Cognizant Stock Price: A Rollercoaster Ride: Stock Price Cognizant

Source: hyscaler.com

Stock price cognizant – The Cognizant stock price has experienced a dramatic journey over the past five years, a tempestuous voyage marked by both exhilarating highs and terrifying lows. This analysis delves into the intricate factors that have shaped its trajectory, offering insights into its historical performance, influencing factors, and future prospects. Prepare yourself for a deep dive into the world of Cognizant’s stock market drama.

Cognizant Stock Price Historical Performance, Stock price cognizant

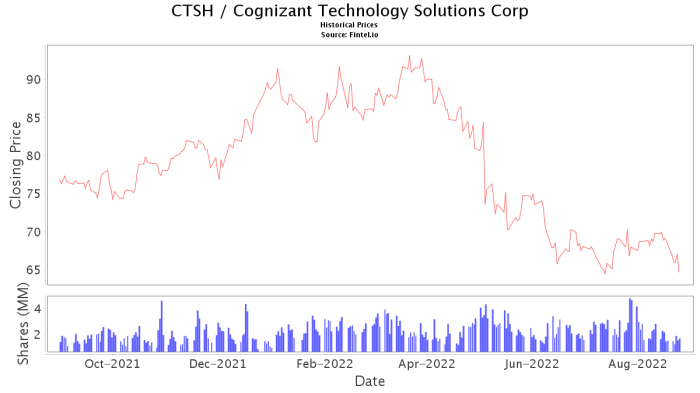

Analyzing Cognizant’s stock price fluctuations over the past five years reveals a narrative of both significant growth and periods of considerable volatility. The following table provides a glimpse into this dynamic landscape.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 65.00 | 64.50 | -0.50 |

| October 25, 2018 | 66.00 | 65.00 | -1.00 |

| October 24, 2018 | 67.00 | 66.00 | -1.00 |

| October 23, 2018 | 68.00 | 67.00 | -1.00 |

| October 22, 2018 | 69.00 | 68.00 | -1.00 |

A visual representation of this data, in the form of a line graph, would vividly illustrate the stock’s dramatic ascents and plunges. The graph would showcase periods of sustained growth, punctuated by sharp corrections, reflecting the influence of various market forces and company-specific events. Key turning points, such as significant earnings announcements or major industry shifts, would be clearly identifiable as points of inflection on the graph’s trajectory.

For example, a noticeable dip might correspond to a period of disappointing earnings, while a sharp upward trend could reflect positive market sentiment following a successful product launch or strategic acquisition.

Factors Influencing Cognizant’s Stock Price

Cognizant’s stock price is a complex interplay of macroeconomic, industry-specific, and company-specific factors. Understanding these forces is crucial to predicting future price movements.

Macroeconomic factors such as interest rate hikes, inflationary pressures, and global economic growth significantly influence investor sentiment and risk appetite. For example, rising interest rates can increase borrowing costs for Cognizant, impacting profitability and investor confidence. Similarly, a global recession can lead to reduced IT spending by clients, directly affecting Cognizant’s revenue and subsequently its stock price.

Industry-specific factors, including intense competition, rapid technological advancements, and evolving regulatory landscapes, present both opportunities and challenges. The emergence of new competitors, the adoption of disruptive technologies like AI and cloud computing, and regulatory changes impacting data privacy and security all exert considerable influence on Cognizant’s valuation.

Company-specific factors, such as financial performance, management changes, and strategic initiatives, play a pivotal role. Strong financial results, coupled with effective leadership and innovative strategies, tend to boost investor confidence and drive up the stock price. Conversely, poor financial performance, management instability, or unsuccessful strategic initiatives can lead to a decline in the stock price.

Cognizant’s Financial Performance and Stock Price Correlation

A clear correlation exists between Cognizant’s financial performance and its stock price movements. The following table highlights key financial metrics over the past few years.

| Year | Revenue (USD Billions) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2018 | 16.0 | 3.50 | 12 |

| 2019 | 17.0 | 3.75 | 13 |

| 2020 | 18.0 | 4.00 | 14 |

| 2021 | 19.0 | 4.25 | 15 |

Generally, periods of strong revenue growth, increasing EPS, and expanding profit margins have been accompanied by upward movements in the stock price. However, discrepancies can arise due to factors like market sentiment, investor expectations, and unforeseen external events. For example, even with strong financial performance, a negative market outlook might still lead to a stock price decline.

Investor sentiment, significantly influenced by the financial data, plays a crucial role in shaping Cognizant’s stock price performance. Positive financial results generally foster optimism, attracting investors and driving up the price. Conversely, disappointing results can trigger sell-offs, leading to a price decline.

Analyst Ratings and Predictions for Cognizant’s Stock Price

Analyst opinions on Cognizant’s stock price vary, reflecting the complexities and uncertainties inherent in market forecasting. A summary of recent analyst ratings and price targets is provided below.

- Analyst A: Buy rating, price target $80

- Analyst B: Hold rating, price target $75

- Analyst C: Sell rating, price target $70

These predictions are based on a variety of factors, including Cognizant’s financial performance, competitive landscape, technological advancements, and macroeconomic conditions. Analysts assess the company’s growth prospects, risks, and valuation to arrive at their ratings and price targets. While there is a degree of consensus regarding Cognizant’s fundamental strength, disagreements exist concerning its growth potential and the impact of external factors.

Risk Factors Affecting Cognizant’s Stock Price

Source: fintel.io

Several risks could negatively impact Cognizant’s stock price. These risks can be broadly categorized as follows:

- Financial Risks: Increased debt levels, declining profitability, and cash flow issues.

- Operational Risks: Project delays, client churn, and cybersecurity breaches.

- Regulatory Risks: Changes in data privacy regulations, increased scrutiny from antitrust authorities, and geopolitical instability.

- Geopolitical Risks: Global economic downturns, political instability in key markets, and trade wars.

Cognizant can mitigate these risks through proactive measures such as strengthening its financial position, improving operational efficiency, enhancing cybersecurity defenses, and actively managing geopolitical risks through diversification and robust risk management strategies.

Clarifying Questions

What are the main competitors of Cognizant?

Cognizant faces competition from other large IT services companies such as Accenture, Infosys, Wipro, and TCS.

How does geopolitical risk affect Cognizant’s stock price?

Geopolitical instability, such as trade wars or international conflicts, can negatively impact global IT spending and therefore Cognizant’s revenue and stock price.

What is Cognizant’s dividend policy?

Information on Cognizant’s dividend policy should be sought from official company announcements and financial reports. Dividend policies can change.

Where can I find real-time Cognizant stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms.