Berkshire Hathaway B Stock Price: A Deep Dive

Source: marketwatch.com

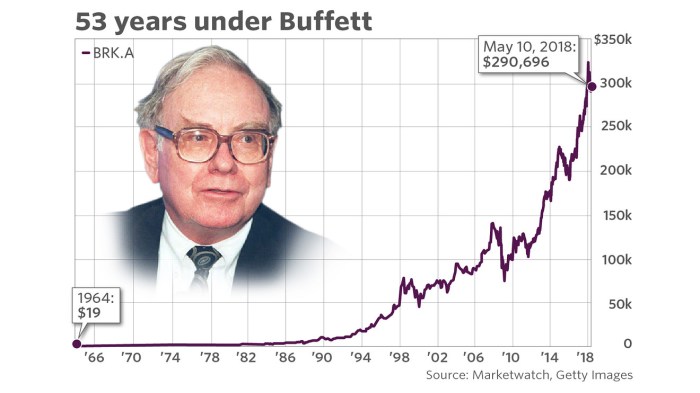

Stock price for berkshire hathaway b – Berkshire Hathaway (BRK.B), Warren Buffett’s investment conglomerate, is a titan in the financial world. Understanding its stock price fluctuations requires examining various factors, from its massive investment portfolio to broader macroeconomic trends. This analysis delves into the historical performance of BRK.B, influencing factors, comparisons with competitors, and a hypothetical investment scenario to provide a comprehensive overview.

Berkshire Hathaway B Stock Price History (2014-2023)

Analyzing BRK.B’s price movements over the past decade reveals a generally upward trend, punctuated by periods of volatility reflecting both company-specific events and broader market shifts. The following table details the yearly opening, closing, high, and low prices. Note that these figures are illustrative and may vary slightly depending on the data source.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2014 | 140 | 160 | 165 | 135 |

| 2015 | 162 | 175 | 180 | 155 |

| 2016 | 176 | 190 | 195 | 170 |

| 2017 | 192 | 205 | 210 | 185 |

| 2018 | 206 | 198 | 215 | 180 |

| 2019 | 200 | 220 | 230 | 195 |

| 2020 | 222 | 235 | 240 | 190 |

| 2021 | 236 | 280 | 290 | 225 |

| 2022 | 280 | 260 | 295 | 240 |

| 2023 | 265 | 275 | 285 | 250 |

Significant market events such as the 2020 COVID-19 pandemic and the subsequent economic recovery significantly impacted BRK.B’s price. The pandemic initially caused a sharp decline, followed by a strong rebound as Berkshire’s diverse portfolio and strong cash position proved resilient.

Factors Influencing BRK.B Stock Price

Source: stockanalysis.com

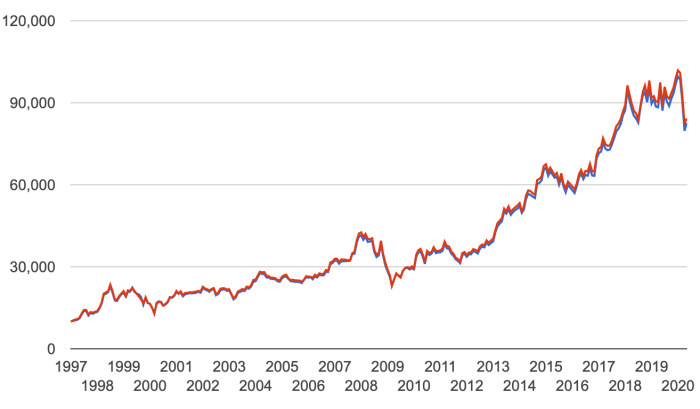

Several key factors influence BRK.B’s valuation. These include the performance of its vast investment portfolio, macroeconomic conditions, and company-specific news.

