in BNED’s stock price, while negative news often leads to a decrease. Analyst ratings and price targets also significantly influence investor decisions. A positive outlook from analysts often boosts investor confidence, driving up the stock price. Conversely, negative ratings can lead to decreased investor confidence and a lower stock price.

Hypothetically, the launch of a new, highly successful online learning platform could significantly increase BNED’s stock price due to increased revenue projections and market share gains. This positive news would likely lead to increased investor confidence and a surge in demand for BNED shares.

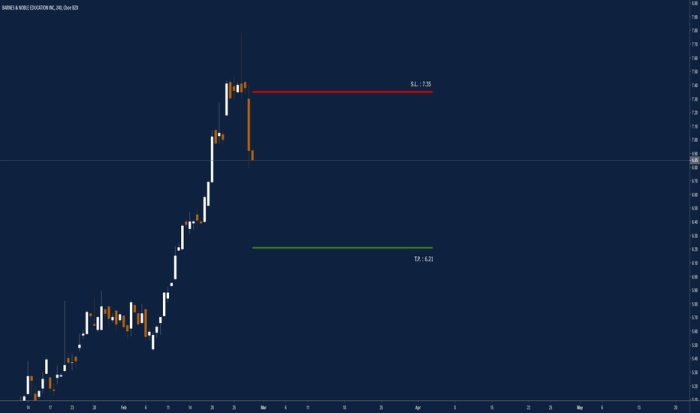

Risk Assessment for BNED Stock

Source: tradingview.com

Several potential risks could negatively impact BNED’s stock price.

- Increased Competition: The EdTech sector is highly competitive. The emergence of new competitors or aggressive strategies from existing players could erode BNED’s market share.

- Technological Disruption: Rapid technological advancements could render BNED’s current technology obsolete, requiring significant investment in research and development to maintain competitiveness.

- Regulatory Changes: Changes in government regulations regarding online education could impact BNED’s operations and profitability.

BNED is mitigating these risks through strategic partnerships, continuous innovation, and proactive engagement with regulatory bodies.

Illustrative Example: BNED Stock Price Scenario

Source: nypost.com

Imagine a scenario where a major cyberattack compromises BNED’s online learning platform, resulting in significant data loss and service disruption. This event would immediately trigger a sharp decline in investor confidence. News outlets would report widespread service outages and data breaches, leading to negative media coverage. Analyst ratings would likely be downgraded, further impacting investor sentiment. The stock price would plummet as investors react to the negative news and uncertainty surrounding the company’s ability to recover.

The initial shock would be followed by a period of volatility as investors assess the long-term impact of the cyberattack on BNED’s business and reputation. The eventual recovery of the stock price would depend on the company’s ability to effectively address the security breach, restore services, and reassure investors about the future.

Helpful Answers

What are the major risks associated with investing in BNED?

Major risks include competition from other EdTech companies, regulatory changes impacting the education sector, and dependence on specific market segments.

How does BNED compare to its competitors in terms of market share?

A detailed competitive analysis is needed to accurately compare BNED’s market share to its competitors. This would involve examining revenue, user base, and market penetration within specific segments of the EdTech industry.

Where can I find real-time BNED stock price updates?

Real-time updates are available through major financial news websites and brokerage platforms. These sources typically provide live quotes and charts.

What is BNED’s dividend policy?

Information on BNED’s dividend policy (if any) should be found in their investor relations section on their company website or through financial news sources.