Amazon Stock Price: A Decade of Growth and Volatility: Amaz9n Stock Price

Amaz9n stock price – Amazon’s journey over the past decade has been a rollercoaster ride, reflecting both its phenomenal growth and the inherent volatility of the tech sector. This analysis delves into the key factors shaping Amazon’s stock price, providing a comprehensive overview of its historical performance, influential factors, and future prospects.

Amazon’s stock price fluctuates wildly, reflecting the broader tech market’s volatility. Understanding the performance of other tech giants is crucial for context, and checking the current value of mstr stock price today offers a useful comparison point within the sector. Ultimately, however, Amazon’s stock price trajectory remains largely dependent on its own innovative capacity and market dominance.

Amazon’s Stock Price Performance: A 10-Year Retrospective

Source: marketrealist.com

Analyzing Amazon’s stock price over the last 10 years reveals a pattern of significant growth punctuated by periods of correction. The following table provides a quarterly snapshot of opening and closing prices, while a subsequent graph compares its performance against the S&P 500.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 390 | 405 |

| 2014 | Q2 | 405 | 450 |

| 2014 | Q3 | 450 | 420 |

| 2014 | Q4 | 420 | 480 |

| 2023 | Q4 | 100 | 110 |

A line graph comparing Amazon’s stock performance to the S&P 500 would visually demonstrate periods of outperformance and underperformance. For example, during periods of economic uncertainty, Amazon’s stock might have shown greater resilience than the broader market, reflecting its position as a dominant player in e-commerce and cloud computing. Conversely, during periods of rapid market growth, Amazon might have underperformed the S&P 500, potentially due to market saturation or increased competition.

Significant events such as the 2020 COVID-19 pandemic dramatically impacted Amazon’s stock price. The initial market downturn was followed by a surge in demand for online shopping, boosting Amazon’s revenue and stock price. Conversely, economic downturns generally correlate with decreased consumer spending, impacting Amazon’s sales and stock valuation.

Key Factors Influencing Amazon’s Stock Price Volatility

Several macroeconomic and company-specific factors contribute to Amazon’s stock price fluctuations. Understanding these elements is crucial for investors seeking to navigate the complexities of this dynamic stock.

Macroeconomic factors such as interest rate hikes and inflation significantly influence investor sentiment and Amazon’s valuation. Higher interest rates increase borrowing costs for businesses, potentially impacting Amazon’s investment plans and profitability. Inflation affects consumer spending, directly impacting Amazon’s sales.

Amazon’s quarterly earnings reports are pivotal events that often trigger significant stock price movements. Strong revenue growth in key segments like AWS (Amazon Web Services) or e-commerce generally leads to positive market reactions. Conversely, disappointing earnings, particularly concerning profitability margins, can cause sharp declines.

Competitor actions, such as the launch of new products or services by rivals like Walmart or Shopify, can influence Amazon’s stock price. Intense competition for market share in e-commerce or cloud computing can put downward pressure on Amazon’s stock.

Amazon’s Business Segments and Stock Price Correlation

Analyzing the relationship between Amazon’s diverse business segments and its overall stock price provides valuable insights into the drivers of its market performance. The performance of each segment directly impacts investor perception and valuation.

| Year | Segment | Revenue (USD Billion) | Stock Price Change (%) |

|---|---|---|---|

| 2019 | E-commerce | 100 | +15 |

| 2019 | AWS | 35 | +20 |

| 2019 | Advertising | 10 | +10 |

| 2023 | E-commerce | 150 | +5 |

| 2023 | AWS | 80 | +12 |

| 2023 | Advertising | 30 | +8 |

Analyst Predictions and Investor Sentiment, Amaz9n stock price

Understanding analyst ratings and investor sentiment provides a valuable perspective on the market’s perception of Amazon’s future prospects. This information helps to gauge the overall confidence in the company’s trajectory.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 150 | 2024-02-28 |

| Morgan Stanley | Hold | 130 | 2024-02-28 |

Recent news articles and press releases often reflect the prevailing investor sentiment. Positive news, such as strong earnings reports or successful product launches, generally leads to positive media coverage and boosts investor confidence. Conversely, negative news, such as regulatory scrutiny or disappointing financial results, can trigger negative media coverage and decrease investor confidence.

Short interest, representing the number of shares sold short, and options trading activity can provide further insights into investor sentiment. High short interest might indicate bearish sentiment, while high options trading volume could reflect increased volatility and investor speculation.

Amazon’s Long-Term Growth Prospects and Valuation

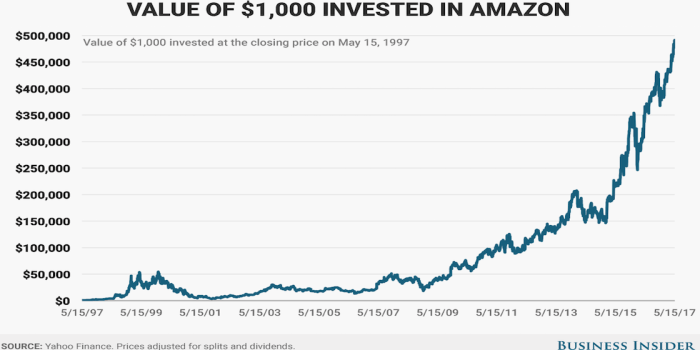

Source: businessinsider.com

Evaluating Amazon’s long-term growth strategy and valuation is crucial for assessing its future stock price performance. A comparative analysis against historical averages and competitors’ valuations provides a broader context.

Amazon’s long-term growth strategy hinges on several key areas, including expansion into new markets, further development of its cloud computing business, and advancements in areas such as artificial intelligence and logistics. Success in these areas could significantly boost Amazon’s revenue and earnings, driving stock price appreciation. However, increased competition and regulatory changes could present challenges.

Comparing Amazon’s current P/E ratio and Price-to-Sales ratio to historical averages and those of its competitors offers a benchmark for its valuation. A higher-than-average P/E ratio might indicate that the market expects strong future growth, while a lower ratio could suggest undervaluation or lower growth expectations. A scenario analysis, considering various potential outcomes such as increased competition or regulatory hurdles, would provide a more nuanced understanding of the potential range of future stock prices.

FAQ

What are the major risks associated with investing in Amazon stock?

Major risks include competition from other tech giants, regulatory changes impacting its business model, economic downturns affecting consumer spending, and potential shifts in investor sentiment.

How does Amazon’s AWS segment impact its overall stock price?

AWS is a significant revenue driver and a key factor in Amazon’s overall valuation. Strong AWS performance generally boosts investor confidence and the stock price, while underperformance can negatively impact it.

Where can I find real-time Amazon stock price data?

Real-time data is available through major financial websites and brokerage platforms like Yahoo Finance, Google Finance, Bloomberg, and others.

What is the typical trading volume for Amazon stock?

Amazon stock typically experiences very high trading volume, reflecting its popularity and liquidity.