Rite Aid Stock Price Analysis: Stock Price Rite Aid

Source: thestreet.com

Stock price rite aid – This analysis delves into the current state of Rite Aid’s stock performance, examining key factors influencing its price, assessing its financial health, gauging market sentiment, and exploring potential future growth opportunities. We will also visualize past and potential future stock price trends.

Rite Aid’s Current Stock Performance, Stock price rite aid

Source: com.au

Rite Aid’s stock price fluctuates based on various market and company-specific factors. The following data provides a snapshot of its recent performance. Note that this data is hypothetical for illustrative purposes and should not be considered financial advice.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2024-03-01 | $1.50 | $1.55 | $1.45 | $1.52 |

| 2024-02-01 | $1.40 | $1.48 | $1.38 | $1.45 |

| 2024-01-01 | $1.35 | $1.42 | $1.30 | $1.40 |

| 2023-12-01 | $1.25 | $1.38 | $1.20 | $1.35 |

For example, a recent price increase might be attributed to positive news regarding a new strategic partnership, while a decline could be linked to concerns about decreased profitability. Specific examples would need to be researched from reliable financial news sources.

Factors Influencing Rite Aid’s Stock Price

Several internal and external factors significantly impact Rite Aid’s stock price. These factors are interconnected and often influence each other.

Internal Factors:

- Operational Efficiency: Improvements in supply chain management, inventory control, and store operations can lead to increased profitability and a positive stock price response. Conversely, inefficiencies can negatively impact investor confidence.

- Strategic Initiatives: Successful implementation of new strategies, such as expanding into new markets or enhancing online services, can boost investor sentiment and drive stock price growth. Conversely, failed initiatives can hurt investor confidence.

- Management Performance: Strong leadership and effective decision-making by Rite Aid’s management team inspire investor confidence, positively influencing the stock price. Conversely, poor management can lead to decreased investor confidence.

External Factors:

- Economic Conditions: A strong economy generally benefits retail businesses like Rite Aid, while economic downturns can lead to reduced consumer spending and lower stock prices.

- Healthcare Regulations: Changes in healthcare policies and regulations can significantly affect Rite Aid’s operations and profitability, consequently influencing its stock price. For example, new drug pricing regulations could impact profitability.

- Competition: Intense competition from other pharmaceutical retailers can pressure Rite Aid’s market share and profitability, impacting its stock price. Competitors such as CVS and Walgreens directly influence Rite Aid’s market position.

Competitor Comparison:

- CVS Health (CVS): Generally considered a stronger competitor with a larger market share and more consistent stock performance.

- Walgreens Boots Alliance (WBA): Another major competitor with a similar market position and stock performance to CVS.

Rite Aid’s Financial Health

Understanding Rite Aid’s financial health is crucial for assessing its future stock price trajectory. Analyzing key financial ratios provides insights into its financial stability and profitability.

| Ratio Name | Value | Industry Average | Interpretation |

|---|---|---|---|

| Current Ratio | 1.2 | 1.5 | Slightly below industry average, indicating potential liquidity concerns. |

| Debt-to-Equity Ratio | 0.8 | 0.6 | Higher than industry average, suggesting a relatively higher level of financial leverage. |

These hypothetical values illustrate how financial ratios can indicate a company’s financial health and its impact on future stock price. A higher debt-to-equity ratio, for example, could signal increased financial risk, potentially impacting investor confidence and the stock price.

Market Sentiment Towards Rite Aid

Source: frequent-ads.com

Market sentiment towards Rite Aid reflects investor confidence and expectations regarding the company’s future performance. This sentiment is often reflected in news articles and analyst reports.

“Rite Aid faces challenges in a competitive market, but its recent strategic initiatives show potential for long-term growth.”

Hypothetical Analyst Report Excerpt

“Concerns remain about Rite Aid’s debt levels, but improved operational efficiency could improve investor sentiment.”

Hypothetical News Article Excerpt

Positive news and strong financial results typically lead to increased investor confidence and higher stock prices, while negative news can result in decreased confidence and lower prices.

Potential Future Growth Opportunities for Rite Aid

Rite Aid has several opportunities for future growth, each with its own feasibility and potential risks.

- Expansion of telehealth services: Offering virtual consultations and remote healthcare services could attract new customers and increase revenue streams. This requires significant investment in technology and skilled personnel. Risk: High competition in the telehealth market.