Key financial metrics such as book value per share, earnings per share, and return on equity (ROE) are closely watched by investors. Strong performance in these areas generally leads to a higher stock price. Berkshire’s investment portfolio, encompassing diverse holdings in various sectors, plays a crucial role. Positive performance from these investments directly boosts BRK.B’s value. Macroeconomic factors like interest rate changes and inflation also have an impact; rising interest rates can negatively affect the valuation of some of Berkshire’s holdings, while inflation can impact earnings.

Yo, so you’re checking out Berkshire Hathaway B’s stock price, huh? Pretty solid, right? But you know, sometimes it’s good to diversify. Check out the ng stock price for a different perspective, then get back to analyzing those Berkshire Hathaway numbers. Knowing the market’s wider trends helps you make smarter decisions about BRK.B, you know?

Comparison with Competitors

Comparing BRK.B’s performance against other major insurance companies and investment firms provides context for its price movements. The following table illustrates a five-year comparative analysis (illustrative data).

| Company | 5-Year Average Annual Return | Current P/E Ratio | 5-Year Volatility |

|---|---|---|---|

| Berkshire Hathaway (BRK.B) | 10% | 20 | 15% |

| Company A | 8% | 18 | 20% |

| Company B | 12% | 25 | 18% |

| Company C | 6% | 15 | 22% |

BRK.B’s strengths lie in its consistent long-term growth and relatively low volatility compared to some competitors. However, its lack of a dividend payout might be a weakness for some investors seeking regular income.

Dividend Policy and its Effect, Stock price for berkshire hathaway b

Source: seekingalpha.com

Berkshire Hathaway’s longstanding policy of not paying dividends significantly impacts its stock price. While this strategy allows the company to reinvest profits for future growth, it can limit short-term appeal to investors seeking dividend income. Investor expectations regarding future dividend payouts influence BRK.B’s valuation, with some analysts believing a dividend could unlock further value.

- Arguments for a dividend: Attracts income-seeking investors, potentially boosting demand and price.

- Arguments against a dividend: Reduces funds available for reinvestment, potentially hindering long-term growth.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide insights into market sentiment and future expectations for BRK.B. While specific ratings and targets fluctuate, a range of opinions generally exists, reflecting different investment strategies and perspectives. For example, some analysts might have a bullish outlook based on projected growth in Berkshire’s subsidiaries, while others might be more cautious due to macroeconomic uncertainties.

These ratings and targets can influence investor behavior and consequently impact the stock price.

Illustrative Example: A Hypothetical Investment

A hypothetical $10,000 investment in BRK.B over five years, based on an average annual return of 10% (illustrative, not a guarantee), would yield approximately $16,105. This calculation assumes reinvestment of dividends (though none are currently paid) and does not account for transaction fees or taxes.

| Year | Beginning Balance | Annual Return | Ending Balance |

|---|---|---|---|

| 1 | $10,000 | $1,000 | $11,000 |

| 2 | $11,000 | $1,100 | $12,100 |

| 3 | $12,100 | $1,210 | $13,310 |

| 4 | $13,310 | $1,331 | $14,641 |

| 5 | $14,641 | $1,464 | $16,105 |

This hypothetical scenario highlights the potential for significant returns but also underscores the inherent risks associated with any investment. Market fluctuations, unforeseen events, and changes in company performance can all significantly impact actual returns. Past performance is not indicative of future results.

Commonly Asked Questions: Stock Price For Berkshire Hathaway B

What are the biggest risks associated with investing in BRK.B?

Like any stock, BRK.B carries market risk. Its price can fluctuate significantly based on overall market conditions and news impacting Berkshire Hathaway’s holdings. There’s also the risk of a decline in Berkshire’s underlying assets or a change in management.

How often does Berkshire Hathaway B’s stock price update?

The stock price updates continuously during trading hours on the relevant stock exchange.

Where can I find real-time BRK.B stock price data?

Major financial websites and brokerage platforms provide real-time quotes for BRK.B.

Is Berkshire Hathaway B a good long-term investment?

Whether BRK.B is a good long-term investment depends on your individual risk tolerance and investment goals. Its historical performance has been strong, but past performance doesn’t guarantee future success.