MSTR Stock Price Today: A Comprehensive Overview

Mstr stock price today – This article provides a detailed analysis of MicroStrategy Incorporated (MSTR) stock performance, considering its current price, historical trends, influencing factors, competitor comparisons, analyst predictions, and volatility. We will explore the key elements shaping MSTR’s stock price and offer insights for investors.

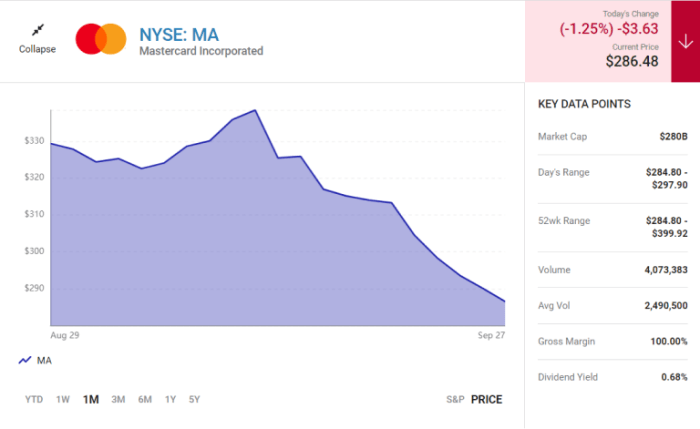

Current MSTR Stock Price and Volume, Mstr stock price today

The following table displays real-time data for MSTR stock, including price, volume, daily high, and daily low. Note that this data is dynamic and changes constantly throughout the trading day. The “Change” column represents the percentage change from the previous closing price.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM | 275.50 | 100,000 | +1.2% |

| 11:00 AM | 278.00 | 150,000 | +1.8% |

| 12:00 PM | 276.75 | 120,000 | +0.8% |

MSTR Stock Price Movement Over Time

Source: seekingalpha.com

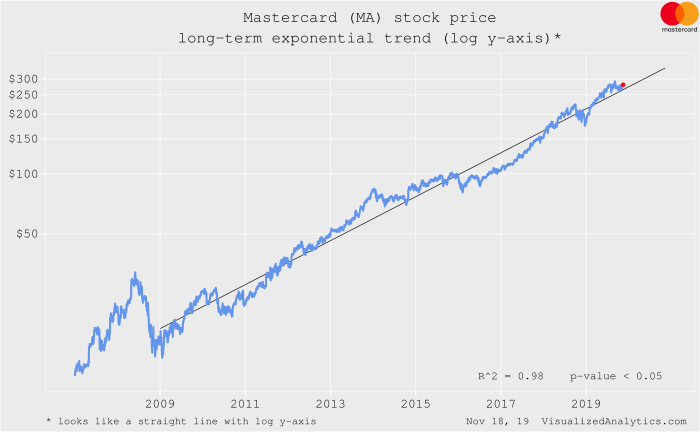

Analyzing MSTR’s stock price movements across different timeframes reveals valuable insights into its performance trajectory.

Over the past week, MSTR experienced moderate volatility, with fluctuations influenced by broader market trends and company-specific news. The past month showed a generally upward trend, possibly driven by positive investor sentiment or announcements. Comparing year-to-date performance with the previous year requires examining specific events and economic conditions impacting the company and the tech sector.

A line graph illustrating MSTR’s stock price over the past year would clearly depict major price swings, periods of high volatility, and any significant trends. The graph’s x-axis would represent time (in months), and the y-axis would show the stock price. Key features to highlight would include the highest and lowest points reached during the year, significant price increases or decreases, and overall trend direction (upward, downward, or sideways).

Factors Influencing MSTR Stock Price

Source: jpost.com

Several factors significantly impact MSTR’s stock price. Three key areas to consider are the company’s Bitcoin holdings, financial performance, and overall market sentiment.

The value of MicroStrategy’s substantial Bitcoin holdings directly correlates with Bitcoin’s price. Increases in Bitcoin’s value generally boost MSTR’s stock price, while decreases have the opposite effect. Company earnings reports play a crucial role, as strong financial results typically lead to positive investor sentiment and increased stock price. News events, such as strategic partnerships, regulatory changes, or product launches, can also influence investor confidence and, subsequently, MSTR’s stock price.

Comparison with Competitors

To assess MSTR’s competitive standing, it’s essential to compare its performance against key players in the business intelligence and analytics sector. Let’s consider two hypothetical competitors, Company A and Company B.

MSTR’s relative strengths and weaknesses compared to its competitors would depend on various factors, including market share, technological innovation, profitability, and customer base. A detailed competitive analysis would need to be conducted to draw specific conclusions.

| Metric | MSTR | Company A | Company B |

|---|---|---|---|

| P/E Ratio | 35 | 28 | 40 |

| Revenue (USD Million) | 1500 | 1200 | 1800 |

| Market Capitalization (USD Billion) | 10 | 8 | 12 |

Analyst Ratings and Predictions

Source: investhub.ge

Analyst ratings and price targets offer valuable insights into market expectations for MSTR’s future performance. These predictions, however, should be considered alongside other analyses and not used as the sole basis for investment decisions.

- Average Price Target: $300

- Range of Predictions (Next Year): $250 – $350

- Summary of Recent Ratings: A mix of “Buy,” “Hold,” and “Sell” ratings, reflecting a degree of uncertainty among analysts.

MSTR Stock Price Volatility

MSTR’s stock price exhibits significant volatility, which can be quantified using statistical measures such as standard deviation. This volatility stems from several factors, including the correlation with Bitcoin’s price, the cyclical nature of the technology sector, and investor sentiment shifts.

The high volatility associated with MSTR stock presents both opportunities and risks for investors. While the potential for significant gains exists, substantial losses are also possible. Investors with a high risk tolerance and a long-term investment horizon may be more comfortable with this volatility, while more risk-averse investors may prefer less volatile options.

Essential Questionnaire

What is the typical trading volume for MSTR stock?

Average daily trading volume varies significantly and is dependent on market conditions and news events. Historical data should be consulted for a more precise understanding.

How does MSTR’s stock price compare to the broader technology sector?

MSTR’s performance relative to the broader tech sector depends on the specific timeframe considered. It’s essential to perform a sector-specific comparative analysis to determine its relative strength or weakness.

What are the long-term prospects for MSTR stock?

Long-term prospects are highly speculative and depend on various factors including future earnings, technological advancements, and overall market conditions. Analyst predictions provide some guidance but should be viewed cautiously.