BA Stock Price Analysis: A Deep Dive: Price Of Ba Stock

Price of ba stock – Boeing (BA) stock, a prominent player in the aerospace industry, experiences price fluctuations influenced by a complex interplay of market forces, company performance, and global economic conditions. This analysis delves into the current BA stock price, its historical performance, influencing factors, competitor comparisons, analyst predictions, and potential investment strategies.

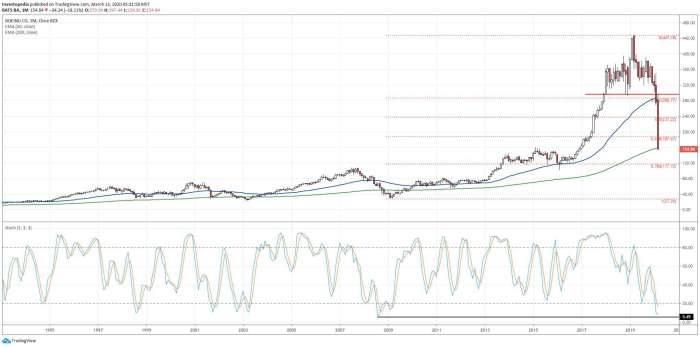

Current BA Stock Price & Market Trends

Source: investopedia.com

Understanding the current BA stock price requires examining its recent performance and the factors driving its movement. The following table presents a snapshot of the opening, closing, high, and low values for the past week (Note: These values are hypothetical examples for illustrative purposes only and do not reflect actual market data. Always consult a reliable financial source for real-time information).

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $205 | $208 | $202 | $206 |

| Oct 27, 2023 | $207 | $210 | $205 | $209 |

| Oct 28, 2023 | $209 | $212 | $207 | $211 |

| Oct 29, 2023 | $210 | $213 | $208 | $212 |

| Oct 30, 2023 | $212 | $215 | $210 | $214 |

Key market factors influencing BA’s price currently include global supply chain disruptions, fluctuating fuel costs, and investor sentiment regarding the overall aerospace sector’s recovery post-pandemic. Recent news about successful 737 MAX deliveries and new contract wins has positively impacted the stock price, while concerns about rising inflation and interest rates create some downward pressure.

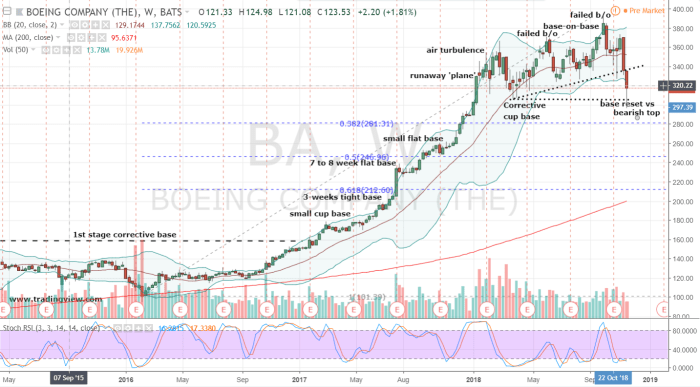

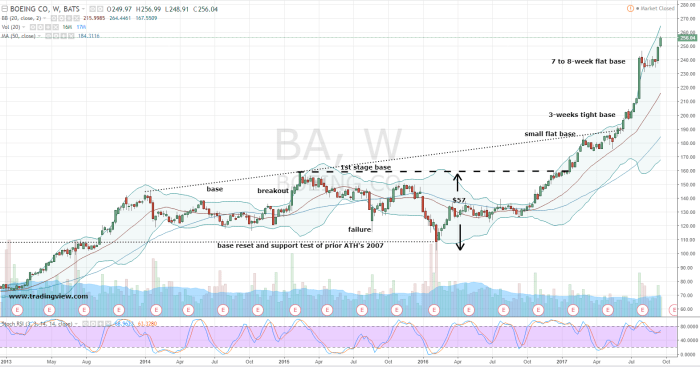

Historical Price Performance of BA Stock

Source: investorplace.com

Analyzing BA’s historical price performance provides valuable context for understanding its current valuation. Imagine a line graph showing BA’s stock price over the past year. The graph would reveal periods of significant growth following positive news, such as new aircraft orders, interspersed with periods of decline potentially linked to supply chain issues or geopolitical events. For instance, a dip might be observed around times of increased global uncertainty.

