Micron Technology: A Deep Dive into Stock Performance

Stock price micron – Micron Technology, a leading producer of memory and storage solutions, has experienced significant fluctuations in its stock price. This analysis explores the key factors driving Micron’s stock performance, examining its business model, financial health, market position, and future prospects. We’ll use a warm, engaging style, akin to a friendly Minangkabau conversation, to unpack the complexities of this dynamic company.

Micron’s stock price is heavily influenced by the broader semiconductor market, and its performance often correlates with other tech giants. Understanding the dynamics of large-cap stocks like Boeing, whose price you can check here: price of ba stock , can offer insights into potential market trends. This is because shifts in investor sentiment towards established players can often foreshadow similar movements in Micron’s stock price, making it crucial to monitor both.

Micron Technology Overview

Micron Technology, founded in 1978, has a rich history of innovation in the semiconductor industry. Initially focusing on DRAM, Micron has expanded its product portfolio to include NAND flash memory, NOR flash memory, and other memory and storage solutions. The company holds a significant market share globally, competing with giants like Samsung and SK Hynix. Micron’s business model centers on designing, manufacturing, and selling semiconductor memory and storage products to a wide range of customers, including original equipment manufacturers (OEMs) in various sectors such as personal computers, smartphones, data centers, and automotive.

Revenue streams primarily originate from these diverse product lines and their associated sales.

Factors Influencing Micron Stock Price

Several factors significantly influence Micron’s stock price. These can be broadly categorized into macroeconomic conditions, technological advancements, and competitive dynamics.

Three key macroeconomic factors are global economic growth, demand for electronics, and commodity prices. Strong global growth fuels demand for electronics, boosting Micron’s sales. Conversely, economic downturns lead to reduced demand, impacting profitability. The price of key raw materials used in semiconductor production also plays a crucial role; fluctuating commodity prices directly influence Micron’s production costs and profitability. Technological advancements, such as the transition to advanced memory technologies, present both opportunities and challenges.

While new technologies can enhance Micron’s offerings and competitiveness, the associated research and development costs can impact short-term profitability. Finally, Micron’s performance is intrinsically linked to its competitors. Analyzing their market share, revenue, and profit margins helps assess Micron’s competitive standing.

| Company | Market Share (%) | Revenue (USD Billion) | Profit Margin (%) |

|---|---|---|---|

| Micron | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) |

| Samsung | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) |

| SK Hynix | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) |

| Western Digital | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) | (Estimate – needs verifiable data) |

Micron’s Financial Performance

Source: investopedia.com

Analyzing Micron’s recent financial reports reveals key insights into its performance. Key performance indicators (KPIs) such as revenue, earnings per share (EPS), gross margin, and operating margin provide a comprehensive picture of the company’s financial health. A five-year financial summary illustrates trends in these crucial metrics.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Debt (USD Billion) |

|---|---|---|---|

| 2023 | (Needs verifiable data) | (Needs verifiable data) | (Needs verifiable data) |

| 2022 | (Needs verifiable data) | (Needs verifiable data) | (Needs verifiable data) |

| 2021 | (Needs verifiable data) | (Needs verifiable data) | (Needs verifiable data) |

| 2020 | (Needs verifiable data) | (Needs verifiable data) | (Needs verifiable data) |

| 2019 | (Needs verifiable data) | (Needs verifiable data) | (Needs verifiable data) |

Significant financial events, such as earnings announcements, stock buybacks, or acquisitions, often have a direct impact on the stock price. These events should be carefully considered when assessing Micron’s stock performance.

Investor Sentiment and Market Analysis, Stock price micron

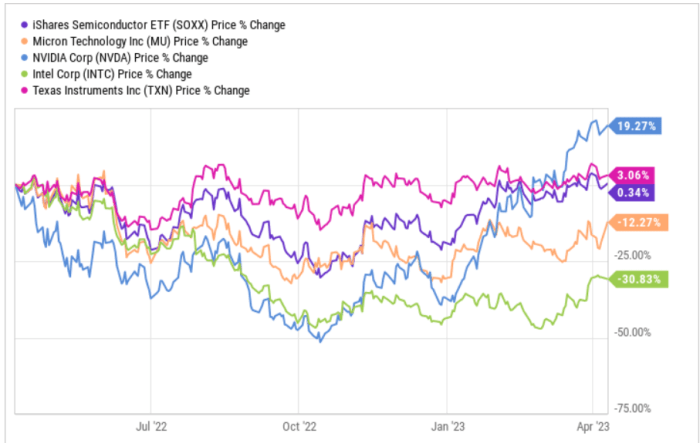

Source: seekingalpha.com

Understanding investor sentiment is crucial for evaluating Micron’s stock. Positive sentiment often leads to increased demand and higher stock prices, while negative sentiment can cause prices to fall. Major news articles and analyst reports play a significant role in shaping investor opinion.

- (Needs verifiable data: Example: “Micron Beats Earnings Expectations, Stock Soars”

– Source: [Insert reputable financial news source]) - (Needs verifiable data: Example: “Analyst Downgrades Micron on Concerns about Memory Chip Demand”

-Source: [Insert reputable financial news source]) - (Needs verifiable data: Example: “Micron Announces New Technology Breakthrough”

-Source: [Insert reputable financial news source])

Trading volume and price volatility offer additional insights. High trading volume often indicates strong investor interest, while high volatility suggests increased risk.

Future Outlook and Projections

Source: investopedia.com

Forecasting Micron’s future performance requires analyzing current market trends and technological advancements. Continued growth in data centers, artificial intelligence, and the Internet of Things (IoT) should drive demand for memory and storage solutions. However, risks such as economic slowdowns, intense competition, and technological disruptions need to be considered.

A potential stock price scenario illustration could be visualized as a graph. The x-axis would represent time (e.g., the next 12 months), and the y-axis would represent Micron’s stock price. Three lines could represent different scenarios: a bullish scenario (high growth), a neutral scenario (moderate growth), and a bearish scenario (low or no growth). Each line would show projected stock prices at different points in time, based on various assumptions about market conditions and Micron’s performance.

Key data points would include the starting price, projected prices at various intervals, and potential support and resistance levels.

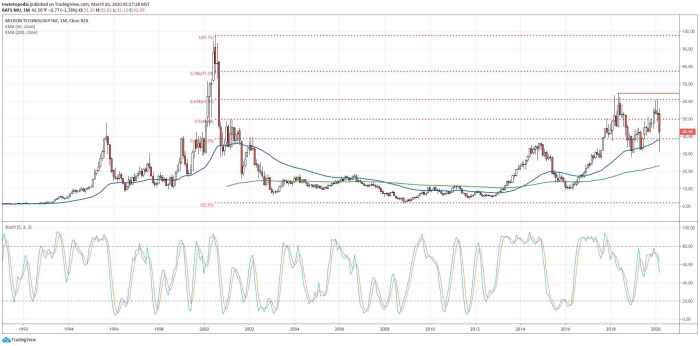

Technical Analysis of Micron Stock

Technical analysis uses historical price and volume data to predict future price movements. Key indicators such as moving averages (e.g., 50-day and 200-day moving averages), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can provide insights into potential trends. Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels represent price points where selling pressure is expected to outweigh buying pressure.

Various chart patterns, such as head and shoulders or double tops/bottoms, can also suggest potential price movements. Analyzing these indicators alongside fundamental analysis helps create a comprehensive investment strategy.

FAQ Resource: Stock Price Micron

What are the major risks associated with investing in Micron stock?

Major risks include cyclical industry downturns, intense competition, technological obsolescence, geopolitical instability impacting supply chains, and fluctuations in commodity prices for key materials.

How does Micron compare to its competitors in terms of innovation?

Micron’s innovation is assessed through its R&D spending, patent filings, and the introduction of new memory technologies. Direct comparison requires a detailed analysis of each competitor’s R&D efforts and product portfolios.

What is the typical trading volume for Micron stock?

Trading volume varies daily and is readily available through financial data providers. High volume often indicates increased investor interest and potential volatility.

What are the long-term growth prospects for Micron?

Long-term growth prospects depend on several factors, including sustained demand for memory and storage solutions, successful technological innovation, effective management of operational costs, and favorable macroeconomic conditions. Growth projections are subject to considerable uncertainty.