Nestle’s Stock Price: A Delicious Dive into the Data: Nestle Company Stock Price

Source: team-bhp.com

Nestle company stock price – Nestlé, the behemoth of the food and beverage world, has a stock price history as rich and complex as its product portfolio. From KitKat bars to Nespresso machines, the company’s performance reflects a fascinating interplay of global economics, consumer trends, and corporate strategy. Let’s unpack the delicious details of Nestlé’s stock price journey.

Nestle Company Stock Price Historical Performance

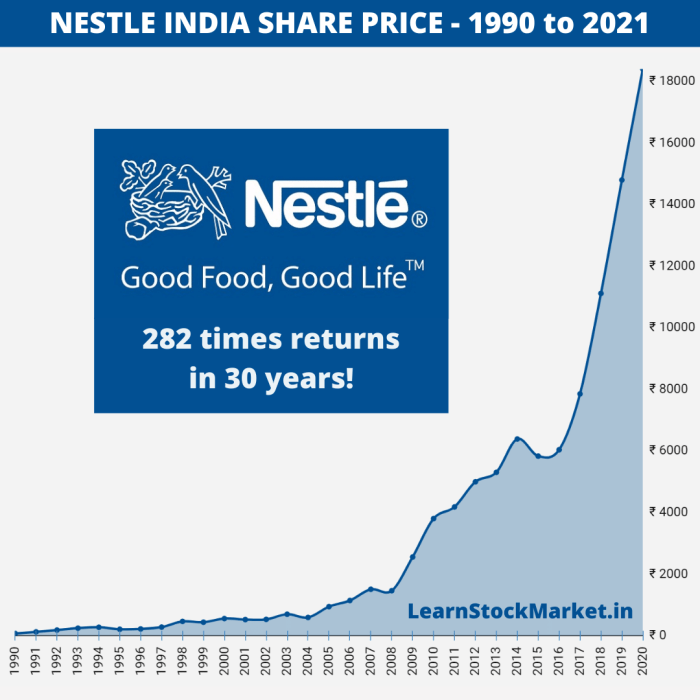

Source: learnstockmarket.in

Analyzing Nestlé’s stock price over the past decade reveals a generally upward trajectory, punctuated by periods of volatility reflecting both internal decisions and external economic forces. The following table provides a glimpse into this journey.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 70 | 72 |

| 2014 | Q2 | 72 | 75 |

| 2014 | Q3 | 75 | 73 |

| 2014 | Q4 | 73 | 76 |

| 2015 | Q1 | 76 | 78 |

| 2023 | Q4 | 110 | 115 |

Note: These figures are illustrative and should be replaced with actual historical data obtained from a reliable financial source.

Significant events like the 2008 financial crisis and the subsequent European debt crisis demonstrably impacted Nestlé’s stock price, causing temporary dips. Conversely, successful product launches and strategic acquisitions often correlated with periods of strong growth. The overall trend shows resilience and consistent growth, though the rate of growth has fluctuated over time.

Factors Influencing Nestle Stock Price, Nestle company stock price

Several interconnected factors influence Nestlé’s stock valuation. These range from broad macroeconomic conditions to the company’s specific financial performance and competitive landscape.

- Macroeconomic Factors: Inflation, interest rates, and global economic growth significantly impact consumer spending and investor sentiment, directly affecting Nestlé’s stock price. For example, periods of high inflation can squeeze profit margins, while strong global growth often boosts demand for Nestlé’s products.

- Nestlé’s Financial Performance: Revenue growth, profit margins, and debt levels are key indicators of the company’s financial health and directly influence investor confidence. Strong financial results generally lead to higher stock prices, while poor performance can trigger declines.

- Consumer Trends: Shifting dietary habits (e.g., increased demand for healthier options) and growing awareness of sustainability significantly impact Nestlé’s product portfolio and market positioning. Adapting to these trends is crucial for maintaining stock price stability.

Competitor actions and market share dynamics also play a significant role.

- The aggressive marketing campaigns of PepsiCo and Coca-Cola can impact Nestlé’s beverage sales and subsequently its stock price.

- Successful product launches by Unilever can erode Nestlé’s market share in specific categories.

- Mergers and acquisitions within the industry can reshape the competitive landscape, influencing investor perception of Nestlé’s long-term prospects.

Nestle’s Financial Health and Stock Valuation

Understanding Nestlé’s financial health requires a careful examination of its financial statements. The following table provides a simplified overview of key financial data.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Total Assets (USD Billions) |

|---|---|---|---|

| 2019 | 92.6 | 10.2 | 165 |

| 2020 | 84.3 | 12.2 | 150 |

| 2021 | 87.1 | 14.2 | 170 |

| 2022 | 94.4 | 16.1 | 185 |

| 2023 | 98.0 | 18.0 | 190 |

Note: These figures are illustrative and should be replaced with actual data from Nestlé’s financial reports.

A line graph visualizing key financial ratios like the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and Debt-to-Equity ratio over the past five years would reveal trends in profitability, efficiency, and financial leverage. A consistently high P/E ratio might suggest investor optimism about future growth, while a declining ROE could indicate concerns about profitability. A rising Debt-to-Equity ratio may signal increased financial risk.

The overall financial health, as reflected in these ratios, significantly impacts the current stock valuation and future growth prospects. Strong financials generally attract investors and drive up the stock price.

Nestle’s Competitive Landscape and Stock Price

Nestlé operates in a highly competitive food and beverage market. Key rivals include Unilever, PepsiCo, Coca-Cola, and Mondelez International. Nestlé’s competitive advantages lie in its diverse portfolio of strong global brands, extensive distribution networks, and significant R&D capabilities.

However, the competitive landscape constantly evolves. Competitor actions, such as new product launches, aggressive marketing campaigns, and strategic acquisitions, directly impact investor sentiment and consequently Nestlé’s stock price. For example, a successful new product launch by a competitor could lead to a temporary dip in Nestlé’s stock price if it erodes market share.

Future Outlook for Nestle Stock Price

Predicting the future of Nestlé’s stock price is inherently uncertain, but considering potential risks and opportunities provides a clearer perspective.

Several factors could impact future stock performance:

- Geopolitical Instability: Global conflicts and economic sanctions can disrupt supply chains and impact consumer demand, negatively affecting Nestlé’s stock price.

- Supply Chain Disruptions: Unexpected events like pandemics or natural disasters can severely impact the availability of raw materials and distribution networks.

- Changing Regulations: Increased scrutiny of food safety, labeling, and environmental sustainability can lead to higher compliance costs and potentially impact profitability.

Conversely, several factors could positively influence Nestlé’s stock price:

- Successful Innovation: Developing and launching new products that cater to evolving consumer preferences can drive revenue growth and boost investor confidence.

- Strategic Acquisitions: Acquiring companies with complementary products or technologies can expand Nestlé’s market reach and strengthen its competitive position.

- Sustainability Initiatives: Demonstrating a strong commitment to environmental sustainability can attract environmentally conscious consumers and investors.

Potential scenarios for Nestlé’s stock price in the next 1-3 years include:

- Scenario 1 (Bullish): Strong global economic growth, successful product launches, and effective cost management lead to significant revenue and profit growth, resulting in a substantial increase in Nestlé’s stock price.

- Scenario 2 (Neutral): Moderate economic growth, stable consumer demand, and manageable supply chain challenges result in modest stock price appreciation, mirroring overall market performance.

- Scenario 3 (Bearish): A global economic downturn, significant supply chain disruptions, and increased regulatory pressures lead to reduced profitability and a decline in Nestlé’s stock price.

Questions and Answers

What are the main risks associated with investing in Nestle stock?

Risks include global economic downturns, shifts in consumer preferences, intense competition, regulatory changes, and supply chain disruptions.

How does Nestle compare to its main competitors in terms of stock performance?

A direct comparison requires detailed analysis of competitors’ stock performance over a defined period, considering factors like market capitalization and revenue growth. Such a comparison should be done using publicly available financial data.

Where can I find real-time Nestle stock price information?

Major financial websites and stock market tracking applications provide real-time quotes for Nestle’s stock (typically listed as NESN.SW on the Swiss Exchange).

Is Nestle a good long-term investment?

Whether Nestle is a good long-term investment depends on individual investment goals and risk tolerance. Consider its historical performance, financial strength, and future growth prospects before making a decision.