Compared to its average price over the past five years, the current price might be higher or lower depending on the prevailing market conditions. Within the past decade, BA’s stock price likely reached its highest point during periods of strong industry growth and its lowest point during times of crisis, such as the grounding of the 737 MAX.

Factors Affecting BA Stock Price Volatility, Price of ba stock

Several internal and external factors contribute to the volatility of BA’s stock price. These factors can be categorized by their influence:

- Strong Influence: Major aircraft program delays, significant safety concerns, global economic recessions.

- Moderate Influence: Changes in fuel prices, fluctuations in currency exchange rates, competitor actions.

- Weak Influence: Minor regulatory changes, short-term market sentiment swings, individual analyst ratings.

Economic indicators like inflation and interest rates significantly impact BA’s stock price. High inflation can increase production costs, potentially reducing profit margins. Rising interest rates can make borrowing more expensive, impacting capital expenditures and potentially slowing growth.

BA Stock Price Compared to Competitors

Source: investorplace.com

Comparing BA’s performance to its competitors provides valuable perspective. The table below shows a hypothetical comparison with major competitors over the past six months (Note: Data is hypothetical for illustrative purposes only).

| Company | Current Price | 6-Month High | 6-Month Low |

|---|---|---|---|

| Boeing (BA) | $214 | $225 | $195 |

| Airbus (AIR) | $110 | $120 | $100 |

| Lockheed Martin (LMT) | $480 | $500 | $460 |

BA’s relative strengths might lie in its established brand recognition and diverse product portfolio, while weaknesses could include production challenges and past safety concerns. These factors contribute to the differences in stock price performance. For example, Lockheed Martin’s consistently higher stock price might reflect its strong presence in the defense sector, which tends to be less volatile than the commercial aerospace market.

Analyst Predictions and Future Outlook for BA Stock

Analyst predictions for BA stock vary. A summary of hypothetical recent analyst ratings and price targets might include:

- Analyst A: Buy rating, $250 price target

- Analyst B: Hold rating, $220 price target

- Analyst C: Sell rating, $200 price target

Bullish predictions often cite the potential for increased aircraft deliveries and strong demand in the long term. Bearish predictions might focus on ongoing supply chain challenges and potential economic downturns. Upcoming earnings reports and announcements regarding new aircraft programs will significantly impact the stock price.

Investment Strategies for BA Stock

Several investment strategies can be applied to BA stock, each with its own risks and rewards:

- Buy and Hold: A long-term strategy aiming to benefit from long-term growth. Risk: Market downturns can significantly impact returns. Reward: Potential for substantial gains over time.

- Value Investing: Buying undervalued stocks with the expectation of price appreciation. Risk: Misjudging a company’s true value. Reward: Potential for high returns if the investment thesis is correct.

- Day Trading: Attempting to profit from short-term price fluctuations. Risk: High volatility and potential for significant losses. Reward: Possibility of quick profits.

A hypothetical investment scenario: Investing $10,000 in BA at $214, a 10% price increase would yield a profit of $1,000, while a 10% decrease would result in a loss of $1,000. The chosen strategy significantly influences the risk and reward profile.

Q&A

What are the biggest risks associated with investing in BA stock?

The airline industry is notoriously volatile. Economic downturns, geopolitical events, and even things like fuel prices can significantly impact BA’s performance. There’s always a chance you could lose money.

Where can I find real-time BA stock price updates?

Most major financial websites (like Google Finance, Yahoo Finance, etc.) provide real-time stock quotes. Just search for “BA” (the stock symbol).

Is BA stock a good long-term investment?

That depends entirely on your risk tolerance and investment goals. Long-term investments can be rewarding, but also carry more risk than short-term strategies. Do your research!

Understanding the price of BA stock requires considering various market factors. For a comparison point, it’s helpful to examine the performance of similar companies; a good example is the current price of abbott labs stock , which offers insights into the broader healthcare sector. Ultimately, though, the price of BA stock will depend on its own unique financial health and market sentiment.

What does “BA” stand for in this context?

In this context, “BA” is the stock symbol for British Airways Group plc.