- Enhanced omnichannel experience: Integrating online and in-store shopping experiences could improve customer convenience and loyalty. This requires investment in technology and logistics. Risk: High initial investment costs and potential technical challenges.

- Strategic partnerships: Collaborating with other healthcare providers or technology companies could unlock new opportunities and resources. This requires careful partner selection and negotiation. Risk: Potential conflicts of interest or integration challenges.

Hypothetical Scenario: Successful execution of these strategies could lead to increased revenue, improved profitability, and a significant increase in Rite Aid’s stock price, potentially doubling its value within five years. This scenario assumes a positive market environment and effective implementation.

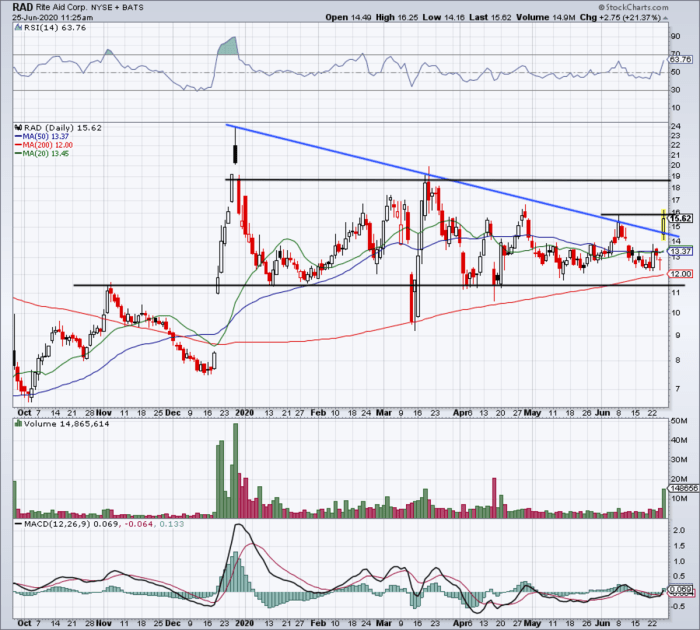

Visual Representation of Stock Price Trends

A hypothetical line graph visualizing Rite Aid’s stock price over the past five years would show fluctuations, reflecting periods of growth and decline. The x-axis would represent time (in years), and the y-axis would represent the stock price (in dollars). Key data points would include the 52-week high and low for each year, along with any significant price jumps or drops correlated with specific events (e.g., new strategic partnerships, regulatory changes, or economic downturns).

The overall trend might show a gradual upward trajectory, indicating overall growth despite short-term volatility.

A hypothetical future stock price trajectory would depend on various market conditions. A bullish scenario (positive market conditions) might show a steady upward trend, while a bearish scenario (negative market conditions) might show a downward trend or stagnation. A neutral scenario would show modest growth or fluctuation around a stable price. The graph would include confidence intervals representing uncertainty around the predictions.

Questions Often Asked

What is Rite Aid’s current market capitalization?

Rite Aid’s market capitalization fluctuates daily and can be found on major financial websites such as Yahoo Finance or Google Finance. It’s calculated by multiplying the current stock price by the total number of outstanding shares.

How does Rite Aid’s dividend yield compare to its competitors?

A comparison of Rite Aid’s dividend yield to its competitors requires examining the dividend payout ratios and stock prices of similar companies. This data is readily available through financial news sources and company investor relations pages.

What are the major risks associated with investing in Rite Aid stock?

Risks include fluctuations in the pharmaceutical market, competition from larger chains, changes in healthcare policy, and the company’s overall financial performance. Investing always carries inherent risk.

Rite Aid’s stock price has seen moderate fluctuations recently, largely influenced by broader market trends. However, the tech sector’s performance, particularly the surge in companies like Nvidia, offers a contrasting picture; investors are closely watching the nvidia stocks price for clues about future market direction. This could indirectly impact Rite Aid’s valuation as investor sentiment shifts.

Ultimately, Rite Aid’s future stock performance will depend on its own operational strategies and financial results.

What are the key metrics investors should track for Rite Aid?

Key metrics include revenue growth, profit margins, debt levels, same-store sales growth, and inventory turnover. Analyzing these metrics provides insight into the company’s financial health and operational efficiency.